The uncertainty that surrounds all the data that will be published this week, as well as the prospects of a slowdown in the global economy, are pushing away purchases of risky assets. Surprisingly, it also does not return the demand for US dollar, which is a safe haven asset for the investors.

The Deutsche Bank forecasts that the US and EU GDP will decline by at least double the amount of the economic downturn during the global financial crisis in 2008, and that the situation will only stabilize after the vaccine on the coronavirus is developed. Meanwhile, the decline in consumer spending and capital investment by companies will remain at a fairly high level. With regards to the monetary and fiscal stimulus measures that central banks and governments have now resorted to, they will only be able to smooth out the damage from the coronavirus, but will not eliminate the long-term problems caused by the pandemic. Deutsche Bank is confident that the GDP of the Eurozone and the United States at the end of 2020 will be 2 trillion dollars less than expected before the pandemic.

The decision of the US Fed to convert Treasury securities to US dollars contributed to the weakening of the currency against risky assets. According to the central bank's statement, from April 6 this year, foreign central banks will be able to exchange Treasury securities for US dollars. This measure will be operational for at least 6 months.

Yesterday, the US Department of Treasury revealed some details on the new small business lending that the government plans to implement. Companies with a staff of less than 500 people can now apply for preferential loans under a simplified procedure, and access to it will be open from April 3. Independent employees working under contract, as well as self-employed Americans can also count on loans. These loans are 100% guaranteed by the government.

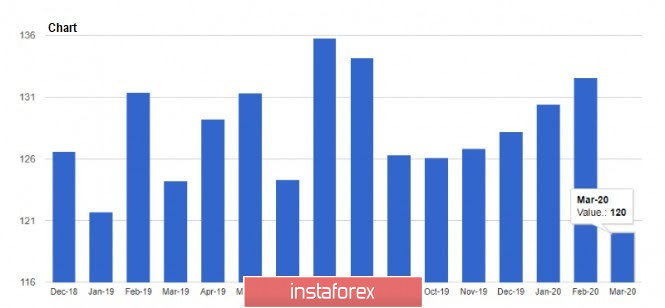

As for fundamental data, according to the Conference Board, the consumer confidence index fell from 132.6 points in February, to 120 points in March 2020. However, we should not be happy about this indicator, as the decline was not due to a shock, but due to a serious economic downturn caused by the coronavirus. Because of the current situation, a further and more severe deterioration is predicted. Moreover, the report is based on the survey from March 1 to March 19, and we know that the upsurge in the pandemic started after March 20.

The US House Price Index rose by 3.9% in January. Economists expect that due to current low interest rates, this strong growth will continue. The Case-Shiller home price index for 10 megacities, on the other hand, rose by 2.6% in January, while the price index for 20 megacities rose by 3.1%.

The decline in the Chicago purchasing managers' index (PMI) in March this year did not surprise the markets. According to MNI Indicators, the Chicago business barometer fell to 47.8 points in March this year, indicating a decline in activity.

As for the technical picture of EUR/USD, there is balance in the market, as both the bulls and the bears are fighting back against each other. Much will depend today on the resistance of 1.1065, as the breakout of which will provide buyers with good growth in the area of the high of 1.1140, followed by a test of the resistance of 1.1240. On the other hand, if the bears were able to prevent it, the pressure on risky assets will return, pushing EUR/USD to the lows of 1.0870 and 1.0780.

GBP/USD

The account deficit in the balance of payments of UK in the 4th quarter of 2019 decreased, as compared to the deficit in the 3rd quarter. This indicates that the UK economy is gradually returning to normal, however, because of the coronavirus pandemic, the current situation may be different. According to the report, the deficit was £ 5.6 billion, while the forecast was £7.1 billion. For the 3rd quarter, the deficit was revised to £19.9 billion from £15.9 billion.

This indicator should be monitored more closely because its next increase will undermine the confidence of investors, which will have a significant impact on the economy, as well as lead to the weakening of the pound in the medium term.

As for the technical picture of GBP/USD, the break of 1.2300 will increase the pressure on the pair, and open the way for the bears to the area of 1.2140 and 1.1980. A break in the resistance area of 1.2490 by the bulls will trigger new purchases to the highs of 1.2600 and 1.2720.