While the European Central Bank (ECB) and the Federal Reserve (FRS) are making significant efforts and measures to counter the effects of COVID-19, the pandemic continues its march around the world.

The number of people infected with coronavirus on our planet is inexorably approaching 2 million people. However, the largest number of COVID-19 infections remains in the United States. All the more surprising are the comments of the American President Trump, who believes that the measures taken to combat the pandemic are effective and working. This is either a psychological move, or the US President is given incomplete and incorrect information.

In Europe, the situation is beginning to stabilize and even improve a little, as in the centers of the epidemic, which is located in Italy and Spain, there is a lower number of cases, as well as deaths. However, I think it is too early to say that the peak of the epidemic has already passed.

Before proceeding to the technical analysis of the euro/dollar currency pair, let me remind you of today's statistics, which may affect the course of trading on the main currency pair of the Forex market. Except for not very significant data from France, the main macroeconomic reports will come from overseas. Starting at 13:30 (London time), a large block of data from the US will be published, where it is worth highlighting releases on retail sales, capacity utilization and inventory in warehouses. Let me remind you that in recent years, market participants mostly ignore macroeconomic statistics, even the most important ones (you can recall the latest Non-farm), but traders should take into account the fundamental factors. All details about the time of data release and forecasts for them can be seen in the economic calendar.

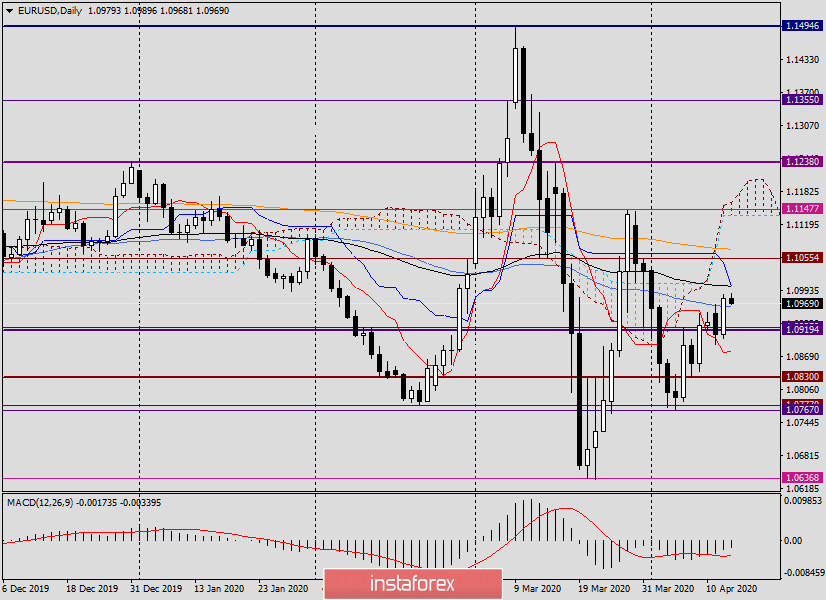

Daily

As expected in yesterday's euro/dollar review, the bulls for the pair did not give up trying to break through the 50 simple moving average, and these attempts were successful.

Following the results of yesterday's trading, the euro/dollar pair rose and ended the session at 1.0980, falling slightly short of the important technical and psychological level of 1.1000. I believe that today the players on the rate increase have every chance to continue growing, the nearest goal of which will be the symbolic mark of 1.1000. As you can see, the 89 exponential moving average and the Kijun line of the Ichimoku indicator converged at 1.1002, which can provide decent resistance to attempts to move further north and push the price down.

At the time of writing this article, the pair is slightly declining and may roll back in the 50 MA broken yesterday (1.0964), from where it will turn up again and test the level of 1.1000 for a breakdown. If the upward scenario continues and the growth is more significant, its next target will be the area of 1.1055-1.1072, where the strong technical level and the orange 200 EMA are held.

To take control of the pair, the bears need to lower the quote below another important level of 1.0900, then break through the Tenkan line (1.0878) and close trading below.

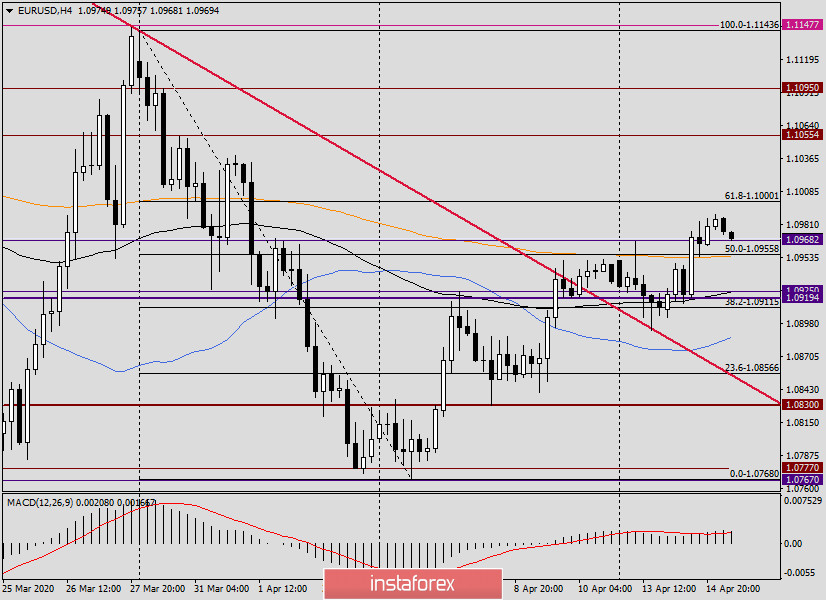

H4

On this timeframe, the pair finally broke above the 200 exponential and gained a foothold over this moving average. Now, with a pullback to 1.0955, the euro/dollar pair can get strong support and turn around to continue the upward movement. If the pair falls below the 200 EMA and is fixed under it with three or more candles, the 200 EMA breakout will have to be recognized as false, which will be a trump card in the sleeve of players on the decline.

Given the technical picture on the daily and 4-hour charts, I would venture to assume that the euro/dollar pair will continue to strengthen. In my opinion, the most relevant trading idea today is to buy after corrective pullbacks to the price zone of 1.0965-1.0945. The nearest targets are near 1.1000, from where you can try to sell the euro/dollar pair if there are reversal candle patterns on H4 and (or) H1.

Good luck!