The AUD/USD pair has strengthened for one and a half weeks. However, yesterday, it showed signs of weakening. The pair grew to the local high of 0.6446. The aussie did not even react to the fluctuations of the greenback. The price easily surged by more than 400 pips. Alas, yesterday, the pair could not resist the pressure since the the US dollar index soared past the 100 mark amid risk aversion. Even unexpectedly positive data on the Australian labor market, which was released during the Asian session, could not change the overall situation.

The US dollar index is fluctuating in a wide range reacting to a volatile fundamental background. It seems like the Covid-19 pandemic loosens its grip on the world. The total infection rate has been decreasing for 4 consecutive days. As a result, the risk-off sentiment and the demand for the greenback dropped. The EU leaders announced their willingness to ease quarantine restrictions. Meanwhile, US president Donald Trump said that he wanted to open the economy claiming that the peak of the pandemic in the country was over.

Such a news flow helped improve market conditions puting the greenback under pressure, which traders use as a safe haven asset. As for the AUD/USD pair, the aussie has received additional support from China as exports in the country fell by 6.6% y/y in March compared to the forecast 14%. Chinese imports shrank by less than 1% while economists expected it to plummet by around 10%. It is a well-known fact that the Australian economy is highly dependent on China's economy. That is why positive trade news from China allowed the aussie to come closer to the borders of the 65th figure.

The fundamental background is highly volatile at the moment. Yesterday, the greenback strengthened against its counterparts amid the pessimistic report from the International Monetary Fund. According to the IMF's forecast, the world economy is likely to drop by 3% this year. However, in 2021, the global economy is expected to skyrocket by 6.7% showing a tremendous growth in 40 years. US dollar buyers did not know how to react to such ambiguous data. As a result, by the end of yesterday, the US dollar index lost almost all the positions it gained earlier.

Apart from that, risk-off sentiment is likely to prevail in the market today amid the news about the spread of the coronavirus pandemic. Reportedly, the number of infection cases began to increase again after 4 days of steady decline. Thus, yesterday, the number of new coronavirus cases across the world surged by 79,900. That is 21,100 more cases than on April 14. Moreover, Italy recorded a spike in the number of deaths yesterday. However, the number of infections keeps falling in the country. Elsewhere, 2,494 people died from the virus in the US yesterday. This is a record number of deaths in one day in the country so far. Overall, the death toll in the US exceeds 30,844. Deaths have been recorded in all states. In total, 638,111 people have been infected in the United States.

Despite such reports, President Donald Trump said last night that the United States had passed the peak of the epidemic. Moreover, today, the White House intends to publish instructions for state authorities on how to remove certain sanitary restrictions in order to open the economy.

It seems like this factor should improve the general sentiment in the foreign exchange market. However, there is one 'but': many governors do not share the optimism of the president. At the same time, not only the Democratic governors, but also his party members, such as Mike Devine, the governor of Ohio, are against lifting the restrictions. Thus, a unique union of governors from the influential and wealthy states of the North-East, New England and the West Coast of the country has now formed in the States (the vast majority of these governors are Democrats). Many of them have already said that they are going to pursue their policy of combating coronavirus, despite the recommendations from the White House. Donal Trump has already promised to deal with this political confrontation. According to experts, the conflict between Trump and the governors is likely to reach its peak in early May, if a difficult epidemiological situation worsens across states and the White House insists on lifting the quarantine restrictions.

In other words, the rise in risk-off sentiment is now caused not only by the renewed surge in the number of Covid-19 cases, but also by the brewing political conflict in the United States. Such a fundamental background has caused an increase in demand for safe haven assets - the greenback in the first place.

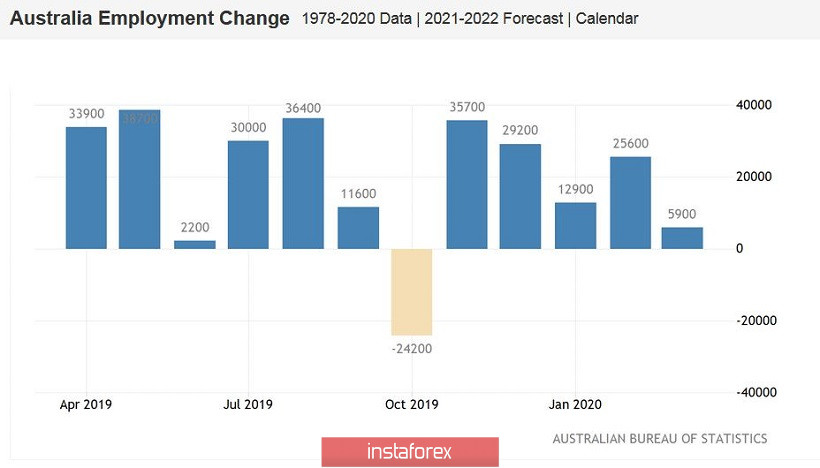

As for the Australian macroeconomic statistics, labor market data in Australia turned out to be better than expected. Unemployment in the country rose by 5.2% in March instead of the forecast of 5.4%. The number of employees advanced by 6,000 compared to an expected 30,000 drop. The only problem is that this data describes only the first two weeks in March while strict quarantine measures were introduced in the second half of the last month. The next labor market report is expected to be much worse.

From a technical point of view, two targets of the downward movement can be defined. Firstly, this is the Tenkan-sen line on the daily chart - 0.6220, and secondly, it is the middle line of the Bollinger Bands indicator on the daily chart - 0.6140. If risk-off sentiment deepens, the pressure on the pair is likely to increase. The resistance level is at 0.6446 where it is better to place a stop loss order.