As many European markets were closed last Friday, volatility declined. The report on US consumer price index for the month of March did not affect the dollar. Much attention was given on the OPEC + meeting, which resulted in a deal to reduce oil production.

US consumer prices declined due to the crisis brought by the coronavirus pandemic. According to the US Department of Labor, the CPI fell by 0.4% in March this year, while back in February, the index increased by 0.1%. As for the base indicator, which does not take into account volatile categories, it fell by 0.1% in March, after rising by 0.2% in February. This suggests that prices dropped due to falling energy sources.

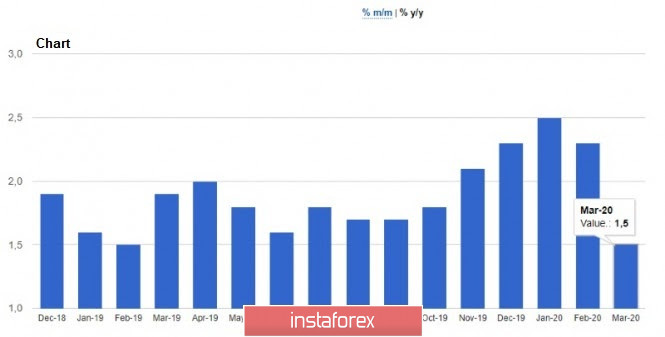

Energy prices fell by 5.8% in March, while gasoline prices fell by 10.5%. Comparing it to March last year, prices rose by 1.5%, while the base indicator increased by 2.1%. Economists expected the general index to fall by 0.3% and the base index to increase by 0.1%.

Inflation is still below the target level, so it is likely that the decline will continue further. Nevertheless, when the economy recovers, given the value of the interest rates right now plus the sharp rise that is expected to happen, consumer prices will jump, especially in the first months when household consumption and expenditure increases.

On the positive side, salary in US increased by 0.8% in March this year, while average weekly earnings grew by 0.2%.

Meanwhile, with regards to oil prices, Mexico unexpectedly withdrew from the OPEC+ agreement, disrupting the conclusion of the final deal. Recall that one of the conditions in the agreement was a reduction in oil production of all countries included in OPEC+.

The good news is, after a conversation with Donald Trump, the President of Mexico agreed to cut oil production by 100,000 barrels a day, fewer than what Saudi Arabia initially wanted, while US would reduce production by 250,000, compensating for Mexico. After that, the Kuwait's energy minister officially announced the conclusion of the OPEC+ deal.

For the technical picture of oil, after a slight decline on Thursday due to Mexico's withdrawal from the OPEC+ agreement, WTI prices stabilized around $ 23 per barrel. Unfortunately, even though the deal has now concluded, demand is still low, so trading will most likely continue to be conducted in a fairly wide price channel of $ 20-28 per barrel. Thus, it is best to enter the market in opposite directions, precisely when these levels are reached.

Returning to statistics, the report on the US budget deficit was published last Friday. According to the US Department of Treasury, it already increased by 8%, amounting to $ 743 billion. The increase was due to the sharp increase in government spending that exceeded tax revenues. Cost growth amounted to $ 2.347 trillion, while tax revenues amount to $ 1.604 trillion.

The report on industrial production in France for the month of February was also released last Friday. According to INSEE, it increased by 0.9%, while economists forecasted it to decrease by 0.4%. However, keep in mind that last February, the coronavirus pandemic has not yet actively spread in Europe. All the damage from it is recorded in March-April this year.

As for the technical picture of EUR/USD, the pair remained unchanged, as many European markets were closed on the weekends due to Easter Sunday. Today, the nearest target of the bulls is the high of 1.0970, where a breakthrough of which will push the pair to the resistance area of 1.1040. However, if pressure on risky assets returns due to low trading volume caused by the day off, the bulls will have to protect the support level of 1.0890, as the lack of demand will quickly push the euro to the lows of the week at 1.0830 and 1.0770.