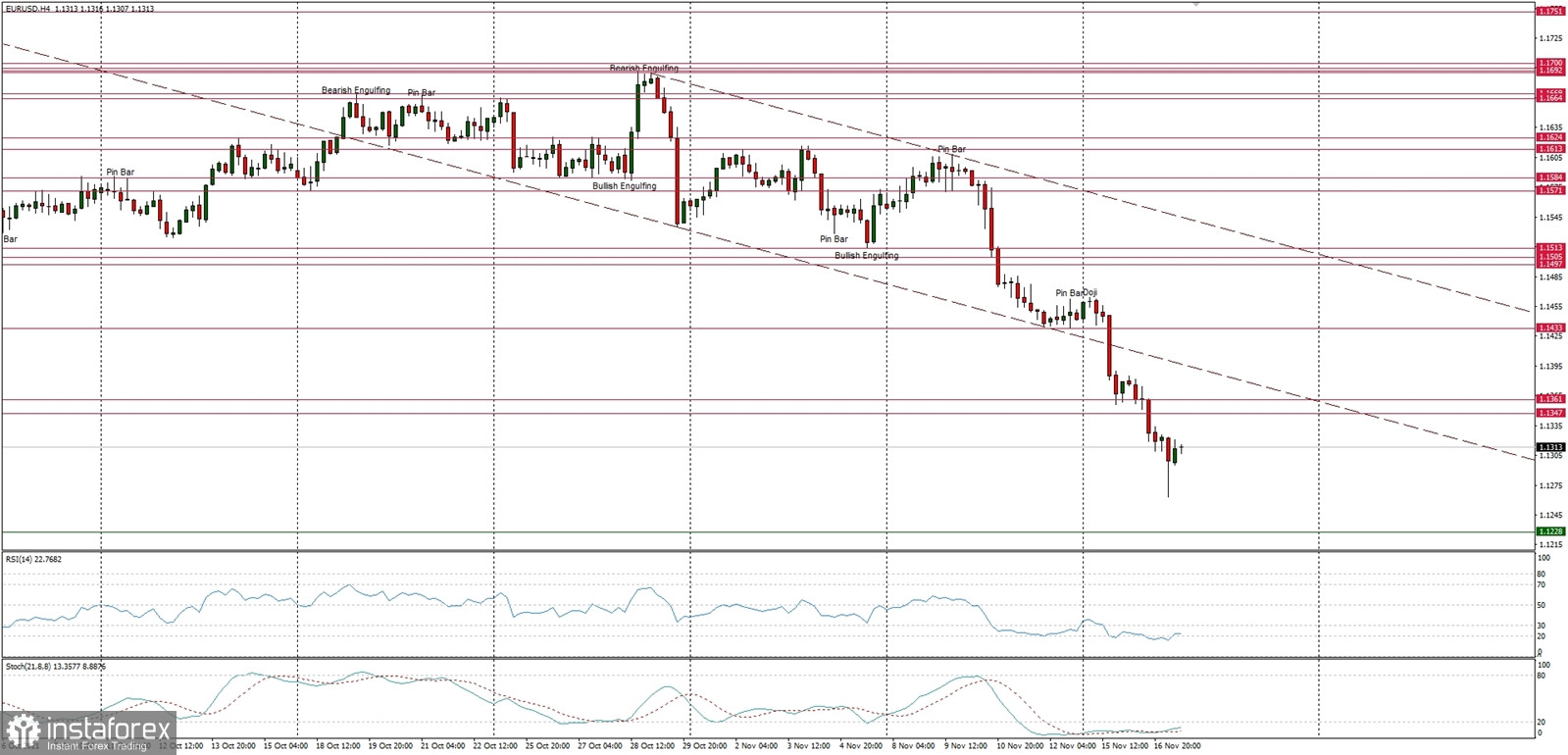

Technical Market Outlook

The EUR/USD pair had broken below the technical support located at 1.1361 and made a new swing low at the level of 1.1263 as the down trend accelerate. The down trend is being continued, so the next target for bears is seen at the level of 1.1228. The current market condition's at the H4 time frame chart are extremely oversold, so a bounce towards the local technical resistance seen at the level of 1.1347 might occur. The key technical resistance is seen at the level of 1.1513 and as long as the price trade below this level, the outlook is bearish.

Weekly Pivot Points:

WR3 - 1.1706

WR2 - 1.1652

WR1 - 1.1528

Weekly Pivot - 1.1479

WS1 - 1.1352

WS2 - 1.1302

WS3 - 1.1169

Trading Outlook:

The market is in control by bears that pushed the price below the level of 1.1501, which was the lowest level since November 2020. The next important long-term target for bears is seen at the level of 1.1365. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.