Consumer inflation in the US declined by 0.4% in March, year-on-year decline from 2.3% to 1.5%, the rate of price decline is quite high, but the disaster is still far away.

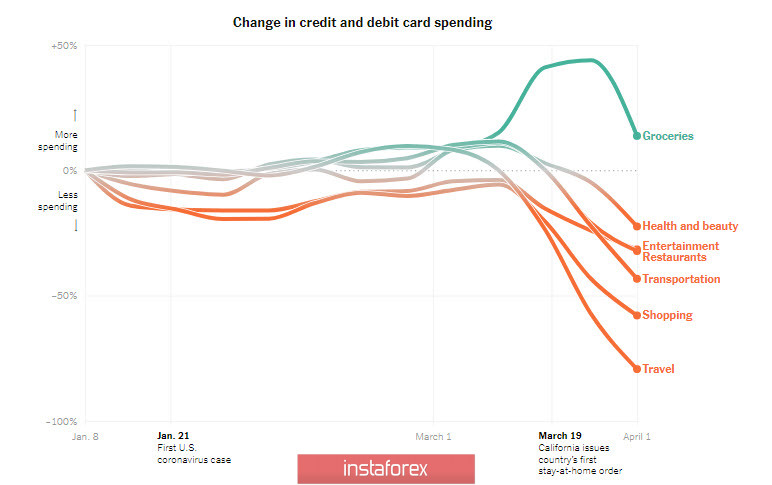

At the same time, serious changes are taking place in the structure of spending by US taxpayers that will no longer allow prices to return to their previous level. The reduction in consumer spending is the highest in history. An analysis of the New York Times shows that consumer spending falls by tens of percent across the spectrum, with the exception of food expenses, but there is a strong decline by the end of March.

The consumer sector accounts for up to 70% of the US economy, so the drop in spending is hitting the economy much harder than the problems with Boeing or the bankruptcy of shale companies. Nevertheless, the inflation model of Fed's St. Louis almost does not provide for the probability of deflation in the next 12 months, and this despite the fact that the range of GDP decline for the 2nd quarter is from 16% (forecast by the Federal Reserve Bank of Philadelphia) to 34% (Goldman Sachs).

The decrease in consumer spending will sharply reduce the level of budget revenues; the Congressional Budget Committee does not yet see a significant impact on the budget of either the coronavirus pandemic or the Fed reaction. The realization that the budget deficit has begun to grow sharply will come in the next month, which will require some decisive action again to support the economy.

The problems are just beginning. The CFTC report showed that demand for the dollar in the spot market still does not receive support in the futures. Therefore, the probability of a further decline in the dollar over the next few weeks remains high.

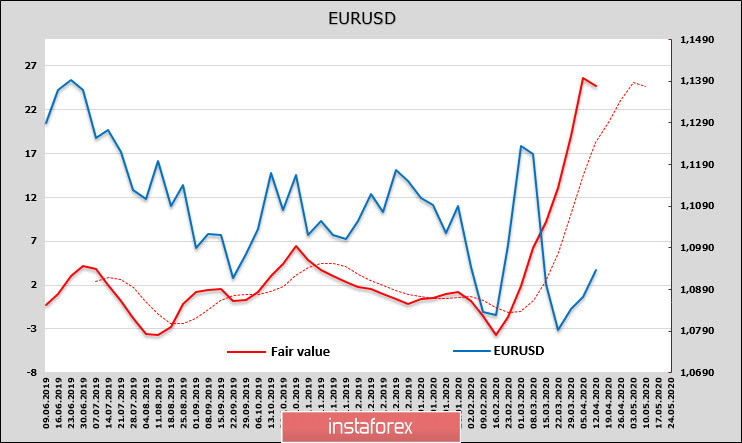

EUR/USD

The euro remains the leader in demand in the futures currency market - according to the CFTC report, the net long position increased again the previous week, and the estimated fair price is still significantly higher than the spot and stopped growing at about 1.14.

The desperate discussion of the eurozone countries on the form and scope of financial assistance received temporary permission at the end of last week. The amount of assistance agreed in the amount of 540 billion euros, while 240 billion will be allocated directly to fight against coronavirus, 100 billion will go to fight unemployment, the rest to support the corporate sector.

This money will be enough for some time, but hardly for a long time. The discussion on how to restore the eurozone economy after the coronavirus continues, the views of the parties are directly opposite. Italy, France and a number of southern countries insist on the issue of corona bonds, while the northern countries, led by Germany, do not want to create a joint debt and are only ready to consider expanding the EU budget.

The nature of the discussion indicates that there will be no new Eurobonds. The supply of the Euro will be limited relative to the supply of the dollar, which means that the force pushing the EUR/USD up will remain. The resistance of 1.1050/70 failed, the nearest goal is 1.1150, and the movement towards the medium-term goal of 1.1310/40 still looks reasonable.

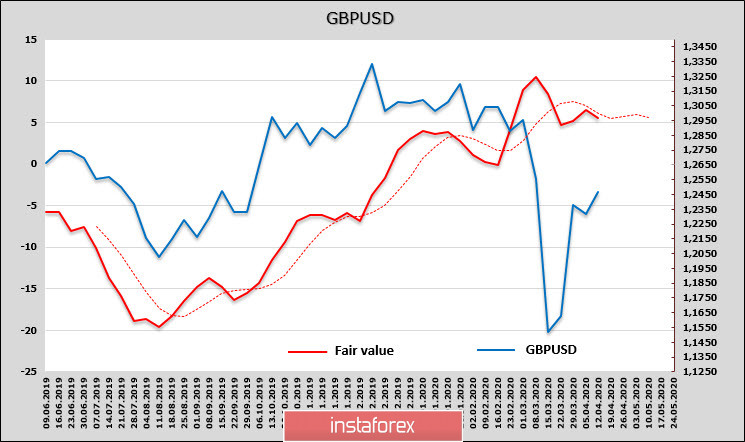

GBP/USD

The week that has come is completely empty for the pound. No significant macroeconomic news is expected, the pound received a small positive impulse after the completion of OPEC ++ negotiations and broke through the resistance of 1.2460/80, increasing the chances of continued growth. The CFTC report came out generally neutral with a slight increase in longs, the estimated fair price is still significantly higher than the spot.

The market for the pound on Monday morning is narrow. Due to a religious holiday, financial institutions will be closed, and activity in the currency market is unlikely to be high. On the other hand, consolidation above the level of 1.25 gives a good chance for the development of an upward movement, impulses can be developed up to 1.2970, however, clarity is needed for sustainable growth regarding the plans of the Bank of England and the government, which are clearly not yet enough. Technically justified purchases, stop 1.2450, since a decrease to this level will mean that the breakdown of the resistance of 1.2460 / 80 is false.