Crypto Industry Outlook:

India appears to be taking an increasingly progressive stance on Bitcoin, especially considering the country is struggling to achieve a unified view of the categorization and legality of this new asset class.

Amidst a multitude of meetings, industry briefings, and growing banking problems, the country's prime minister speaks more and more loudly about cryptocurrencies.

During the Sydney Dialogue, Prime Minister Narendra Modi called on democratic countries to work together to make the best use of cryptocurrencies and Blockchain technology. It also stated that it should not be used for unethical purposes.

On Monday, at a high-level meeting, Modi spoke about cryptocurrencies in the context of money laundering and terrorist financing. The general atmosphere around the meeting suggested that strong forward-looking and progressive regulatory measures were in preparation.

The Government of India has previously taken steps to establish a solid regulatory infrastructure for a rapidly growing sector. He has had many discussions, including one with the Reserve Bank of India (RBI), the Ministry of Finance and the Ministry of the Interior, as well as cryptocurrency experts and important industry players from India and beyond.

Despite the objective point of view expressed by some government ministers, RBI Governor Shaktikanta Das remains unconvinced. The director reiterated his position yesterday that a cryptocurrency trading permit could jeopardize any financial system as it is not supervised by central banks.

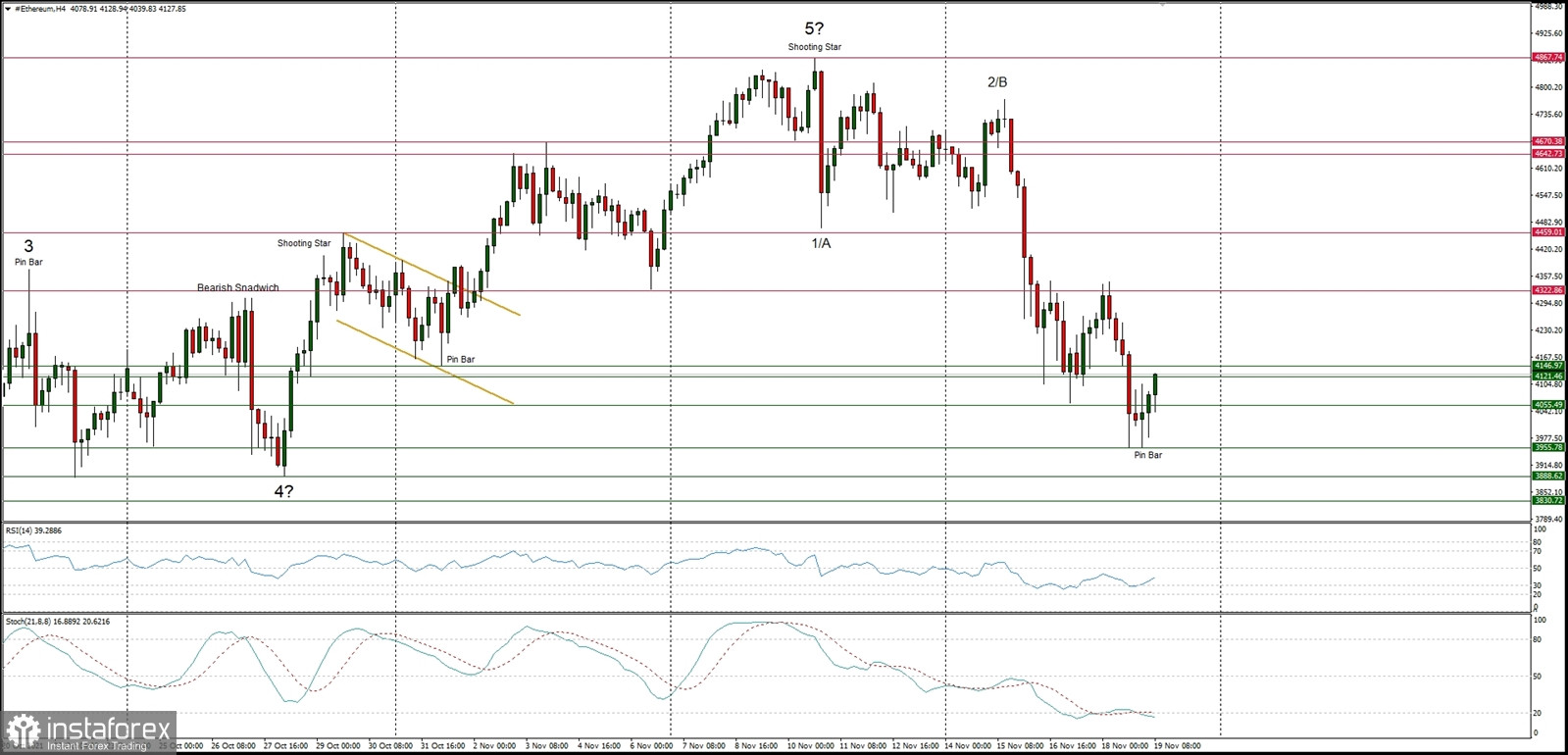

Technical Market Outlook

The ETH/USD pair has bounced from the level of $3,955 which is located just below the 161% Fibonacci projection for the wave 3/C. The bounce is being continued and the bulls are testing the technical resistance seen at the level of $4,146, just below the key technical resistance seen at $4,322. The weak and negative momentum still support the short-term bearish outlook for ETH. Please notice, the five wave impulsive increase might had been terminated at the level of $4,870 already and now might be the time for a deeper correction.

Weekly Pivot Points:

WR3 - $5,138

WR2 - $5,019

WR1 - $4,756

Weekly Pivot - $4,615

WS1 - $4,352

WS2 - $4,211

WS3 - $3,960

Trading Outlook:

The next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.