The NZD/USD pair dropped today as the Dollar Index rallied. Now, the pair is traded at 0.7001 right above 0.7 psychological level. The bias remains bearish even if the price seems undecided.

After the US Unemployment Claims indicator was reported worse than expected in yesterday's session, NZD/USD tried to grow, but it failed to take out the immediate resistance levels. Today, New Zealand Credit Card Spending was reported at -5.6% versus -12.8% in the previous reporting period.

NZD/USD is trading in the red and it could extend its sell-off as traders are expecting the US Federal Reserve to hike rates in its upcoming meeting after higher inflation reported by the United States.

NZD/USD retesting the buyers

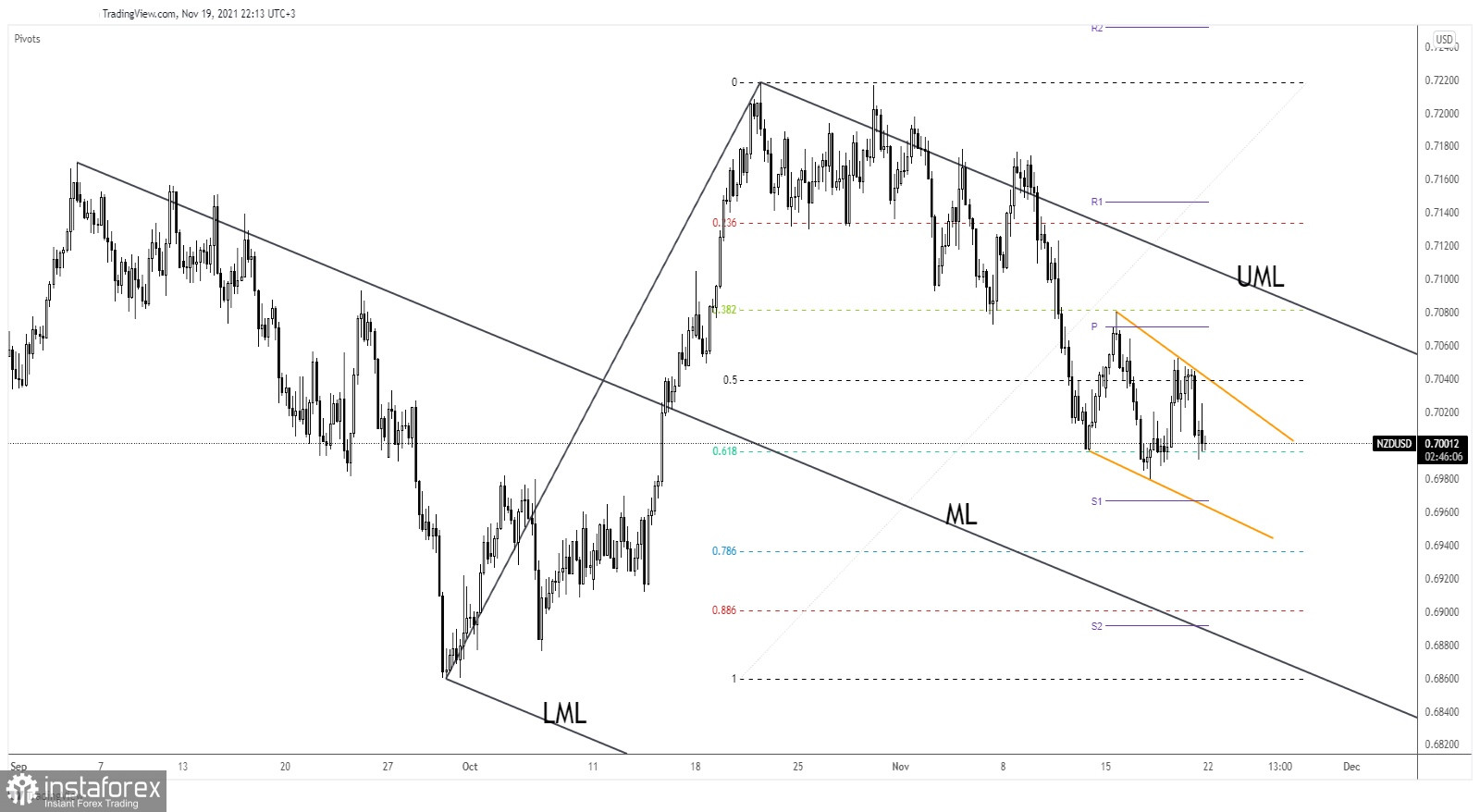

Technically, NZD/USD tested and retested the 50% retracement level, and now it is challenging the 61.8% retracement level. The price action could develop the Falling Wedge pattern, but this formation is far from being confirmed.

Dropping and stabilizing below the 61.8% (0.6996) retracement level could signal a potential further drop. The pattern's downside line stands as a major target. The former low of 0.6979 is seen as a support level as well.

NZD/USD prediction

The pressure remains high as long as the pair stays under the downtrend line. A larger downside movement could be activated by a new lower low, by a bearish closure below 0.6979. An upside reversal could be signaled by a valid breakout above the downtrend line.