Dear colleagues.

There is no pause in the outpour of shocking scenarios, and Donald Trump has once again managed to surprise the public. According to the calculations of White House analysts, on a light scenario, there is an estimated 150,000 deaths in the US due to the COVID-19 pandemic, while the worst-case scenario draws over 2 million number of infected cases. Despite this, the US citizens seemed to look rather pleased with this announcement.

Against this backdrop, the US intelligence sees this better than blaming China for underestimating the number of victims. The underestimation on China's part is only natural, as they were able to control the spread of the virus immediately although it might have seemed so impossible to do so. The current state of the virus outbreak in the US is none other than due to the collapse of the vaunted American health care system, which is costing the budget a tidy sum of $ 1.3 trillion. This scenario gravely affects the US economy and not in a good way.

Massive injections of central banks and the Federal Reserve System led to some stabilization in financial markets, the liquidity of which improved significantly. Thus, for example, from February 25 to March 31, the US Federal Reserve alone emitted about $ 1.7 trillion into the system (Fig. 1), effectively doubling its balance sheet.

Figure 1: Federal Reserve Balance

The issue eliminated the global lack of dollars in the system and stabilized stock indices, which, having sensed an infusion, won back half of their fall. However, volatility, called the indicator of fear, continues to remain at its extreme values. The VIX volatility index, derived from the S&P 500 wide market index remains at around 50, while the annual average of this index is around 19. When Donald Trump launched a trade war against China, last December 2018, the volatility was at similar values, however, these values reached its peak and after which they began to actively decline.

The situation of instability is significantly limiting the ability of the investors to buy assets. A conservative investor and trader should wait for volatility to normalize before opening deals. However, the growth of volatility opens up new opportunities for aggressive traders who can earn on short-term price movements that occur daily in a wide range.

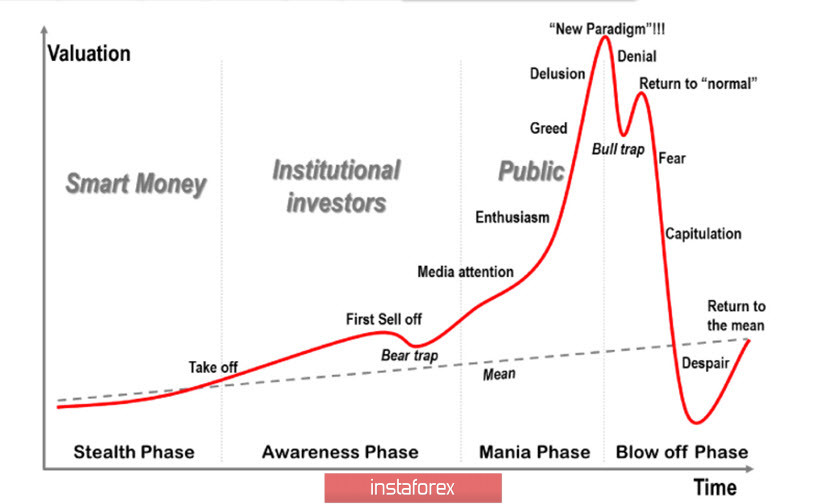

The situation in the US is growing to be more and more complicated every day, which raises questions about the timing of the US economy's recovery from the crisis. This somehow means that we can assume that the market situation is now about close to being normal again. This outlook might be the last opportunity for investors to exit assets because, after which, a global collapse will occur in the markets (Fig. 2).

Figure 2: Market Bubble Formation and Collapse Model

As you can see from the diagram, the market is now in a collapse phase, and the COVID-19 pandemic continues to gain momentum. The labor market is already in shock, only over the past week the number of initial applications for unemployment benefits in the US has increased to 6.6 million, while more than 3 million applications have already been submitted two weeks ago. On Thursday, April 9, a new influx with the unemployment rate is expected as well as an increase in the number of applications by another 5 million. Recent data on the labor market showed that in March the American economy lost -701 thousand jobs, and the unemployment rate rose to 4.4%. In this case, applications submitted after March 12 were not taken into account.

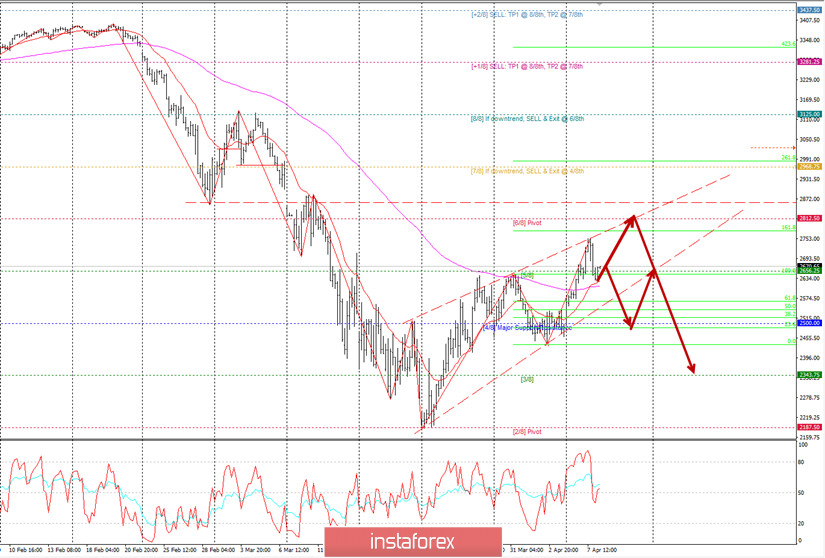

From a technical point of view, the dynamics of the S&P 500 (#SPX) is also quite remarkable. In the second half of March and early April, the index won back half of its fall, however, the upward trend structure that was formed on the daily time chart (Fig. 3) is seemingly appalling. The fact is that the trend in the vast majority of cases breaks through in the direction opposite to its inclination, that is, down.

Fig. 3: Technical analysis of the S&P 500 #SPX graph

In order to break the structure of a potential decline - to get out of the downward trend, the markets need a very powerful positive impetus. But where to get it? Monetary stimulus measures are used to their fullest, but the printing press cannot stop the virus from spreading. The epidemic in the two largest economic centers namely, the US and the EU, is vastly growing every day and the volume of problems is growing every hour. The world economy is functioning a third of its capabilities, and so far no structural changes have occurred in it, and in this sense, investors around the world are now faced with the choice to invest in a printing press or refrain from investing and just buy gold?

Fig. 4: Technical picture of the DAX30 index

The world economy is noticeably fragmented into separate components, and if we look at the situation in the eurozone, particularly in Germany, the situation looks better than that of the US. At least in Italy and Germany, the daily number of new infections is declining, which gives hope for a faster recovery in the European economy.

The technical picture of the German DAX30 index (#DAX) looks more optimistic than the S&P 500 index (#SPX). Based on the Dow postulate, indexes take into account all the growth of German assets. The graph shows that after the formation of the reversal pattern, the German leaders' index began to increase and left the formed consolidation upwards, which implies a movement with targets located at 11250 and 12500 (Fig. 4). The number 12500 now looks incredible, but you can not argue with technology. In general, traders can consider buying opportunities, taking into account and considering the inadequacy of the existing situation. If the #DAX index falls below 9200, losses should be reported immediately.

On Friday, Protestants and Catholics around the world will celebrate the bright holiday of the Resurrection of Christ, in this regard, most markets will be closed. Be careful, cautious, and in view of reduced liquidity, limit your risks. Let the coronavirus pass us. Amen!