Hello, dear traders!

Recently, the market is quite unpredictable, in the sense that fundamental factors are often ignored by investors. At the same time, not only the macroeconomic reports, but also the measures taken by the world's leading central banks to mitigate the negative economic consequences caused by the COVID-19 outbreak remain without a proper response. In fact, in the current situation, technical factors play a particularly important role in the movements of currency pairs, which will be given greater importance in this review.

However, first, let's briefly talk about the subject of coronavirus. Europe is still feverish from the pandemic. Reports of fewer deaths in some of the most infected countries are not confirmed, as the situation worsens again the next day and the daily mortality rate increases. However, the situation in the Eurozone countries is different. If French President Macron signed a decree extending the strict quarantine until May 11, then in Italy, where the situation is still far from stable improvement, a decision is being made to ease the quarantine. First of all, this applies to stores whose assortment consists of stationery and products for newborns.

If you go to the analysis of the main currency pair of the Forex market and start with the events of today, reports on the import price index will be received from the US at 13:30 (London time), and a little later there will be speeches by members of the Open Market Committee (FOMC), Bullard and Evans.

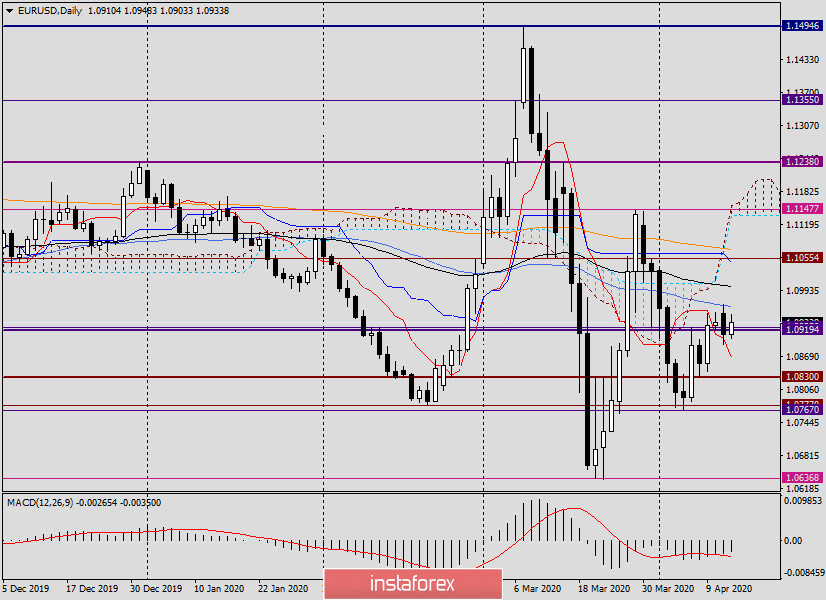

Daily

Yesterday's idea to buy a pair on a decline in the price zone of 1.0920-1.0900 was confirmed. At the end of Monday's trading, the minimum values were shown at 1.0893, and the session ended at 1.0912.

Today, the euro/dollar pair is strengthening, and at the time of writing this review, trading is conducted near 1.0932. The 50 simple moving average, which passes at 1.0963, still provides serious resistance to attempts to grow. However, it should be noted that at the moment 50 MA has not been re-tested for a breakdown, and I think this probability should not be excluded. Moreover, I would venture to assume that if the highs of 1.0967 were recorded yesterday, the rise may continue to the 89th exponential, which is at the level of 1.1002. Given the importance and significance of the psychological level of 1.1000, much in the future direction of the quote will depend on the closing price of today's trading relative to this landmark mark. If the euro bulls manage to finish today's session above 1.1000, their next target may be the area of 1.1047-1.1055, where the Kijun line of the Ichimoku indicator and the strong technical level of 1.1055 is located.

If the pair is unable to resume the rise and returns to yesterday's downward dynamics, after updating the lows of Monday, the euro/dollar risks falling to the area of 1.0870-1.0830, where the Tenkan line passes and the minimum values of trading on April 8-9. The longer-term goal of bears for euro/dollar will be a strong support zone of 1.0777-1.0767.

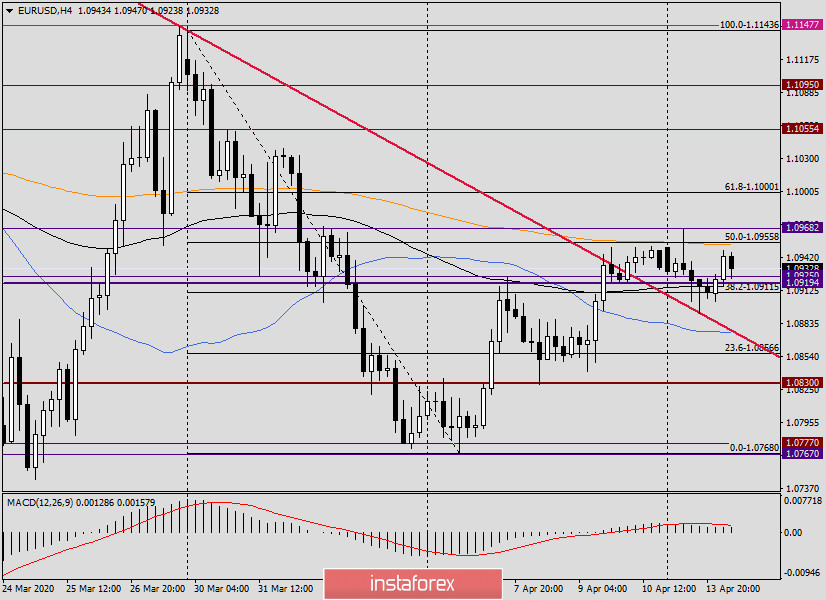

H4

On this timeframe, we can see that the pair managed to overcome the red resistance line of 1.1484-1.1443 with difficulty. The quote was fixed above this line, and yesterday it was rolled back and given the opportunity to open long positions.

But the 200 exponential moving average can't go up yet. It is like a barrier is in a horizontal position and prevents attempts to further growth. Taking into account the technical picture on this and daily charts, we can offer the following trading plan.

At the moment, in my opinion, both purchases and sales remain relevant, but purchases look a little more preferable. If the pair gives another pullback to the broken red resistance line, right under which 50 MA is located, then you can think about opening long positions near 1.0880. Those who want to try more aggressive and risky purchases can try around 1.0917.

Sales, as noted above, are considered on attempts to break above 1.1000. It is riskier to try to sell the euro/dollar after rising to the price zone of 1.0953-1.0963. That's all for now.

Good luck!