The euro continues to remain under pressure today in pair with the US dollar, as well as the British pound. However, the data on inflationary pressure in Germany, as well as industrial production in the Eurozone, which still needs to experience the largest reduction in recent years, managed to keep risk assets from a new jump down.

But before analyzing the data, I would like to briefly touch on the problems of growth in the yield of government bonds, especially Italian ones, which many traders paid attention to today, asking one single question – whether the European Central Bank will expand its asset purchase program further or will take a wait-and-see position. It is not surprising that after the meeting of the eurozone finance ministers last week and the approval of the € 500 billion aid package, not all countries liked it, since such assistance is clearly not enough, and the increase in budget holes due to changes in fiscal measures is not right for everyone's exit. If Germany can afford it, Italy and other weaker Eurozone countries can't. Increased spending will inevitably lead to a drop in demand for government bonds and an increase in their yield, which is a very bad sign for investors who invest in this country. Against this background, there was talk that another intervention by the European Central Bank could not be avoided. The expected expansion of the asset repurchase program that will allow you to stop the growth and decrease yield. However, the Central Bank itself does not comment on this situation, referring to the fact that each state must solve its own fiscal problems, and the main task of the ECB is to protect the euro.

In good news, we can note today's speech by the US Treasury Secretary, who said that he supports the G20 plan to defer payments on debt obligations of low-income countries. Steven Mnuchin also noted that the US is separately considering further easing the debt burden for some low-income countries that are facing difficulties due to the spread of the coronavirus.

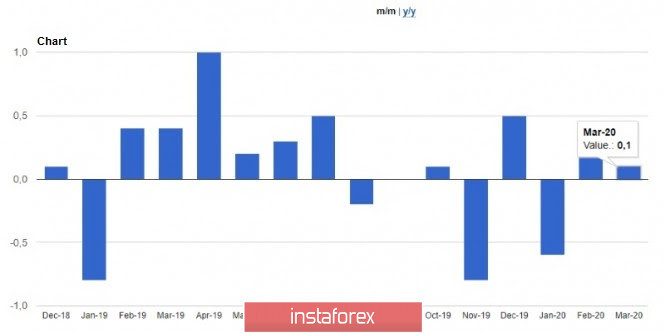

Returning to the topic of reports that were released today on the European economy, we should note German inflation, which is quite stable in response to shocks. According to the Federal Bureau of Statistics of the country Destatis, due to a sharp fall in energy prices, the growth of consumer prices in Germany slowed in March this year, but the data fully coincided with the forecasts of economists, without causing significant changes in the market. Thus, the final consumer price index (CPI) increased by 0.1% compared to the previous month and by 1.4% compared to the same period of the previous year. The EU-standardised index also showed an increase of 0.1% compared to the previous month and 1.3% compared to the same period of the previous year, which also fully coincided with forecasts.

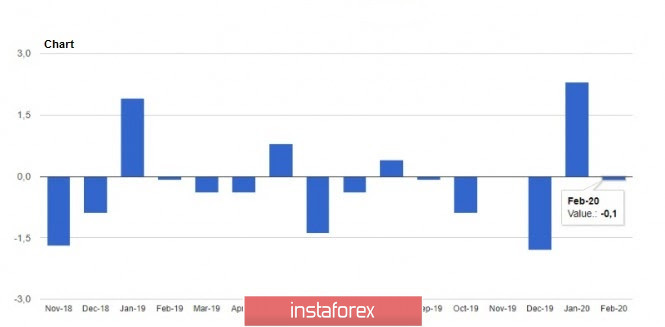

But industrial production in the Eurozone was less fortunate. It is already declining due to the spread of the coronavirus. Even despite the fact that our data is published only for February, there is clearly a very bad trend for the future. According to data, in February, industrial production in the Eurozone fell by 0.1%, which coincided with the forecasts of economists. However, you do not need to go far. Having studied the recent data on activity in the manufacturing sector of the Eurozone, we can say for sure that the data for March will be depressing. It will be possible to talk about the end of the recession in the industry only closer to mid-summer when all enterprises will start to fully function. But this is according to the most optimistic forecasts since it is far from clear how and when all the restrictive measures will be lifted.

As for the technical picture of the euro/dollar pair, it has not changed much compared to the morning forecast. Most likely, the bears will continue to put pressure on risky assets in order to reduce to the support of 1.0815, and then update the minimum of 1.0770. Today, the bulls will fight for the resistance of 1.0900, as only a return to this range will allow us to talk about a larger increase in the euro to the maximum of this week in the area of the 10th figure.