4-hour timeframe

Average volatility over the past five days: 87p (high).

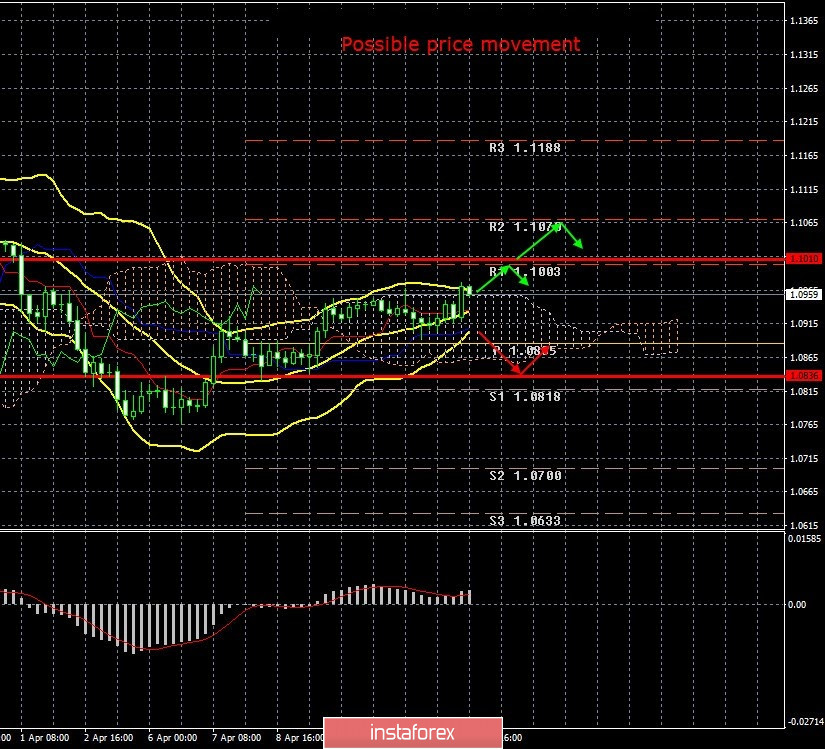

The EUR/USD currency pair resumed the upward movement on April 14 after a minimal correction as part of the upward trend. Everything is perfect from a technical point of view. The euro/dollar pair rebounded from the Senkou Span B line yesterday, which is a strong resistance, adjusted to the Kijun-sen line, which is a support for the current trend, rebounded from it and resumed the upward movement. In recent hours, traders also managed to overcome the upper border of the Ichimoku cloud, which also strengthened the current Golden Cross. Thus, the upward movement may continue, which is fully consistent with our "correction against correction" strategy, which we have already mentioned several times. At the moment, the pair is approaching the 1.10 level, which is a psychologically important mark.We expect that the strengthening of the euro will end in this level. In addition to the $1.10 level, the resistance and volatility levels of 1,1003 and 1,1010 are located nearby. Thus, formally we have three resistance at once, from which quotes of the pair can rebound. Further movement will depend on consolidation in the 1.09–1.10 area. We believe that it is in this area that the final part of the pair's movement will occur, after two months with maximum volatility. The pair could even be in an open flat for a while. However, one should always remember that other scenarios are possible. For example, the upward movement will continue above the $1.10 level. Therefore, trading should be on technical indicators. Moreover, the macroeconomic background is currently empty and insignificant. Traders have been ignoring almost all the news for almost two months, messages and data from the European Union and the United States.

