Panic is spreading across the market at the moment and this feeling is only getting stronger. Apart from poor US labor market data, the sharp increase in unemployment has had a negative impact on the American economy. At the same time, the market tried not to react to what was happening for a while. The euro fell ahead of weak retail sales and industrial production data in the US. Usually, similar events repeat in the market. As soon as data was released, the euro started to rise. However, the figures were so weak that the insignificant increase of the euro was short lived. The euro started moving in a downward trend. Moreover, no news were reported at that moment. It means that the market is in a panic. However, it is not entirely true. The thing is that risk appetite is decreasing. Investors are turning to safe haven assets. It seems like the US economy is moving into recession. Since the situation in the US is very unstable, similar events are likely to take place in other countries as well. It's just that the US macroeconomic statistics are usually published earlier.

Retail sales in the US dropped by 6.2% y/y in March versus an increase by 4.6% in February. Economists expected the indicator to sink by 2.0%. In other words, millions of people who have lost their jobs since mid-March cut their spending as they do not expect to find a new job in the near future. At the same time, unemployment keeps growing. Consequently, sales are likely to only decline in the long-term. In addition, industrial production plunged by -5.5% compared to a zero growth in February. Experts predicted the indicator to decrease by -1.5%. As a result, the situation in the US industrial sector is terrible as well.

Retail sales (US):

The EU is scheduled to publish industrial production data for February during the day. The Eurozone industrial production is expected to plummet by 2.2% from 1.9%. It looks like the industrial decline has deepened long before the coronavirus outbreak. The results for March are likely to be much weaker. Thus, at some point, we can understand those investors who, against the background of extremely weak American statistics, are still trying to sell off the euro.

Industrial production (Europe):

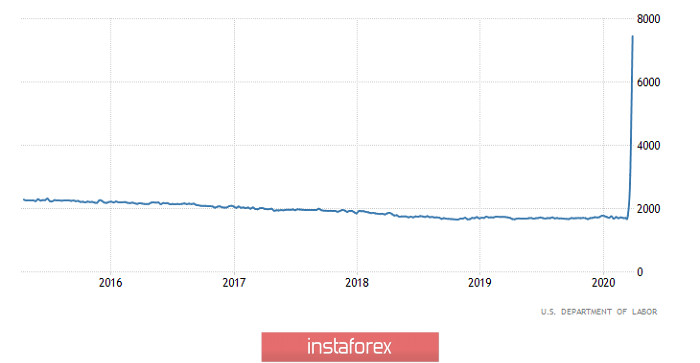

The US jobless claims data will be reported today. The first-time claims are expected to reach 4,720,000 compared to last week's 6,606,000. Secondary filings are expected to break the record set last week, as their number may advance by 10,500,000 versus 7,455,00 reported last week. Similar wave of unemployment is predicted to cover the rest of the world. Most likely, this will lead to fluctuations and the dollar can strengthen as a result.

Secondary jobless claims (US):

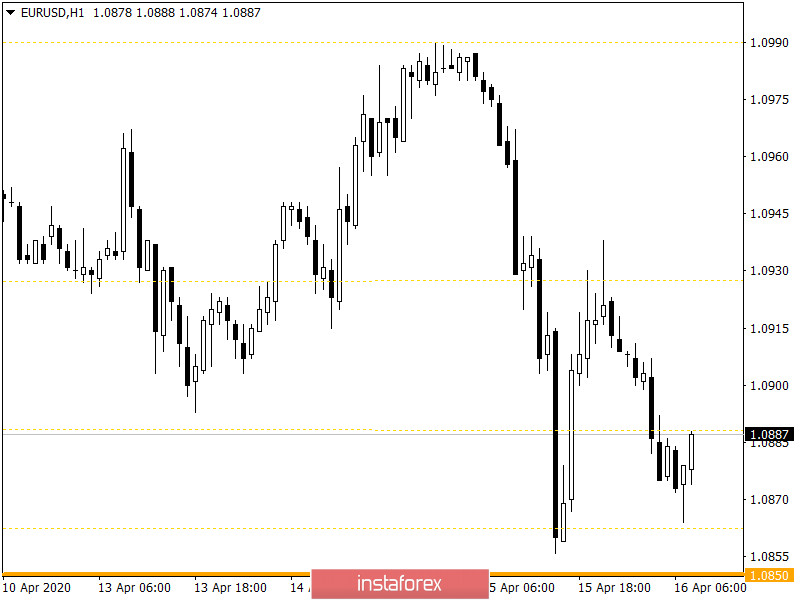

From the point of view of technical analysis, the pair showed an intense downward movement and fell to the level of 1.0850 trying to approach the psychological level of 1.1000.

In terms of the trading chart general review, there were some fluctuations recorded during the day.

The level of 1.0850 is likely to serve as a variable support. In case of partial recovery, the pair can rise to 1.0900/1.0910. If sellers manage to consolidate lower than 1.0850, the downward trend can begin again.

According to the comprehensive indicator analysis, there is a signal to open sell deals on the hourly and daily charts due to an intense downward movement.