The Fed's unlimited purchases of Treasury and mortgage bonds have led investors to bathe in money. They are faced with the urgent question of what to buy? Someone buys shares, referring to the fact that the recovery of US stock indices in the years of previous recessions started much earlier than the economic recovery. Someone is holding on to the US dollar as their main safe-haven asset. Someone increases the share of gold in the investment portfolio, nodding to the fact that it worked very well during previous downturns. In my opinion, the latter option deserves attention.

The long-term prospects of the precious metal look unambiguously "bullish". Ultra-soft monetary policy of central banks leads to the weakening of the lion's share of the world's major currencies. At the same time, global debt market rates are falling, and many bonds are currently trading at negative yields. Do not rely on the fact that after the recession, the regulators are beginning to normalize monetary policy. Neither the Fed nor the ECB was able to return rates to pre-crisis levels in 2009-2019. The pandemic forced them to turn to QE. Quantitative easing programs are serious and long-term, which is a bullish factor for XAU/USD.

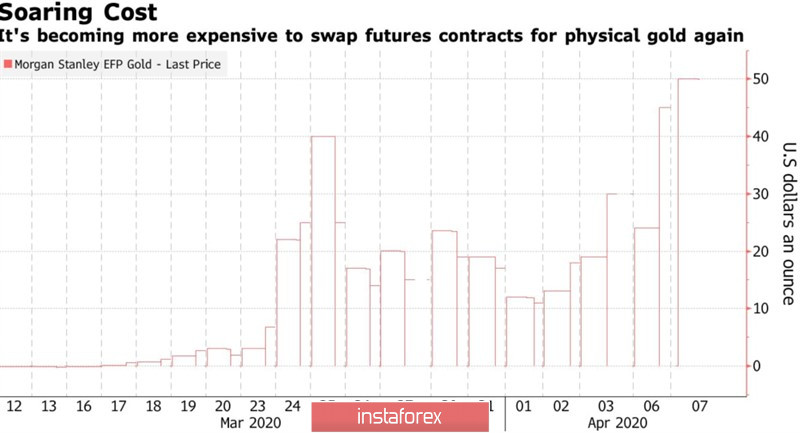

In the short term, gold would look even better than it does now, if not for the increased interest of investors in the US dollar. During the epidemic of closed factories, stopped production of the physical asset, and the overlapping boundaries make you worry about the supplies. As a result, the difference in prices of the precious metal in New York and London reached $40-50 per ounce several times. Investors were shackled by the fear that the available stock of gold on COMEX will not be enough to meet their needs. And although JP Morgan and other market makers have declared their readiness to put as many physical assets as necessary, the fear has not fully passed.

Spread in the value of gold in New York and London

The main obstacle that does not allow us to restore the upward trend for XAU/USD is the US currency. Investors are actively playing back the theory of the dollar's smile, suggesting that in the third stage, the USD index is growing from the bottom of the smile due to the belief in a faster recovery of US GDP than foreign counterparts. President Larry Kudlow, the chief economic adviser, said it would take 4-8 weeks for the United States to return to full capacity. However, to begin with, it is necessary that the peak of the coronavirus is left behind.

Due to the USD index, the precious metal can move in the same direction as the US stock market. The reasons should be found in the fact that the role of the main safe-haven asset is performed by the dollar. At the same time, the terrible statistics on the US will strengthen its position and weaken the position of competitors in the face of the S&P 500 and XAU/USD. On the other hand, the improved epidemiological situation and the willingness of the White House to expand the scope of fiscal stimulus will contribute to the growth of stocks. While stock indices tend to consolidate, the drop in gold to support at $1,600 and $1,570 per ounce makes sense to use it to form long positions.

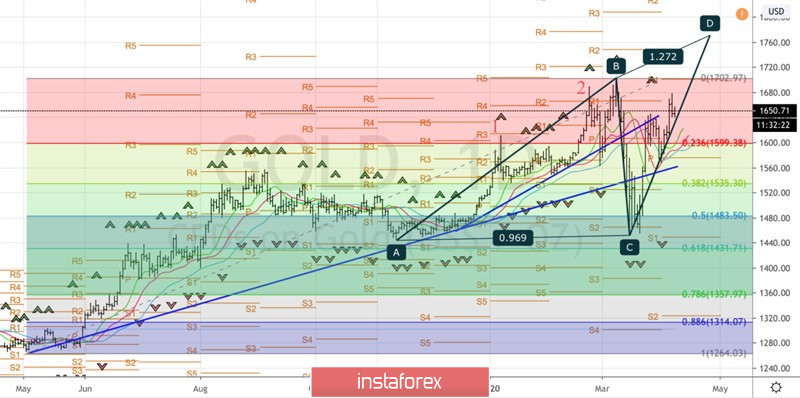

Gold, the daily chart