To open long positions on GBPUSD, you need:

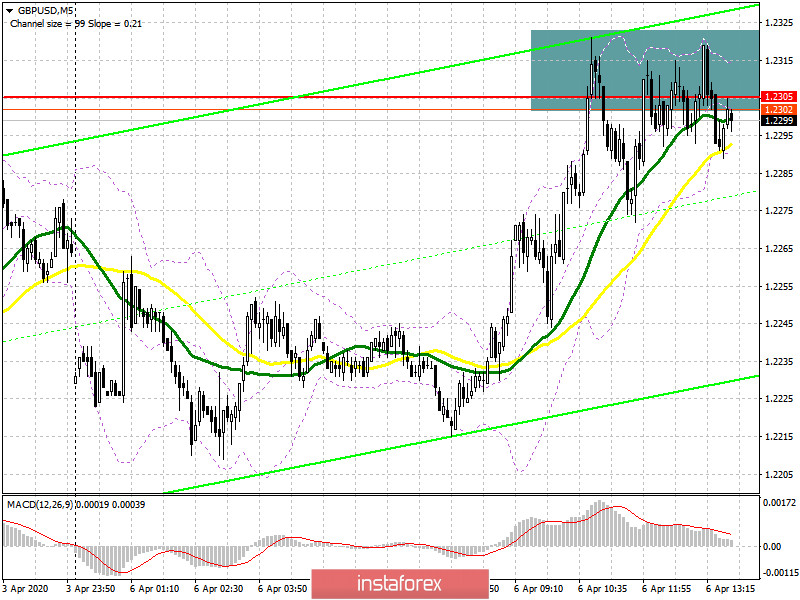

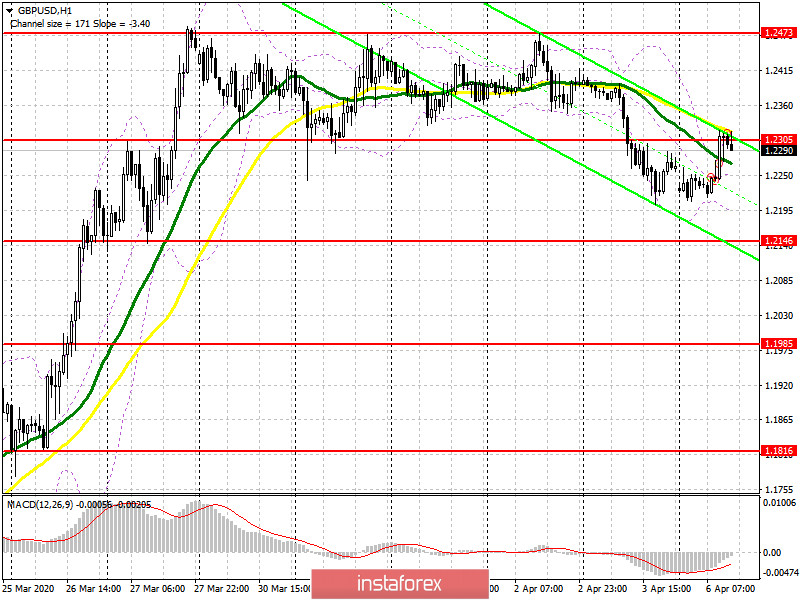

In the morning forecast, I paid attention to the level of 1.2305, around which the bulls could have problems, which happened. However, it is worth noting that bears are not in a hurry to return to the market at this resistance even after forming a false breakout there, which is clearly visible on the 5-minute chart. In the second half of the day, the buyers' task will be to break through and consolidate above this range, which will lead to a larger upward correction of the pair to the area of last week's maximum of 1.2473, where I recommend fixing the profits. It is important to note that if the bulls manage to close the day above 1.2305 – this will be a very strong bullish signal in the medium term, which will open a direct path to new highs in the area of 1.2605 and 1.2686. In the scenario of a decline in GBP/USD, you can still count on long positions only after forming a false breakout from the support of 1.2146 or buy the pound immediately on a rebound from the minimum of 1.1985.

To open short positions on GBPUSD, you need:

Due to weak fundamental data on the construction sector, the bears stopped the growth of the pair and did not let it go above the resistance of 1.2305. Until such time as trading is conducted below this range, the option of reducing the pound will remain quite high, and the nearest target of sellers will be a minimum of 1.2146, where I recommend fixing the profits. To maintain the downward correction, the bears will also only need to update the low of last Friday. In the scenario of GBP/USD growth in the second half of the day above the resistance of 1.2305, it is best to return to short positions on the rebound from the maximum of 1.2473 or after updating the larger resistance of 1.2605, counting on correction of 50-60 points within the day.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 daily averages, which indicates an active struggle between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the upper limit of the indicator around 1.2305 will lead to an increase in the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20