Economic calendar (Universal time)

There are no important events in today's economic calendar.

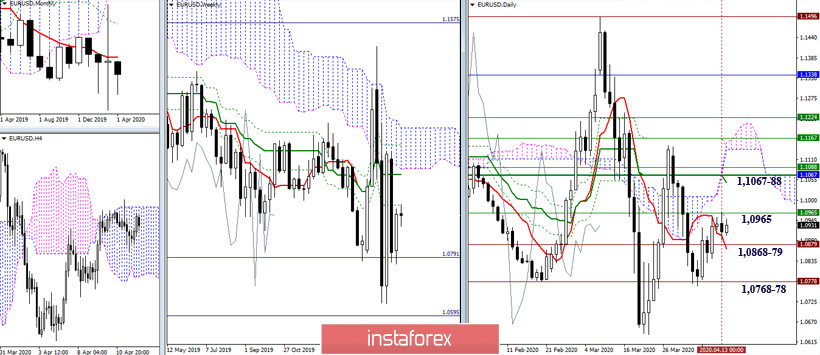

EUR / USD

Players on the increase failed to break through the resistance level of 1.0965 yesterday. When testing the level, the pair indicated a slow down. As a result, despite the fact that the uncertainty has been added, the main conclusions and expectations have not changed. It is still important for players to increase to break through the resistance encountered (1.0965), then their attention and interest will be directed to the fight against the secured resistance area 1.1067-88 (daily Kijun + weekly Kijun and Senkou Span A + monthly Tenkan). If current slow down persists, it is possible to form a consolidation between the met resistance of 1.0965 and the supports of 1.0868-79 (daily Tenkan + historical level). Strengthening of bearish sentiment may occur during the breakdown and consolidation below 1.0768-78 (minimum extremum + historical level).

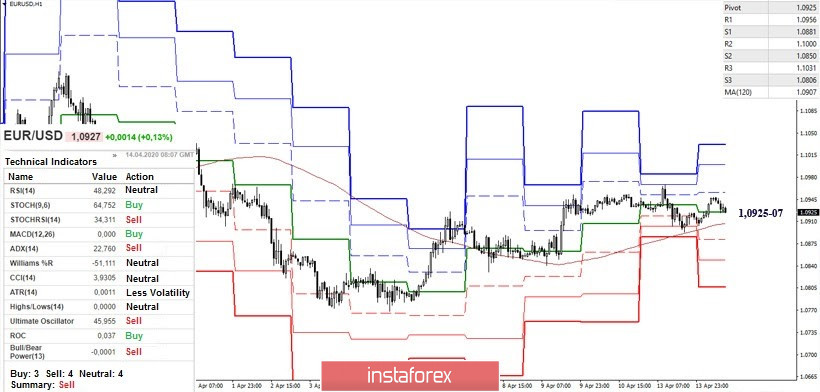

With yesterday's decline, the weekly long-term trend fulfilled its mission and helped the players to increase to maintain their main advantage. Nevertheless, the bulls could not go beyond the correction zone (1.0968) and restore the upward trend to H1, which remains their first priority. At the moment, the pair is testing key support for the lower halves again, which are joining forces today at 1.0925-07 (central Pivot level + weekly long-term trend). A reliable consolidation below will change the current balance of forces and may serve to strengthen the bearish sentiment. The following intraday supports will be the classic Pivot levels 1.0881 - 1.0850 - 1.0806.

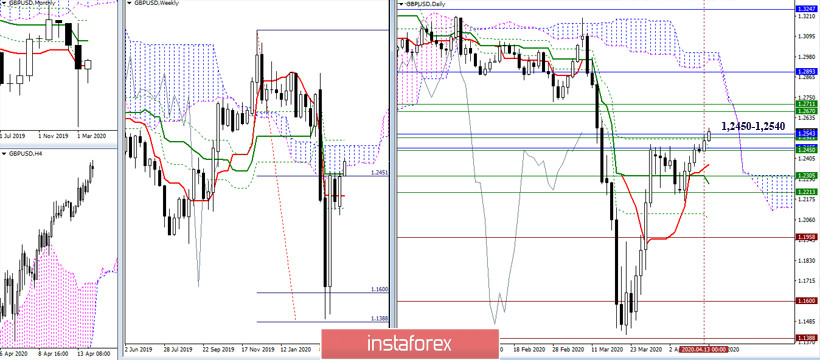

GBP / USD

Players to increase are fighting to break through the significant resistance zone, previously designated within 1.2450 - 1.2540 (monthly Tenkan + weekly Kijun and Senkou Span A + final line of the daily cross + monthly Fibo Kijun). Breaking through and securely consolidating above will allow us to consider new ranges, while the next landmark will be the area 1.2670-1.2711, which allows us to eliminate the weekly dead cross and enter the bull zone relative to the weekly cloud. However, failure during the conquest of 1.2450 - 1.2540 can delay the pair in the zone of attraction of these levels, and consolidating under them will contribute to the formation of another rebound from the resistance encountered.

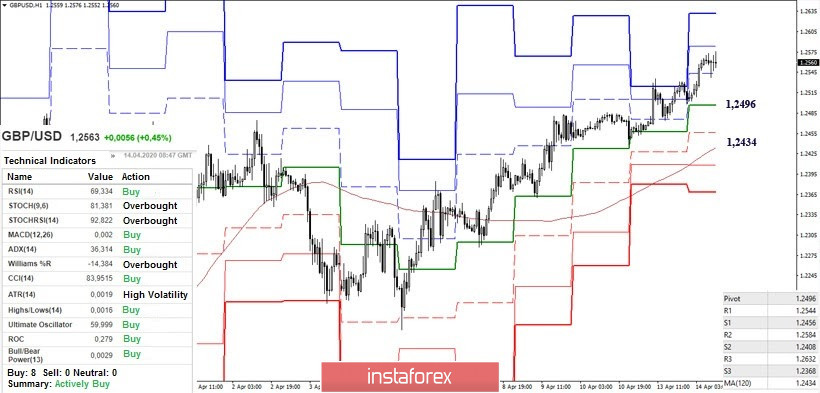

At the time of analysis, the advantage belongs to players to increase, who develop an upward trend in the lower halves. Among the upward reference points within the day, the resistance R2 (1.2584) and R3 (1.2632) remained now. At the same time, the central Pivot level (1.2496) and the weekly long-term trend (1.2434) will be of primary importance among the supporters with a change in mood and the emergence of a downward correction. Consolidating below the key support of the lower halves coincides with the loss of the most significant levels of the higher halves. Therefore, players to decline will most likely take advantage of this circumstance and will strive to realize a rebound from the resistance zone encountered (1.2450 - 1.2540).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)