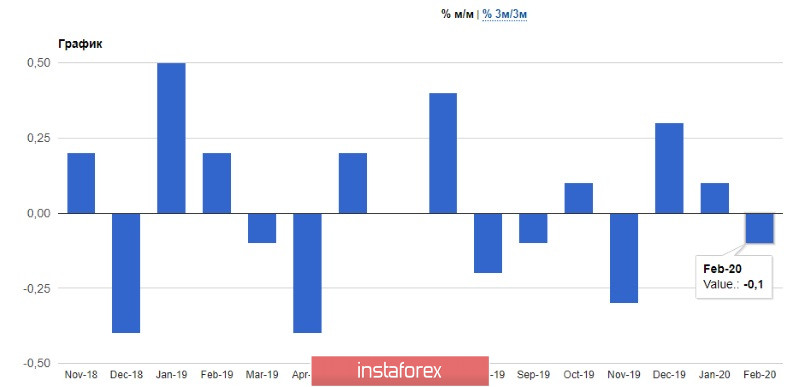

The pound sterling has crept to the highest level of the last week. However, its momentum is not strong enough to climb higher. Traders neglected the data on the UK GDP which shrank in February this year. The coronavirus pandemic and stimulus fiscal measures in the UK could entail even deeper contraction in March and April. According to the official data, the UK GDP edged down 0.1% in February month-on-month. It is not the coronavirus which affected the British economy, but storms which hurt manufacturing activity and construction.

Economists expected a 0.1% uptick. Moreover, they warn that the economy is set to struggle with the pandemic in the nearest 6 months. There are odds that the UK GDP will drop 5-7% in March. In April, it could slump by 15-20%. The reason is the collapse both in the production and the service sector that was triggered by COVID-19.

The UK GDP grew 0.3% in February from a year ago. In the three months to February, the economy rose 0.1% sequentially and 0.7% in annual terms. Recently, the Bank of England decided on direct funding of extra government spending during the pandemic. Such a decision will facilitate the recovery in the second half of the year. On the flip side, some opponents of this approach are worried that the central bank could adopt this measure on a regular basis, but under the current conditions households and some businesses need financial aid first and foremost, being more vulnerable.

As for the statistics on the UK industrial production, February could be the last month with a positive value in the nearest future. The industrial output inched up 0.1% in February on month, but fell 2.8% on a yearly basis. The consensus suggested a 0.3% rise and the same drop accordingly.

As for the visible trade balance, the UK trade deficit widened notably in February to £11 bln from £5.8 bln in January and £1.4 bln in December 2019. Such a serious deficit growth comes as a result of declining exports like in many advanced countries during the whole last year on the back of the US trade wars. However, a huge deficit is quite normal for the UK.

As I said earlier, from the technical viewpoint, the sterling buyers are holding the upper hand now. However, the pair will hardly manage to break above the important resistance level of 1.2490. Only a surge in supply and positive news on the coronavirus front will enable the sterling to surpass this level that will open the door to highs 1.2600 and 1.2690. If the currency pair remains trapped in a range, the nearest support will be its middle of 1.2380. Large market players will focus on 1.2280.

EUR/USDToday the ECB posted the minutes of the latest policy meeting which revealed disagreement in the ranks of the top officials. The new bond-buying program was not approved unanimously. Meanwhile finance ministers have been convening for a summit for three days in a row, but they still cannot settle lots of differences. Some ECB board members voted for limits to the asset-buying program while other officials voted for a large increase of the current stimulus programs. I said in my morning review that the euro's fate will depend on the outcome of the Eurogroup's summit.

Traders took no notice of the data on Germany's exports for February as exports had grown before the pandemic broke out. Destatis reported that Germany's exports climbed 1.3% in February to €109.3 bln. At the same time, imports dropped 1.6% to €88.5 bln. Economists assumed exports to have declined 0.8%. The trade balance surplus expanded to €21.6 bln, higher than the gthe forecast for a €17.2 bln proficit.

Analyzing EUR/USD in technical terms, the pair was trading sideways for the last couple of days. Eventually, the pair escaped the trading range that increased sharply long positions on the euro. The nearest upward target for EUR/USD is resistance at 1.0960. The actual breakout of this level will depend on the results of the Eurogroup's talks. In case of successful outcome, the pair could test the highs of 1.1040 and 1.1140. Otherwise, the pair could retrace to 1.0825 and 1.0770.