Greetings, dear colleagues!

Today's review of the main currency pair of the Forex market will start with the US macroeconomic reports that were published yesterday.

The NAHB housing market index showed a sharp drop in March, with similar scales last seen in 2012. Data on retail sales, capacity utilization, and industrial production also came out worse than forecasts. All figures in the economic calendar.

There is no doubt that these are the consequences of the COVID-19 pandemic that has been rampant in the United States. I can also assume that the state of the American economy will only get worse due to the negative impact of a new type of coronavirus. Especially since the peak of the epidemic in the United States, according to most experts, has not yet passed. Although Donald Trump believes otherwise. It should be noted here that the 45th President of the United States always has his own point of view. His confrontation with the World Health Organization (WHO) is what's only worth attention. If someone does not know, then recently the US has been blaming China for the spread of the coronavirus, where COVID-19 was launched on the planet Earth. Given this factor, the coronavirus can be called Chinese, which Trump did, thus causing discontent and indignation in Beijing. Donald Trump believes that China and WHO underestimated or simply missed the development of the situation with the coronavirus. It turns out that Trump has long proposed to ban travel to China, but the WHO disobeyed him, and now the American leader does not want the United States to pay contributions to the budget of the World Health Organization. Ending this part of the review, I note that recently many people are trying to find political and economic dividends for themselves amid the spread of COVID-19. In such situations, Trump is a big doc, and it would be very strange if he did not take advantage of this, especially in the run-up to the presidential election.

If we return to the macroeconomic statistics, today at 10:00 (London time), the Eurozone will present data on industrial production, the rest of the statistics will come from overseas. At 13:30 (London time), data will be published on initial applications for unemployment benefits, as well as the number of construction permits and new home mortgages.

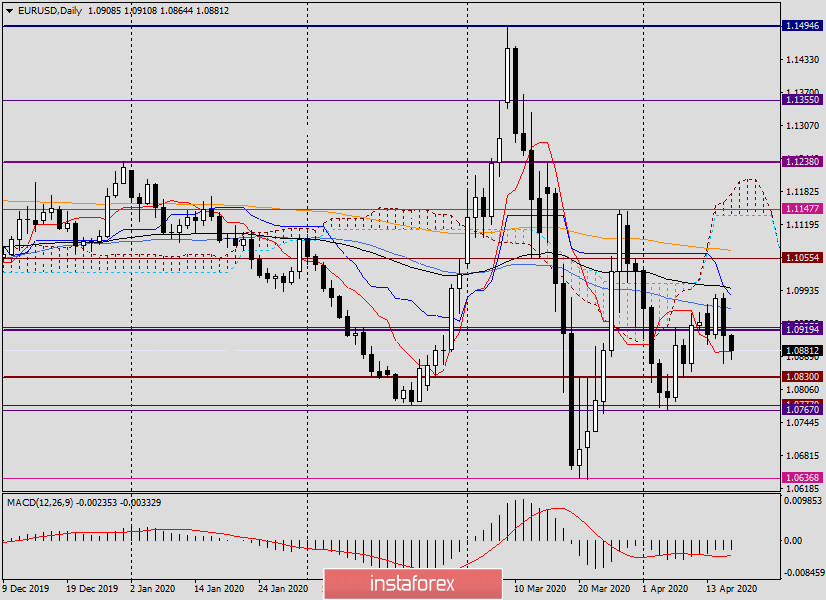

Daily

As you can see, following the results of trading on April 25, the pair failed to continue strengthening and declined, ending the session at 1.0909. Given that the lows were shown at 1.0856, the euro still got off well, closing trading above the significant level of 1.0900.

Now, at the time of writing, the pressure on the euro/dollar pair continues, and the pair is trading near 1.0870. If today's trading closes below the Tenkan line of the Ichimoku indicator and below yesterday's lows, it will be possible to seriously think that large sellers have returned to the market and the pair will continue moving in the south direction. In this case, the next target will be the area of 1.0830-1.0767, the breakout of which will finally indicate a bear market for the euro/dollar. At the moment, we must admit that the bulls for the pair did not cope with their task, which was to pass 50 simple moving average and then raise the quote to a significant psychological level of 1.1000.

As has been repeatedly noted in previous articles, the market situation often and sometimes unexpectedly changes. Now the most relevant trading idea could be considered sales, however, in my personal opinion, this is not quite correct, so I will indicate guidelines for positioning in both directions.

It is better to open sales at the breakdown of the support of 1.0856 or after the fact of the breakdown on the rollback to this level. The second option for opening short positions can be offered after rising to the price zone of 1.0915-1.0950.

Buying aggressively and riskily can be tried from the current prices (1.0874). It is less risky to buy near the support of 1.0856 or after falling into the strong technical zone of 1.0830-1.0767. Do not forget that before opening positions, it is better to enlist the support of the corresponding candle signals on the 4-hour and hourly charts.

Good luck with trading!