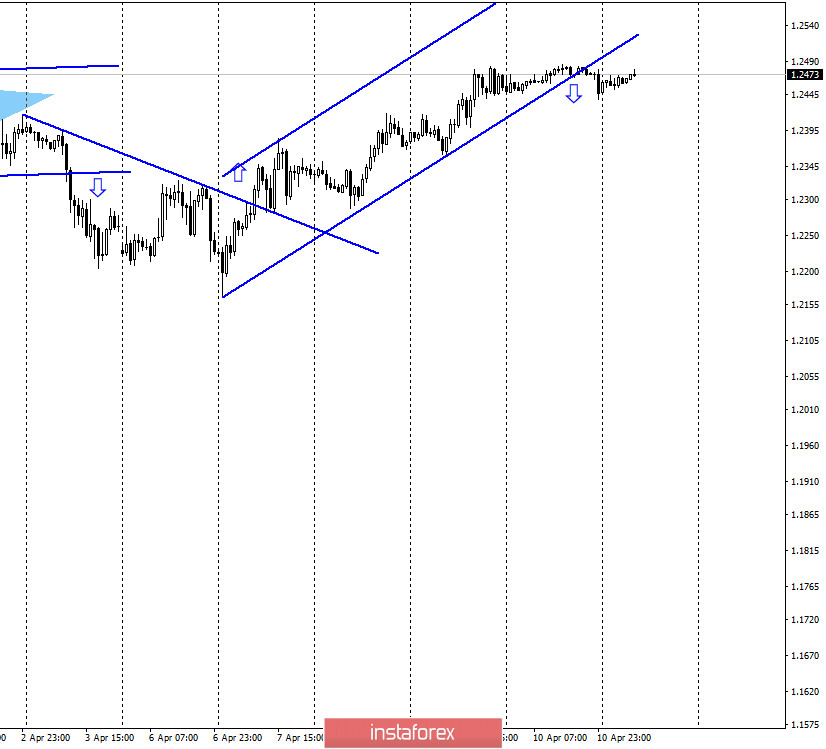

GBP/USD – 1H.

Hello, traders! As seen on the hourly chart, the pound/dollar pair moves in a very narrow sideways corridor, but on Monday morning, quite unexpectedly, the traders' lack of initiative stopped and the pair's quotes sharply moved up. Thus, even without a reversal in favor of the US currency, the growth just resumed after a few days of downtime. The pair has already managed to secure under the upward trend corridor, which somewhat confuses all the cards for traders. This corridor is no longer working, at the same time, the fall in quotes, according to the signal of breaking its lower border, has not started. This is a very ugly situation. At the moment, there are no signals on the hourly chart that can be worked out.

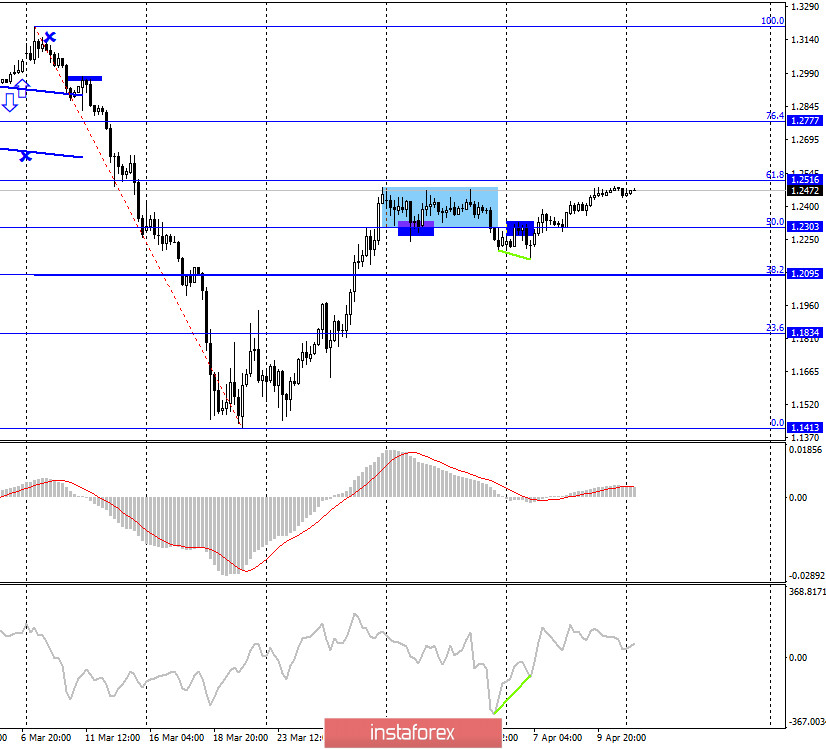

GBP/USD – 4H.

According to the 4-hour chart, the pound/dollar pair continues to grow in the direction of the corrective level of 61.8% (1.2516). Thus, the picture is more clear on the older chart. The rebound of quotes from this Fibo level will work in favor of the US dollar and the beginning of a fall in the direction of the corrective level of 50.0% (1.2303). Fixing the pair's exchange rate above the Fibo level of 61.8% will increase the probability of further growth towards the next corrective level of 76.4% (1.2777). Today, the divergence is not observed in any indicator.

