4-hour timeframe

Average volatility over the past five days: 86p (high).

The EUR /USD currency pair was trading with low volatility on Monday, April 13. The euro/dollar passed only 68 points during the day. And although this value is generally quite high for the euro, in the current situation it is very, very small. However, we warned that the first trading day of the week might be boring. The reason is the Catholic Easter, which is celebrated today, while Good Friday was celebrated last Friday, so market activity also tended to zero. Moreover, not a single important macroeconomic report is set for release today. Thus, traders who are on holidays in the foreign exchange market simply had nothing to react to. Accordingly, the low activity of the currency pair is completely justified.

As we have said many times, we need to pay more attention to technical factors. We have already made this conclusion several times based on the complete or almost complete disregard of nearly any macroeconomic statistics by traders. Moreover, completely different news, messages and reports were ignored. For example, data that the European Central Bank and the Federal Reserve have refinanced their economies by multibillion-dollar amounts did not affect the movement of the currency pair. For example, the US consumer price index for March, which was published on Friday and quite seriously differed compared to February, did not cause any reaction from market participants. Although inflation is one of the most important indicators of the state of the economy. In fact, the only reports that were not ignored are data from overseas on applications for unemployment benefits, as well as on NonFarm Payrolls. However, one can not even say that traders responded to these reports with a sharp sell-off of the US currency. In fact, the pair continues to approach its normal trading mode and rhythm. And at the moment, we are still inclined to the hypothesis that all the fundamental and macroeconomic backgrounds have no influence on the market. Moreover, from our point of view, the "correction against correction" scenario continues to be executed. We expected to see the pair grow to the $1.10 level, which is a psychologically important mark, but we failed to reach this level on the first trading day of the week. However, this does not mean that the pair will not be able to resume growth tomorrow. In any case, the euro's fate against the dollar will be decided in the area of 1.0900–1.1000, since the final consolidation should take place after the multidirectional movements over the past one and a half to two months.

From a technical point of view, the euro/dollar pair reached a strong resistance line of the Ichimoku Senkou Span B indicator today and rebounded from it. That is why the downward movement to the critical Kijun-sen line began. From this line, in turn, there may also be a rebound with a reversal upward and a resumption of the upward movement. None of the volatility levels of today have been worked out and is unlikely to be. The movement is weak, and it is unlikely to increase tomorrow, as the calendar of macroeconomic events will remain empty for the next trading day. There are also no signs of market nervousness, as there is no news at the moment. Even the topic of coronavirus has already ceased to impress traders, as the situation remains the same day after day. Previous and stable growth rates of disease and mortality. Some countries report small declines in the rate of proliferation growth, while others remain the same. As a result, as of April 13, 1.864 million officially registered cases of COVID-2019 worldwide, of which 557 thousand were recorded in the United States, and a total of 115 thousand deaths. Research and testing in the field of vaccination is continuing. However, there are no concrete results yet.

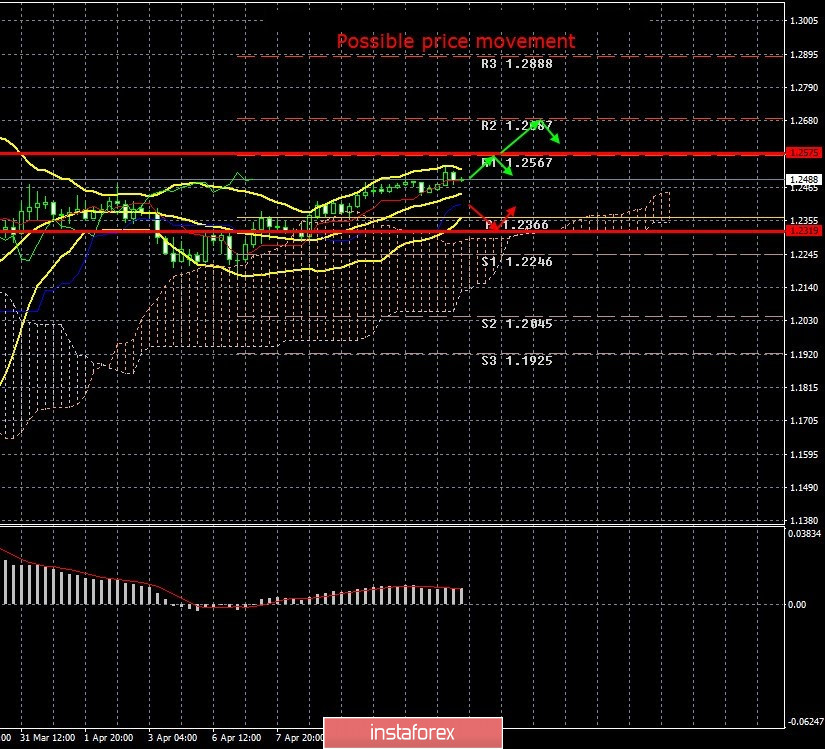

4-hour timeframe

Average volatility over the past five days: 128p (high).

The GBP/USD currency pair also traded with low volatility on April 13, by only 88 points. Yes, 88 points is small for the British currency in the current state of the market. And looking at the illustration of the movement of the pair, one gets the impression that there is no movement at all. These are all the consequences of the super-volatility that has been observed in the last two months. One important fact should still be noted despite the fact that today there were no macroeconomic statistics in either the UK or the US. Firstly, the pound/dollar pair got out of the side channel, limited by the levels of 1.2207 and 1.2470. Over the course of the day, the pair slowly crossed the upper border without rebounding off it, as it had at least three times before. Thus, the pair has a chance of resuming the trend movement. Secondly, unlike the euro, which began to adjust today, the pound continued to rise against the US currency. We consider this lack of correlation on a half-day to be very significant. As a result, the pair's quotes continue to move towards the first target - the resistance level of 1.2567, which almost coincides with the volatility level of 1.2575.

By the way, this week promises to be super boring for the British currency. If a couple of reports will still be published in the EU that have ghostly chances to influence the mood of traders, not a single one is expected from the UK. Moreover, for obvious reasons, the entire active life of the pound is now put on hold. There is no news on Brexit or on trade negotiations with the EU. Thus, we do not see why volatility is increasing this week.

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair began to adjust against the Ichimoku Golden Cross on the 4-hour timeframe. It is advised that you consider selling orders after consolidating the price below the Kijun-sen line with the first targets of 1.0849 and 1.0818.

For long positions:

It is advised to consider new purchases of the euro/dollar pair in small lots (since the Golden Cross remains weak) with the objectives of the Senkou Span B line and the resistance level of 1,1003 in the event of a price rebound from the critical line.

Recommendations for GBP/USD:

For short positions:

The pound/dollar pair went beyond the side channel, indicating a desire to continue the upward trend. Thus, it is advised to return to selling the pound before the bears cross the Kijun-sen line, small lots with the first targets of 1.2319 and 1.2246.

For long positions:

You can now buy the GBP/USD pair with the target of 1.2567, since traders managed to overcome the area of 1.2450–1.2470. At the same time, the MACD indicator is pointing down, I practically do not respond to upward movement, since it is rather weak.