The USD/CAD pair increased as much as 1.2662 as the Dollar Index boosted the USD. Now, the pair dropped a little and it's traded at 1.2639 level. Still, the bias remains bullish, USD/CAD could approach and reach fresh new highs anytime.

In the short term, the Loonie could try to appreciate a little after the Canadian retail sales data come in better than expected. The Retail Sales indicator reported only a 0.6% drop in September versus 1.6% expected and after a 2.1% drop in August, while the Core Retail Sales dropped only by 0.2% versus 1.0% estimated.

USD/CAD Attracted By The Median Line!

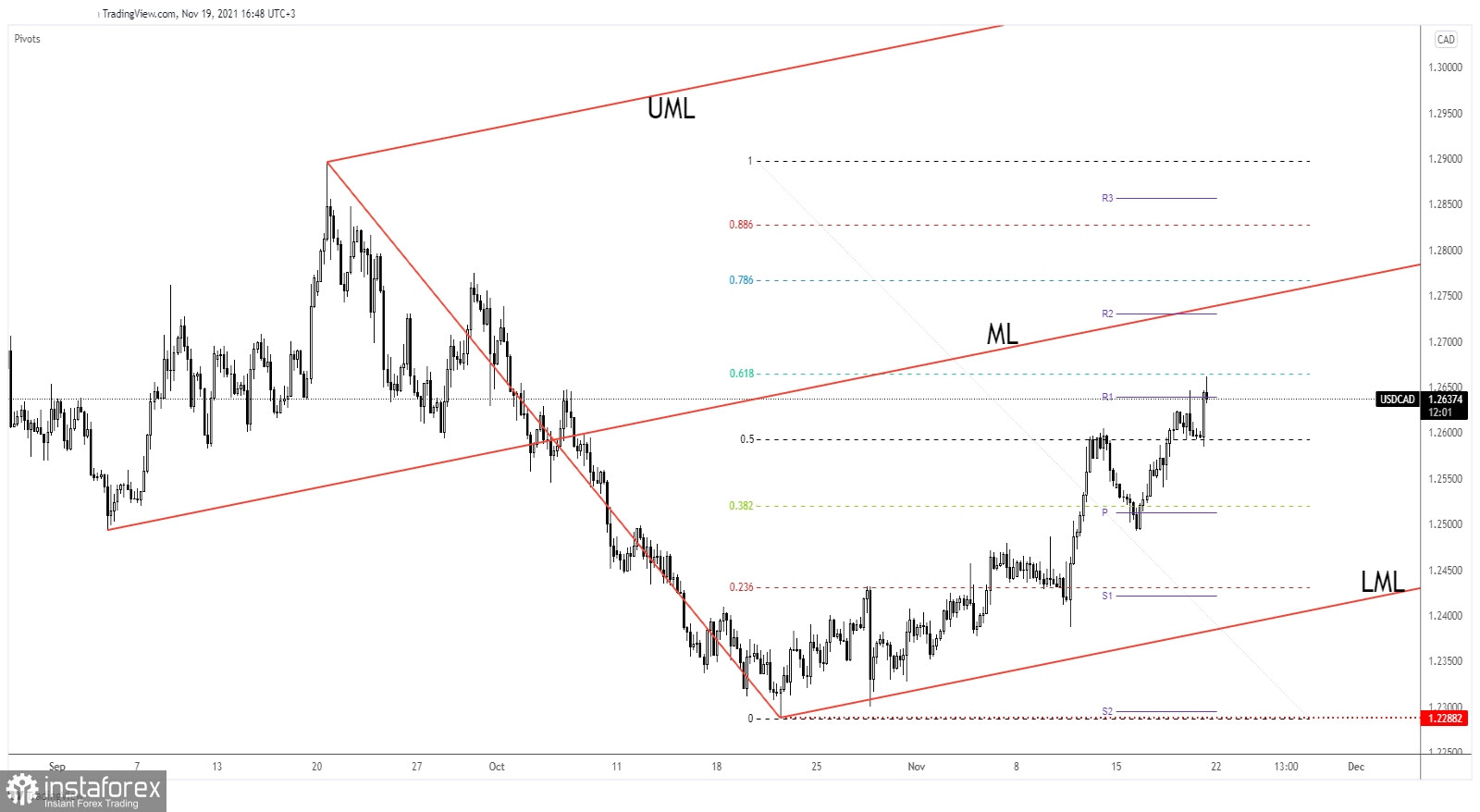

If you remember, I've told you in my previous analysis that the USD/CAD pair could extend its growth if it stays above the 50% retracement level. Today, it has registered a major bullish engulfing invalidating its drop below the 50% level.

Now, it has managed to close above the weekly R1 (1.2639) level which was seen as a static resistance. Stabilizing above this obstacle may confirm further growth. Still, in the short term, we cannot exclude a temporary decline before climbing towards new highs.

USD/CAD Outlook!

At the time of writing, USD/CAD is traded in the red only because the DXY crashes. Also, after its failure to take out the 61.8% retracement level, the pair could come down to retest the 50% retracement level.

It could still grow as long as it stays above the 50% (1.2592) retracement level. Developing a minor consolidation here could bring new long opportunities. Stabilizing above 1.26 psychological level could signal an upside continuation.

The median line (ML) could still attract the price, this is seen as an upside target. USD/CAD confirmed the ascending pitchfork after retesting the lower median line (LML). A new higher high, jumping and closing above the 61.8% retracement level could signal more gains.