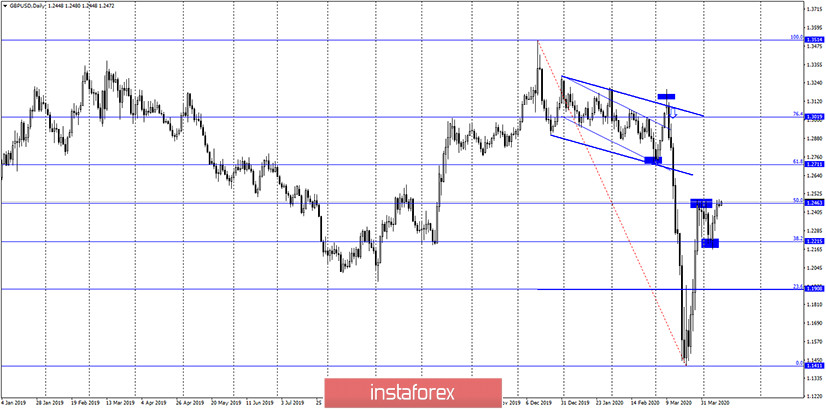

GBP/USD – Daily.

As seen on the daily chart, the pair's quotes performed an increase to the corrective level of 50.0% (1.2463), and at the moment there are all signs that this level will be passed. If so, the growth of the British pound's quotes will continue in the direction of the next Fibo level of 61.8% (1.2711). There is very little news on the British pound right now. Traders are now discussing the deal reached by OPEC+, which implies a gradual reduction in oil production by all market players. This has a certain relation to both Great Britain and America since both countries produce oil on their territory, therefore, they are interested in the growth of prices for "black gold". However, this is not strong enough news to affect the movement of the pound/dollar pair.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the two upper trend lines.

Overview of fundamentals:

No important reports were released in the UK on Friday. In America, there were reports on inflation, which did not affect the actions of traders.

The economic calendar for the US and the UK:

The European Union – Easter Monday

On April 13, news from the UK is not expected, as the day will be a holiday – Easter Monday. The latest news is that Prime Minister Boris Johnson has been released from the hospital after recovering from the coronavirus.

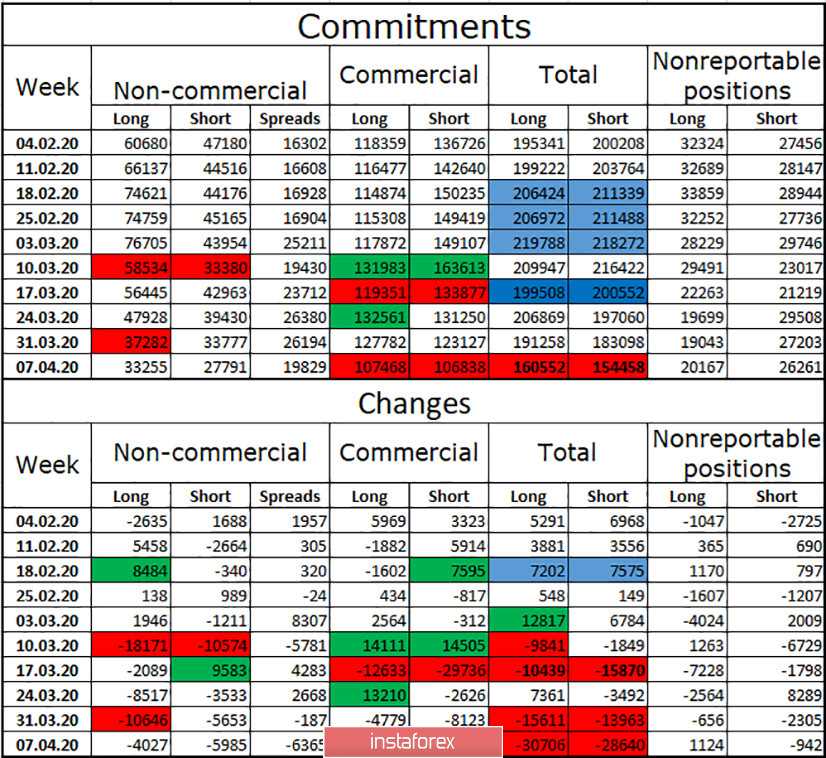

COT (Commitments of Traders) report:

On Friday, another COT report was released, which showed an even greater reduction in the total number of contracts for major market players. Both groups of speculators and hedgers got rid of long and short contracts. Thus, the attractiveness of the pound/dollar pair for large investors is getting lower and lower. Commercial group, which represents companies that hedge risks in the foreign exchange market, had the most contract losses. However, speculators also closed both buy and sell contracts. At the same time, the total losses for short and long are approximately the same for the week before April 7, and the overall advantage remains on the side of long, but it is minimal: 160,000-154,000.

Forecast for GBP/USD and recommendations to traders:

I believe that today we should consider selling the British dollar with the goal of 1.2303 when rebounding from the level of 1.2516. I recommend buying the pound if it is possible to close above the level of 61.8% on the 4-hour chart with the goal of 1.2777.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.