Investors regained optimism in light of upbeat economic data from China and a decrease in the death toll in Europe and the US. Such developments assure investors that the coronavirus pandemic has passed its peak, easing the adverse impact on the global economy.

Today China's customs administration reported that exports, imports, and trade proficit turned out to be much higher than expected. Such information propelled a rally of Asia-Pacific stocks. As a result, the US dollar came under pressure.

According to the customs administration, exports fell 6.6% in March in annual terms, much slower than the expected slump of 14.0%, following a 17.2% drop in February. Imports declined just 0.9% from a 4.0% fall in the previous month. Economists had expected a sharp drop of 9.5%. Trade balance proficit expanded to $19.9 billion in March from a proficit worth $7.09 billion in February. The actual figure beat expectations of an $18.55 billion proficit.

So, China's economy could revive sooner than expected. Such prospects inspire optimism. Once, the same lifebuoy rescued the global economy from apocalypse in 2008/09 in the wake of the mortgage crisis in the US.

Apart from this news, investors are cautiously optimistic in light of fresh reports from the EU and the US on a slowdown in the coronavirus fatalities. If medical forecasts come true (the odds are high), the pandemic both in Europe and the US is likely to reach the plateau this or next week. I said this earlier in my reviews, under such developments the market will regain appetite for risk. Thus, the US dollar will intensify its fall, first and foremost, against risky assets, including commodity currencies.Besides, I suppose oil prices will extend a smooth upward wave for obvious reasons. On the one hand, oil prices will benefit from the new OPEC+ pact on oil production cuts. On the other hand, economic recovery in the US and Europe will boost demand for energy.

I'm still optimistic about prospects of the Russian ruble, the Canadian dollar, the Australian dollar, and the New Zealand dollar. All of them are likely to advance. Moreover, the easing pressure from the COVID-19 pandemic will prop up the euro and the pound sterling. On the flip side, the yen is expected to lose ground against the US dollar.

Intraday analysis

USD/JPY found support at 107.50. If this level holds steadily, the pair could reverse upwards aiming for 109.39 amid demand for risky assets.

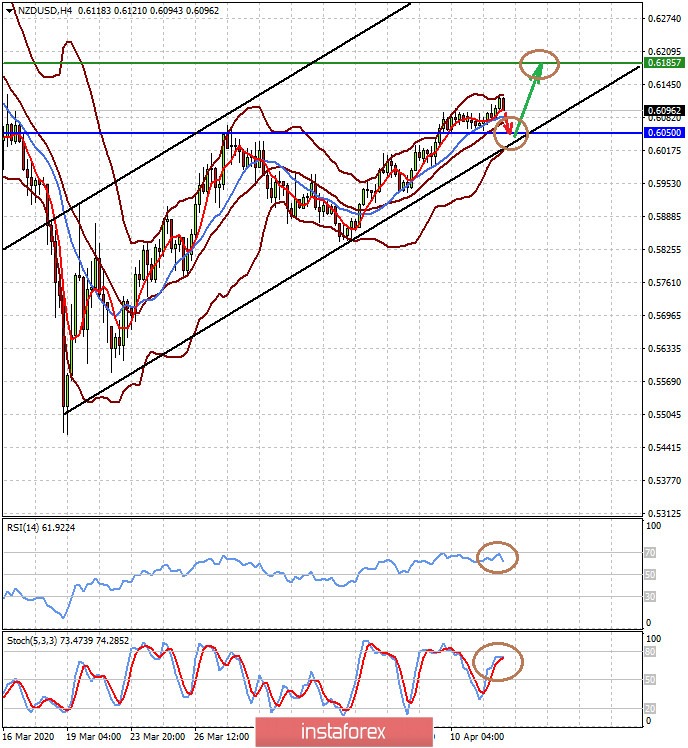

NZD/USD is making a correctional decline towards 0.6050 inside the overall bullish trend. It makes sense to buy the pair roughly from this level with the target level of 0.6185.