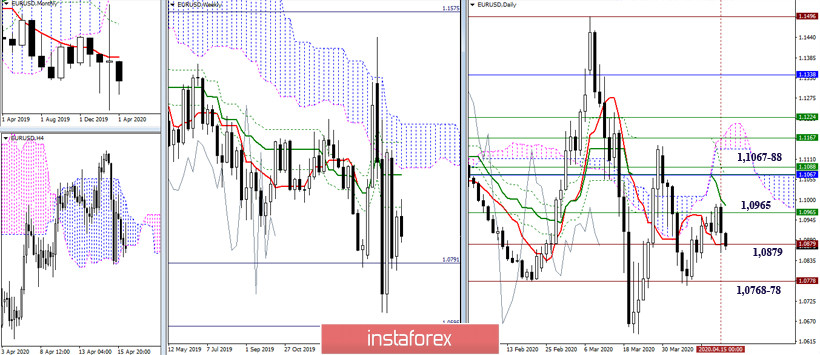

EUR/USD

Bulls failed to break the level of 1.0965 (weekly FiboTenkan). A daily mid-term trend is moving towards this resistance zone. As a result, if there is a break of resistance, bulls may get bigger income. Yesterday, the bearish mood prevailed in the market. The EUR/USD pair dropped to the support level of 1.0879 (daily Tenkan + all-time level). If the pair breaks the support levels, it may decrease to the levels of 1.0778-68 (the minimum extremum + all-time level).

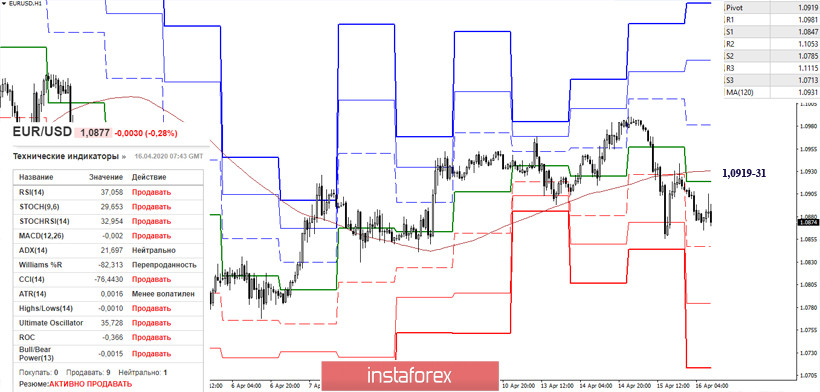

Holders of sell positions can benefit from smaller time frames. The intraday targets are classical pivot levels, including S1 (1.0847) – S2 (1.0785) – S3 (1.0713). The market mood may change, if the pair rises and consolidates above the key resistance levels of smaller time frames. The next target is to hit a new high (1.0990) and break resistance of bigger time frames at 1.0965.

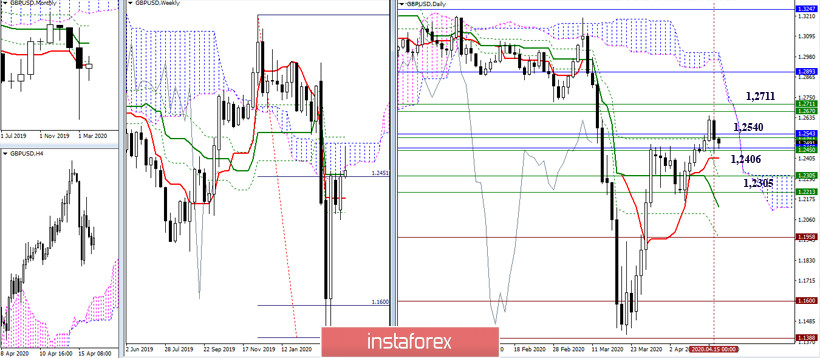

GBP/USD

Yesterday, bulls took a pause. Thanks to it the GBP/USD pair managed to advance to the zone of important levels such as 1.2540 – 1.2450 – 1.2406 (monthly Tenkan- weekly Kijun Sen and Senkou Span A + monthly Fibo-Tenkan + daily Tenkan). Bearish sentiment can be boosted in a longer-term perspective by a consolidation below a wide support area (1.2540 – 1.2450 – 1.2406). If the pair consolidates above the mentioned levels, traders may start buying.

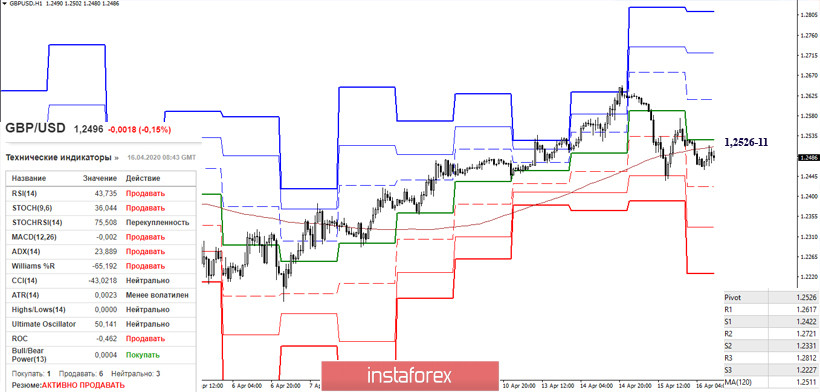

At the moment, on the smaller time frames, the pair is trying to hit the key levels such as the central pivot level of the day (1.2526) and the weekly level (1.2511). If the quote moves above the mentioned levels, the market sentiment may become bullish. If the quote drops below the levels, bears will prevail. The intraday target levels are 1.2422 (S1) – 1.2331 (S2) –1.2227 (S3). Resistance of classical pivot levels is located at 1.2617 – 1.2721 – 1.2812.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)