Fed protocols and Eurogroup meetings were ignored by investors.

Hello, traders!

Yesterday's minutes of the Federal Open Market Committee (FOMC) of the US Federal Reserve, as expected, revealed the uneasy mood of the Fed's leaders. Well, what else can be the mood when the COVID-19 epidemic continues to spread around the world, and the focus of the pandemic is located in the United States of America?

The minutes referred to a significant decrease in liquidity and very difficult trading conditions, including in the treasury securities market. FOMC members rated the prospects for the US economy as significantly worse and extremely uncertain. In general, the minutes of the Open Market Committee was quite pessimistic, but this factor was not a revelation for market participants. Everyone is well aware of the current situation and the extremely negative consequences of the pandemic for the American and global economy. The Fed expressed its readiness to keep rates at current levels until the situation stabilizes and the US economy recovers from the negative effects of COVID-19.

Since there was nothing unexpected or extraordinary in the minutes, the market simply ignored them, as well as the latest catastrophically bad data on the US labor market. But labor reports for March have not yet given a full picture of the consequences of COVID-19. The peak of the epidemic has not passed, and we regret to admit that the worst is yet to come.

In the meantime, one of the most acute problems in the United States is an acute shortage of medical personnel. It has reached the point where medical students receive their degrees in absentia and take the Hippocratic Oath over the phone. Perhaps this has not been seen even in the coolest fantasy blockbusters. But today - the reality is this.

As for Europe, there is a small but steady decline in the number of new coronavirus infections, but the situation remains tense and it is still very early to relax.

The Eurogroup conference, which was held in a video format, did not yield any results. Finance Ministers of 19 countries failed to agree to support the European economy from the consequences of COVID-19 in the amount of 500 billion euros. As usual, in such situations, the wealthiest countries, namely Germany and the Netherlands, refused to share the financial burden. Thus, Italy and Spain continue to remain virtually without the help of their European "friends-partners".

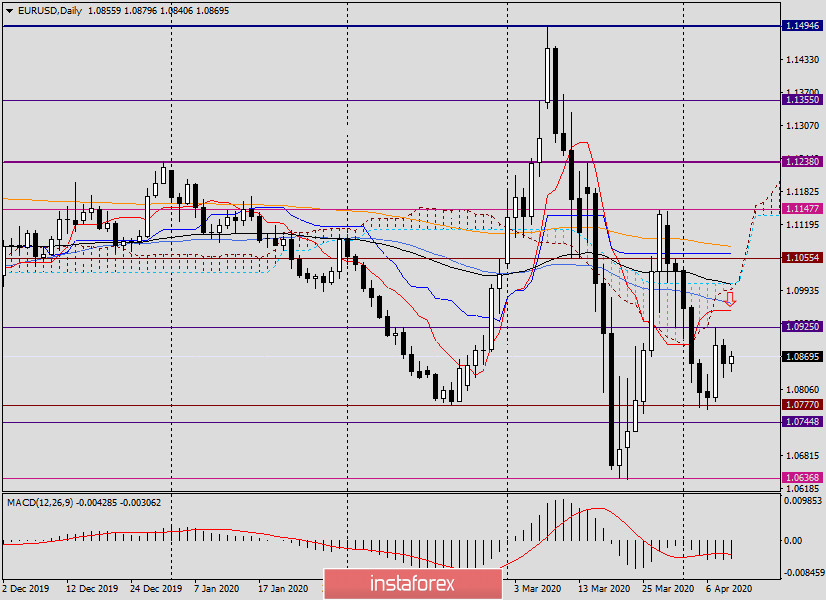

If we go to the analysis of the technical picture for the EUR/USD currency pair, it has not undergone any changes, as the price charts eloquently indicate.

Daily

Following the results of yesterday's trading, the pair slightly declined and ended the session on April 8 at 1.0855. However, yesterday's candle formed a long lower shadow, which may indicate the market's reluctance to decline and lead to another attempt to rise to the maximum values of trading on April 7 - the level of 1.0925.

However, it is worth noting that passing above this level may be limited by the price zone of 1.0955-1.1005, where the Tenkan line of the Ichimoku indicator, 50 simple moving average, the lower border of the cloud and 89 exponential are located.

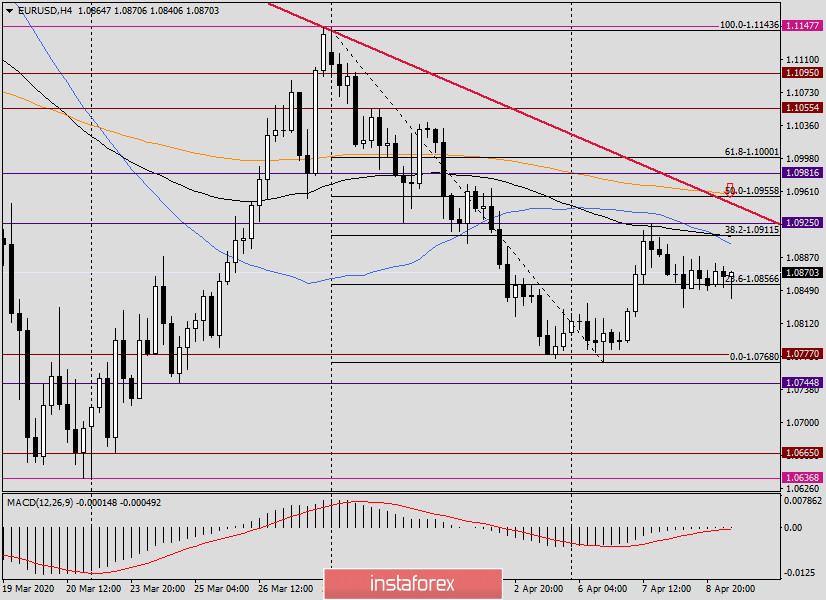

H4

On this timeframe, at the moment of completion of the review, there is a consolidation, after which there is often a strong directional movement. Given the current situation, it is very difficult to predict the future price behavior. If we take into account the technical picture, then sales on this chart look good from the area of 1.0955-1.1005. Although, if the pair breaks the red resistance line 1.1484-1.1443, 200 EMA and gets fixed higher, you can try buying on the pullback to the broken line and 200 exponential.

However, I am more inclined to assume that the main trading idea for the euro/dollar is sales after growth in the area of 1.0955-1.1005. At the moment, it is likely that the breakdown of the red resistance line and the 200 EMA will fail, that is, it will be false.

Today, a large block of macroeconomic statistics will come from the US, and at 15:00 (London time), Federal Reserve Chairman Jerome Powell is scheduled to speak. Perhaps these events will have an impact on the price dynamics of the major currency pairs and will help investors to determine the direction.

Good luck!