4-hour timeframe

Average volatility over the past five days: 75p (high).

The EUR/USD pair sharply turned down on Wednesday, April 15, and began a downward movement, dropping currently below the Kijun-sen line. Thus, the upward trend was replaced by a downward trend. And we state the fact that we almost perfectly predicted the pivot point of the pair. According to our "correction versus correction" scenario, we expected growth to the psychological level of 1.1000, around which we expected the upward movement to be completed. In fact, the pair reached the 1.0990 level. Thus, at the moment, we can assume that the growth of the euro/dollar quotes has ended and now we are waiting for either a long period of consolidation in the side channel, or a new downward trend that will be stronger than the previous two segments of the trend (downward and upward). If the second option is true, then the pair will go below the 1.0768 level - the previous local low. Today's lower level of volatility has already been worked out and overcome. Volatility has risen again and currently stands at 134 points. Thus, the second wave of panic may now begin in the foreign exchange market, which, although it will be weaker than the first, nevertheless, can again cause strong movements, which are very difficult to predict.

Today was the first time this week that at least some macroeconomic publications were planned. In the European Union, the calendar of macroeconomic statistics for April 15 is completely empty, but in the United States, more or less significant indicators of the state of the US economy have already been published. Yesterday we said that the state of the US labor market or the unemployment rate is more or less clear. Now it's time for other equally important indicators. Today it became known that retail sales decreased in monthly terms compared to February by 8.7%. Recall that the forecasts were ultra-low-a reduction from 6.5% to 8.0%. However, the actual value of the indicator was still worse. Retail sales excluding automobiles fell 4.5% mom, falling in the forecast range of -3.0-4.5%. Industrial production in March lost 5.5% in annual terms and 5.4% in monthly terms. Thus, almost all statistics from overseas turned out to be weaker than market participants expected. This is what we warned about yesterday when we said that the reports are likely to be worse than the forecast values, as was the case with applications for unemployment benefits and NonFarm Payrolls.

At the same time, US President Donald Trump announced the suspension of funding for the World Health Organization. Earlier, Trump has already stated that the US spends the most money on funding WHO, but the organization itself for some reason spends the most money on China. Moreover, Trump said the organization did not properly work on the coronavirus case, gave incorrect recommendations to America and "only thanks to Trump himself", who refused to follow the instructions of the WHO, managed to avoid a larger epidemic in the country. Today, Trump to suspend funding for WHO. "The reality is that WHO did not receive, verify or distribute information in a timely and transparent manner. The world expects WHO to work with countries so that accurate information about international health threats is received in a timely manner, " Trump said. Thus, the US leader believes that WHO has failed in its duties and must now be held accountable. In turn, UN Secretary-General Antonio Guterres said that now is not the time to limit the funding of who or any other organization that is fighting the epidemic. However, Trump already seems to have declared war on this organization.

From a technical point of view, a new Dead Cross could be formed in the near future. The Bollinger bands have already started to expand downwards, so the downward movement may continue. The lower line of the Ichimoku cloud is not a strong support, and there should be no problems with overcoming it. However, we believe that a new downward trend may not start, but instead there will be a sideways movement in the channel with a width of 100-150 points. In the coming days, it will become clear what to expect from the pair. So far, we have only to state the fact that traders again ignored all the macroeconomic data. Reports from overseas were disastrous, but the US dollar still rose in value during the day.

4-hour timeframe

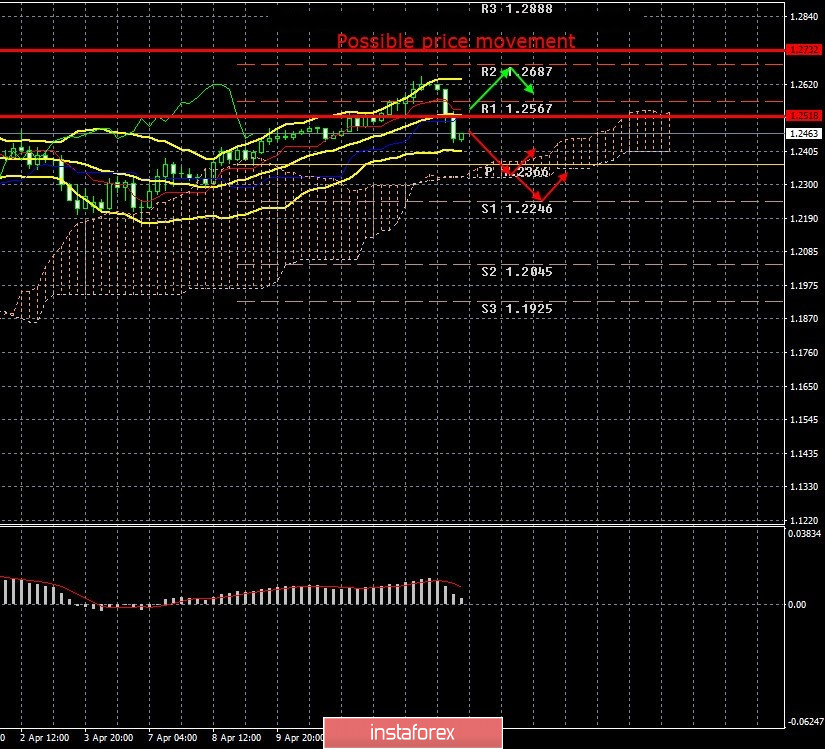

Average volatility over the past five days: 107pt (high).

The GBP/USD currency pair also turned down and began a rather strong downward movement on April 15. Thus, the US currency has risen in price today across the entire spectrum of the market. However, in the pound's case, we do not believe that the upward trend is complete. More precisely, it is best, as before, to pay close attention to technical indicators. However, the premonition says that the pound can recover to its initial levels of about 1.2800. Like it or not, we'll find out later. In the meantime, quotes of the British currency consolidated below the critical line, so the Golden Cross from the Ichimoku indicator is weakened and put on the verge of cancellation. The trend has already changed downward, and now the pound/dollar pair could try to fall to the Senkou Span B line, which is a strong support line. Not a single macroeconomic report has been published in the UK today, and data from overseas should provoke sales of the US currency, and not vice versa. Thus, in the case of the GBP/USD pair, the macroeconomic background continues to play no role. Unfortunately. Volatility on April 15 increased again, it is already almost 200 points and is the highest for the last six trading days. Perhaps a second wave of panic is beginning. The oil market has fallen again today. WTI crude fell to $20 per barrel and Brent to $28. Thus, another wave of panic from the commodity market, despite the signing of an agreement to reduce oil production by OPEC+ countries, could be transmitted to the foreign exchange market. Oil prices are not expected to rise until May 1, when a new agreement between OPEC+ countries will come into force.

Recommendations for EUR/USD:

For short positions:

The EUR/USD started a new downward movement on the 4-hour timeframe. Thus, sell orders are now relevant with the first target of 1.0818. However, we recommend that you be careful with sales, since the pair has already gone down more than 100 points today.

For long positions:

It is recommended to buy the currency pair after the price consolidates above the Kijun-sen critical line with the first target at the resistance level of 1,1003.

Recommendations for GBP/USD:

For short positions:

The pound/dollar began a new downward movement. Thus, it is now recommended that we return to selling the pound with the goals of the Senkou Span B line and the first support level of 1.2246.

For long positions:

It is recommended to consider new purchases of the GBP/USD pair before consolidating the price above the Kijun-sen line with targets at resistance levels 1.2567 and 1.2687. Volatility is growing again, so a new wave of panic in the foreign exchange market is possible.