Dollar rose after the report that retail sales and industrial production in the US declined sharply. However, in the afternoon, the currency declined, after the news that US President Donald Trump continues to coordinate measures necessary to open the economy.

Yesterday, Trump talked with company executives on the topic of resuming work and businesses, since quarantine measures have already affected the economy negatively. Other details of the conversation were not reported. However, at the beginning of this week, Trump announced that he wants to reopen the economy in May this year, despite all the quarantine measures and the continued surge of COVID-19 in the US.

Euro also rose because of Chancellor Angela Merkel's announcement that Germany will open its economy on Monday, April 20. Major events, however, are still banned until August 31.

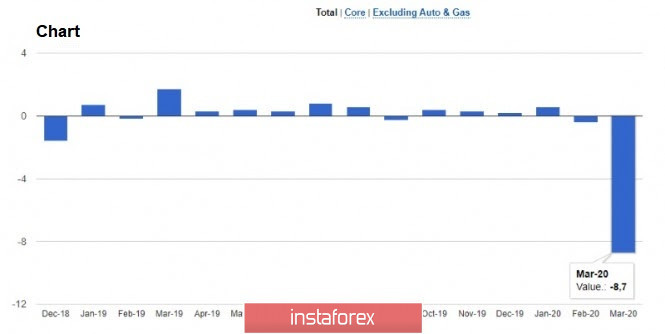

The quarantine measures have caused a sharp decline in retail sales. According to the US Department of Labor, Americans drastically reduced their spending because of the coronavirus and the impending crisis and recession. Thus, sales fell immediately by 8.7% in March. Economists expected it to decline by 8.0%. There is, however, an imperceptible surge in purchases on online platforms.

US industrial production also fell sharply in March due to the pandemic. Because supply chains were disrupted and demand declined sharply, industrial production fell by 5.4% in March. Economists expected the index to fall by 3.5%. The manufacturing industry is the one who suffered the most, with a decrease of 6.3% compared to February. Mining production declined by 2%.

Production in the area of responsibility of the Federal Reserve Bank of New York declined. According to a report, the overall manufacturing index fell to -78.2 points in April 2020. Economists expected the figure to be -32.5 points.

Demand for safe haven assets have risen sharply. Thus, for EUR/USD, bears will continue reducing the pair to the support level of 1.0830. They will also try to update the lows of 1.0770. Bulls, on the other hand, will fight for the resistance level of 1.0910, since only the return to this range will allow euro to reach the highs of this week in the region of the 10th figure.

CAD

The Bank of Canada announced yesterday that it will buy bonds worth up to 50 billion Canadian dollars. Corporate bonds worth up to 10 billion Canadian dollars will also be bought.

Stephen Poloz, head of the Bank of Canada, said that there's a significant and rapid decline in the country's economic activity, so more drastic measures are needed to soften the blow. According to him, the decline was due to the weakening demand and lower inflation. Nevertheless, the risk of prolonged deflation in Canada is low, and the outlook of the economy will very much depend on how long the quarantine measures will last. Poloz did not mention any forecasts.

Meanwhile, the movement of USD/CAD will depend more on oil prices than on changes in the economy. The surge of purchases yesterday broke the downward correction, so the pair is now returning to the wide side channel of 1.4060-1.4300. Traders will most likely continue buying in this area. The middle of the channel, 1.4190, needs to be taken into account when building a trading strategy.