The USD/CAD pair was trading in the red at 1.2597 at the time of writing. DXY's sell-off forced USD to depreciate versus all its rivals and not only against CAD. It remains to see what will really happen as the bias is bullish in the short term.

Fundamentally, USD was punished by the US Unemployment Claims indicator which was reported at 268K above 260K expected. On the other hand, the Canadian ADP Non-Farm Employment Change was reported at 65.8K versus 41.0K in the previous reporting period.

Technically, after its amazing rally, the Dollar Index was somehow expected to retreat. The DXY is in a corrective phase, so USD's depreciation is natural.

USD/CAD upside could be over

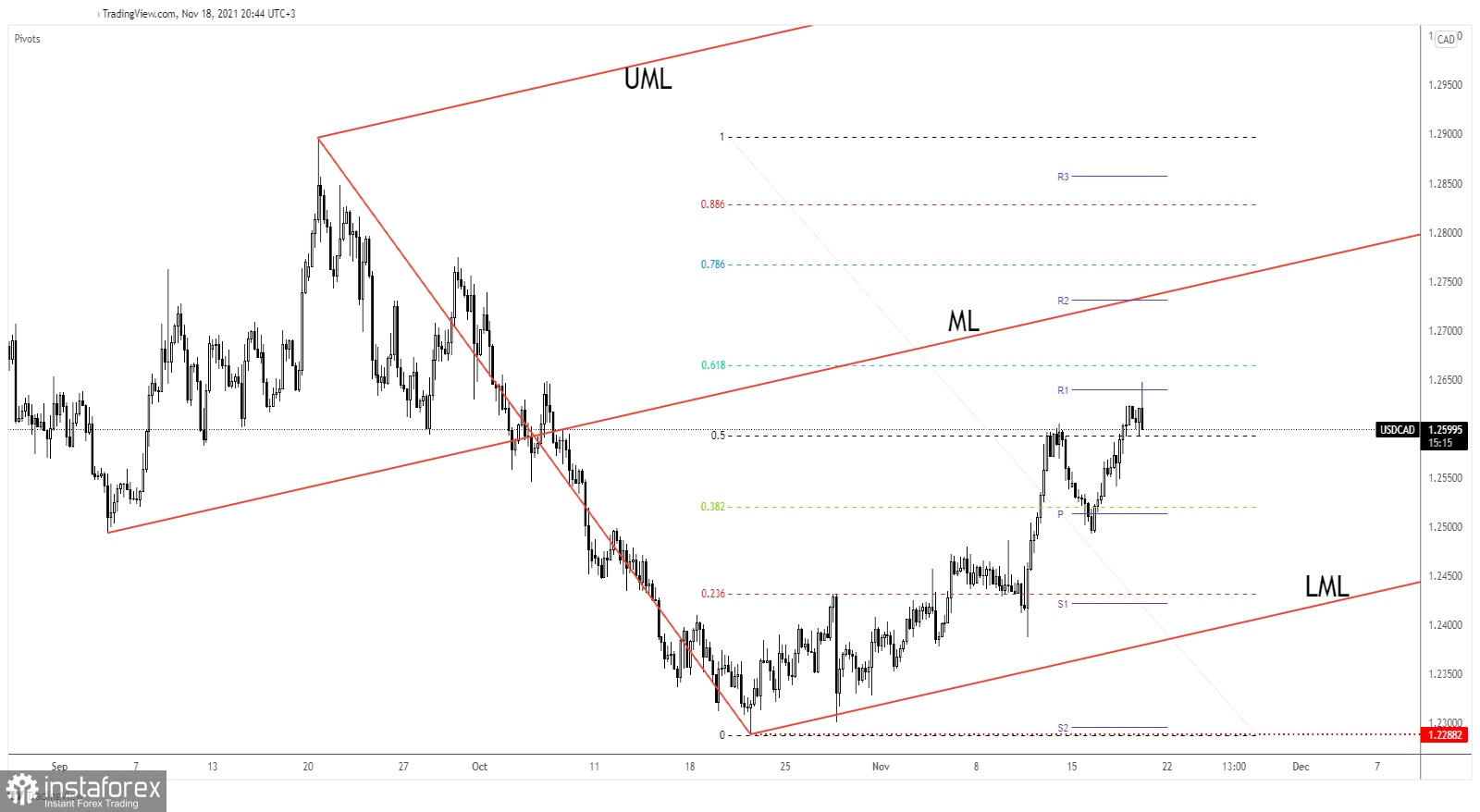

USD/CAD is about to register a false breakout with great separation through the weekly R1 (1.2639). It's valid breakout above the 50% retracement level signaled potential upside continuation.

As long as it stays above the 50% (1.2592) retracement level, USD/CAD could still extend its growth. In the short term, minor accumulation, consolidation above this level could bring new long opportunities and could validate more gains ahead.

USD/CAD outlook

Staying above the 50% retracement level could still indicate potential further growth. A minor consolidation here could bring new long opportunities. The Ascending Pitchfork's median line (ML) stands as a major upside target and obstacle.

On the other hand, dropping and stabilizing below the 50% retracement level could indicate a potential drop towards the 38.2% retracement level and down to the weekly pivot point of 1.2599.