Economic calendar (Universal time)

The most significant events of today's economic calendar are expected at 12:30 (US retail sales data) and 14:30 (US crude oil inventories).

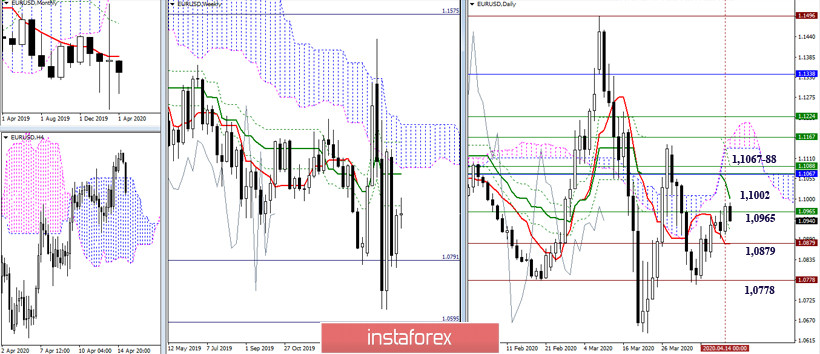

EUR / USD

Yesterday, the pair made a new attempt to break through the level of 1.0965, closing the day above the level. Today, players to increase must confirm the breakdown, if there is not enough strength, then the opponent can take advantage of the situation again, which is already happening in the lower halves, and, being active, begin to form a rebound from the resistance encountered. Among the important supports today, 1.0879 and 1.0778 can be noted. The nearest resistances are located at 1.1002 - 1.1067-88.

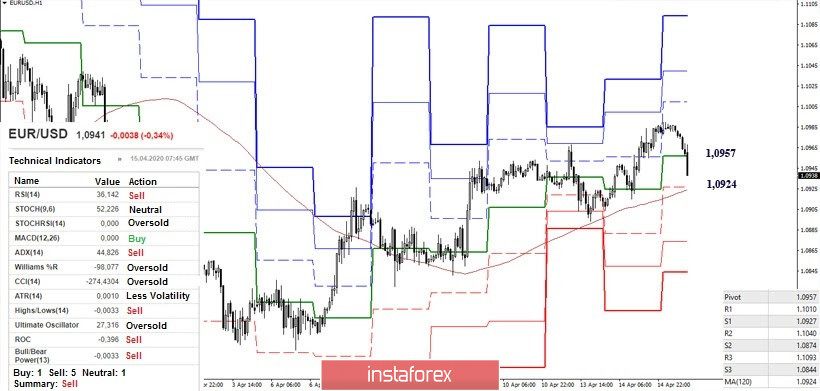

The promotion players declined under new moods and trends after opening a new working day almost at its peak, as a result of which they could not cope, by now they have almost completely lost all yesterday's gains. Meanwhile, support for the weekly long-term trend (1.0924) is ahead. The loss of the moving average and its reversal will serve to implement a bearish rebound from the encountered resistance of the upper halves. The next bearish landmarks intraday are 1.0874 (S2) - 1.0844 (S3). An attempt to rehabilitate and restore the situation for players to increase today will be a reliable consolidation above the central Pivot level of the day (1.0957), the next guideline 1.0990 is the restoration of the upward trend of the lower halves.

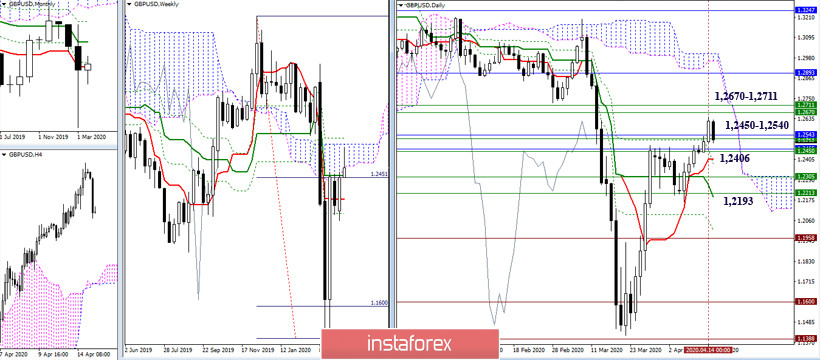

GBP / USD

Yesterday, the pair went beyond the resistance zone 1.2450 - 1.2540 and almost reached the influence of the following resistance 1.2670-1.2711. Today, it will either confirm the gains of players to increase or level their achievements. To date, the passed zone (1.2450-1.2540) is being tested as support. The activity and performance of bears can complete the ascent and contribute to the beginning of a new downward correction, the reference points of which are the levels of the daily golden cross 1.2406 (Tenkan) - 1.2193 (Kijun).

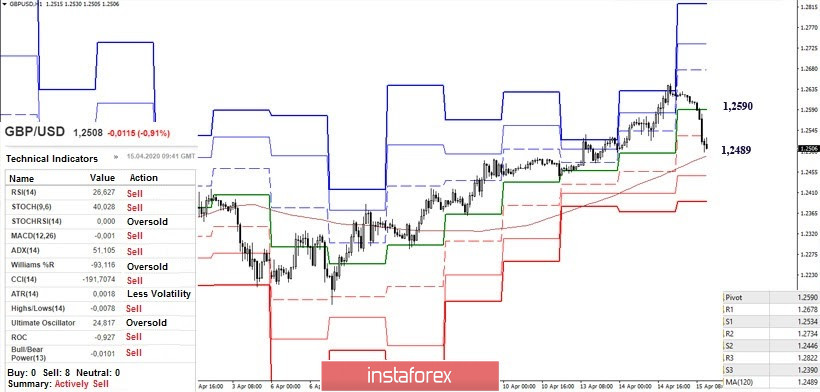

We are currently seeing an active decline in the lower halves. The players to decline did not even notice the level of 1.2590 (central Pivot level) and are now close to supporting the weekly long-term trend (1.2489). Now, consolidating lower in the day will allow us to expect further development of the daily downward correction, which will turn into a full-fledged downward trend on H1. Today, the downward landmarks within the day are also 1.2446 (S2) and 1.2390 (S3). The value for players to increase will be the return of 1.2590 (central Pivot-level of the day) and the update of the maximum (1.2647).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)