Last Friday was Good Friday, and it was Easter on Monday. Thus, no macroeconomic statistics were published on these days. A little bit of significant news will arrive tomorrow. So that market participants will not die of boredom, they can study new data on the coronavirus epidemic and read more and more comments and statements by US President Donald Trump, who is still the main news-maker in the world. In principle, it is quite possible to create a separate online publication specifically for Trump's interviews and statements. Because social networks can no longer cope with the influx of comments from the US president. According to the latest information, Trump still wants to lift at least some of the quarantine measures in May. Naturally, this idea implies a restart of the economy, and not a simple desire to end the quarantine. The presidential administration is finalizing a plan to ease the quarantine, as Trump announced today. "I have discussed this issue a lot with my team and leading experts. We are very close to completing the plan to open the country. Soon we will distribute important recommendations to the governors so that they can open their states. "The country will open and open with success," Trump said. The US leader also noted that it is the president who decides when to end the quarantine. Thus, Trump took full responsibility for what was happening. It doesn't matter if he understood this, but if suddenly the doctors are right and a second epidemic breaks out in the country due to the lifting of the quarantine, Trump will be blamed for sure. However, the president can, as usual, use his most favorite weapon and say anything to remove responsibility from himself. Immediately there will be "other guilty persons" who "advised Trump to open the country" or "misinformed him". In principle, Trump's rush is clear and understandable. The country is approaching the presidential election, and all the Trump campaign's have been killed by the coronavirus. If earlier the US president could say that the country's economy significantly grew under him, now he can only remember this. According to approximate calculations, the US economy has already contracted to "pre-Trump levels" in the two months of the epidemic. Thus, the US leader urgently needs to do something to prevent the economy from collapsing even more. So that by November it has somehow recovered. Unfortunately, it does not take into account the fact that if the quarantine measures are removed or relaxed, the growth rate of the spread of COVID-2019 infection may begin to grow again. Accordingly, these are potentially new cases, additional burden on the health sector, and new deaths. The United States remains in first place in the world in terms of the number of cases. Their number is already approaching 600,000. The number of deaths is almost 24,000.

4-hour timeframe

Average volatility over the past five days: 122p (high).

The GBP/USD pair continues to grow on April 14 as if nothing happened. The British currency continues to strengthen against the dollar, despite the fact that there are no special reasons for this and no reasons. Fundamental and macroeconomic backgrounds remain completely empty. No information is coming from the UK right now, just as it is from the US. We mean important economic information. Meanwhile, experts believe that Britain will become the most affected country from coronavirus. At the moment, the number of cases of infection in Great Britain is already 90,000 and around 11,000 recorded deaths. That is, the mortality rate in Britain is much higher than the average worldwide - 3-5%. They exceed 10%. And given the fact that the British are allowed to go outside and spend any time there (formally one hour, but no one checks the actual duration of each citizen's stay outside the house), the epidemic's growth rate is not slowing. Representatives of the health sector believe that the UK will have a second and third wave of a pandemic, and only mass vaccination can save the British population. However, the creation of the vaccine will take at least a year. How many more people can get sick during this time and how much will die is hard to imagine. Wellcome Trust fund director Jeremy Farrar, who finances the development of the vaccine, believes that creating a vaccine even in 12 months is "a very ambitious goal." In general, there is no positive news from the UK, and although the pound sterling is growing, it still does not give the impression of a strong currency that is growing for a reason. However, technical factors are now on the side of the British currency, so growth is worth bargaining for.

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair resumed its upward movement on the 4-hour timeframe. Thus, it is recommended to consider selling orders after consolidating the price below the Kijun-sen line with the first targets of 1.0836 and 1.0818.

For long positions:

At this time, traders are advised to stay with purchases of the euro/dollar pair with targets at 1,1003 and 1,1010, since the pair rebounded off the Kijun-sen line and then overcame Senkou Span B.

Recommendations for GBP/USD:

For short positions:

The pound/dollar pair has left the side channel and continues the upward trend. Thus, it is advised to return to selling the pound before bears overcome the Kijun-sen line, small lots with the first goals of 1.2407 and Senkou Span B line

For long positions:

Now it is recommended to stay in purchases with goals 1.2651 and 1.2687, as there are no signs of the beginning of the correction. The MACD indicator may turn down from time to time, since the upward movement is rather weak.