Economic calendar (Universal time)

Among the significant events of today's economic calendar are:

9:00 EU consumer price index;

14:00 US Consumer Confidence Index.

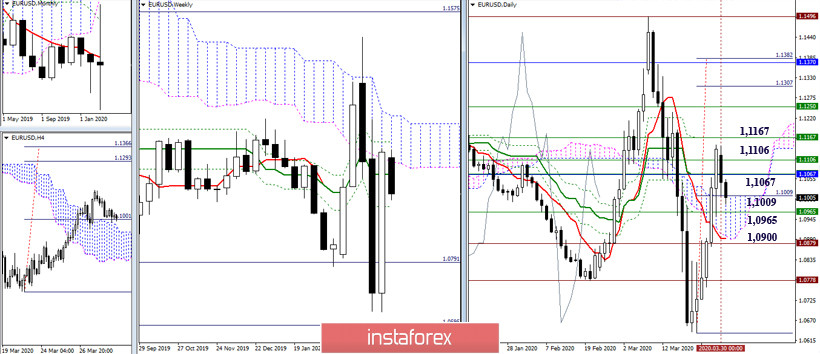

EUR / USD

As expected, players to upgrade took a break during the beginning of the week. Today, we close the month, so the struggle for the result will be relevant again, as it will determine further prospects. Under the current conditions, the main role of support today belongs to the daily cloud (1.1009 - 1.0900), which has an increase from the weekly Fibo Kijun (1.1065). A consolidation below may level out the bullish gains of the previous week and bring back plans to restore the downtrend. In turn, for players to increase, an important border is the closing of the month of March above the monthly short-term trend (1.1066).

After yesterday's analysis, the players to decline managed to gain the central Pivot level, thanks to which they gained an advantage by continuing to decline to the next key benchmark - the weekly long-term trend, which stands at the level of 1.0960 today. Consolidating below the moving average and its reversal will serve as a good basis for turning a downward correction on H1 into a downward trend. The intraday supports are also 1.0989 (S1) - 1.0933 (S2) - 1.0855 (S3). Changes in moods and balance of power are possible today when players return to the side to increase the central Pivot level (1.1067), the next upward reference will be the update of last week's maximum (1.1147).

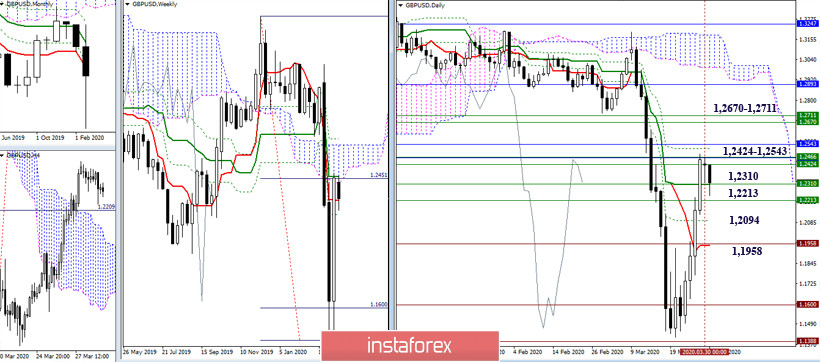

GBP / USD

Having reached the zone of strong resistance 1.2424 -1.2543 (the monthly Tenkan and Fibo Kijun + the weekly Senkou Span A and Kijun + the daily Fibo Kijun), the players to increase indicated slowdown, but the bulls are trying to save what they have reached . Moreover, maintaining positions, and even more so conquering the encountered resistance, will be a March victory for players to increase. But loss of height and a decrease in support will weaken the bullish sentiment, the most significant milestone in this direction 1.1958 - the minimum extreme of the past, allowing you to close March in the downward trend zone.

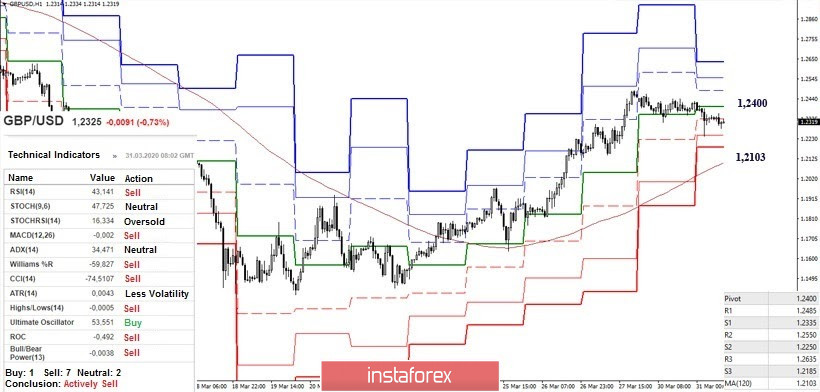

In the lower halves, the advantage belongs to players to decline who continue to develop a downward correction. The first important support was left behind (central Pivot level of 1.2400), so the future plans of the bears are now associated with the weekly long-term trend (1.2103), since the moving is at a considerable distance from the price chart, and the scale of the decline is small, then inside the day, as significant supports today, then within the day, as significant supports today, we should note the support for the classic Pivot levels of 1.2250 (S2) and 1.2185 (S3). The return of bullish advantages in the current conditions is possible after fixing above the Central Pivot level (1.2400) and updating the high of the previous week (1.2484).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)