The US dollar has recovered some ground against the euro and the British pound. Today, a particularly large drop was recorded at the Asian session. The demand for risk assets is gradually slowing down, since it is not entirely clear what decision has been made at the Eurogroup meeting. Apparently, the parties did not come to a single agreement on Corona-Bonds and other measures to increase fiscal stimulus.

Yesterday's statements made by Larry Kudlow, the Director of the United States National Economic Council, were extremely pessimistic. According to Kodlow, the US economy is experiencing a serious contraction and is expected to start recovering no earlier than 2 months after the end of the coronavirus pandemic, which, by the way, continues to gain momentum in the country. The number of deaths in the United States is still increasing.

There is no doubt that the US economy will contract. The only thing that has left is to assume how serious the decline can be. According to Ben Bernanke, a former Chair of the Federal Reserve, US GDP is likely to drop by 38% or more in the second quarter of this year. Bernanke expects a similar surge in unemployment. The former head of the Fed compared the current state of affairs more with a natural disaster than with the Great Depression, which the current crisis can even surpass.

Meanwhile, forecasts for other countries are no better. According to Commerzbank's report, based on the current dynamics of the fall in macroeconomic indicators, UK GDP is expected to plunge by more than 20% in the second quarter. The UK consumer spending is likely to drop as well as. Thus, it can take the economy more than 4 years to fully recover.

As mentioned above, there has been no news on the meeting of the eurozone finance ministers. However, only one statement has been made by the European Central Bank, which announced temporary collateral easing measures. This step is aimed at maintaining lending during the current economic downturn. Considering the fact that the European regulator is ready to accept Greek sovereign debt instruments as collateral indicates how difficult the situation in the eurozone is at the moment. The ECB will also ease the conditions for the use of credit claims as collateral. These temporary measures will last only during the coronavirus crisis.

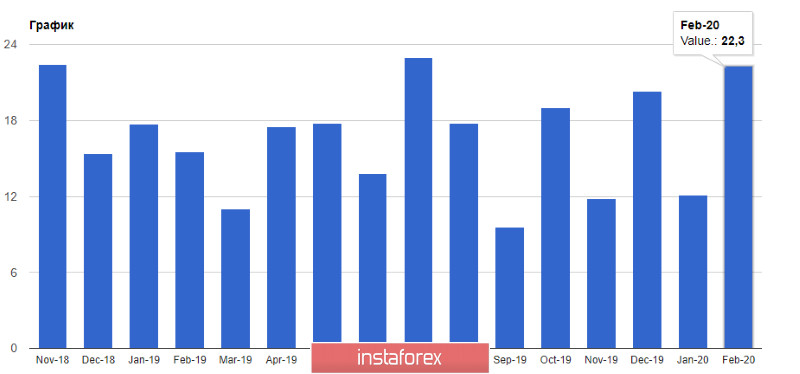

As for the fundamental statistics, yesterday's reports did not attract traders' attention. The consumer lending in the US increased in February. According to the Federal Reserve, the total consumer lending surged by $22.3 billion compared with the same period of the previous year, when the indicator rose by 6.4%. Economists had forecast the consumer landing to grow by $14.2 billion. Revolving loans jumped by 4.6% and non-revolving credit - by 7%.

The US job vacancies report for February did not spark interest as well. According to the Ministry of Labor, job vacancies fell to 6.9 million in February from 7 million in January. This data was collected before the spread of the coronavirus. Therefore, it is in no way comparable with the current state of the labor market.

The Redbook retail sales report for March has caught investors' attention. Thus, retail sales in the United States increased by 0.9% in March and by 7.0% from the same period in 2019. Over the week from March 29 to April 4, the indicator advanced by 5.3% compared to last year.

Technical picture for EUR/USD: yesterday, the pair failed to consolidate above the resistance level of 1.0900. Today, it is preferable for the buyers of risky assets not to rush to open long positions. It is better to wait for the price to update the major support level of 1.0825. The lack of bullish activity at this level is likely to indicate the deterioration of the market situation. As a result, the pair can drop to the weekly low of 1.0770. It is possible to speak about the extension of the upward correction in the euro only after a breakthrough and consolidation above the resistance level of 1.0900, which can lead to an increase in risk assets in the area of 1.1020 and 1.1140.