Earlier this week, Austria became the first European country to impose travel restrictions on people who have not been vaccinated against COVID-19. The republic has the lowest level of vaccination in the region, that is, 65%.

In addition, in Germany this week the record for the number of cases per day was broken - more than 65 thousand people. The country's health minister Jens Spahn did not rule out the possibility of introducing a nationwide lockdown. According to Spahn, the situation is now even more serious than it was a week ago.

The composite index of the largest enterprises in the region Stoxx Europe 600 fell by 0.3% and amounted to 486.08 points.

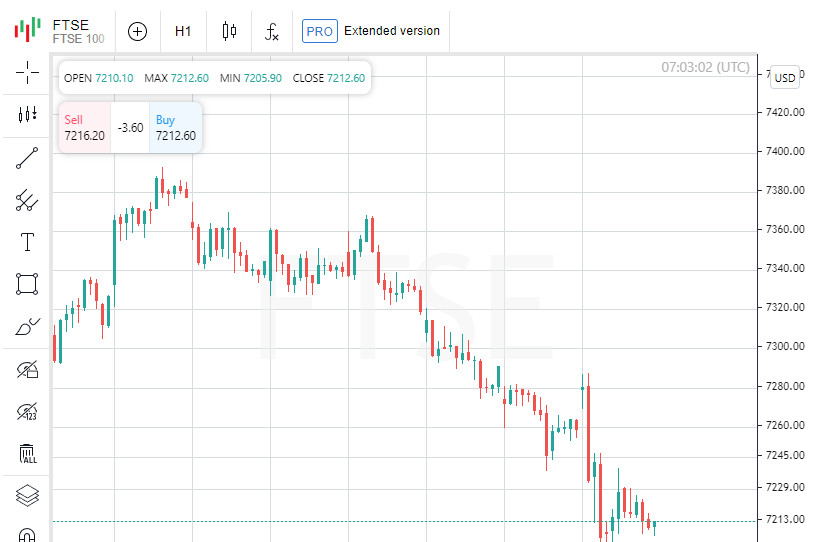

The German DAX dropped 0.3%, the French CAC 40 - 0.4%, the British FTSE 100 - 0.5%. Italy's FTSE MIB and Spain's IBEX lost 1.2% and 0.5%, respectively.

The European Central Bank (ECB) should not rush to tighten monetary policy, even in the face of "unwanted and painful" inflation, said ECB President Christine Lagarde. The main factors driving inflation - supply chain problems and rising energy prices - will ease over the medium term, she said.

Retail sales in the UK in October rose from the previous month for the first time in six months - by 0.8%, but decreased by 1.3% compared to October last year, according to the National Statistical Office (ONS) of the country.

At the same time, the consumer confidence index in the country in November rose by three points compared to the previous month and amounted to minus 14 points, according to data from GfK NOP Ltd., which calculates this indicator. The indicator increased for the first time in four months.

Producer prices in Germany in October increased by 18.4% compared to the same month last year, according to data from the Federal Statistical Office of Germany (Destatis). Growth was at its highest since November 1951.

British home improvement chain Kingfisher was down 4.4%. The company in the third quarter of this year reduced its revenue by 2.4%. However, the report marks a strong start to the fourth quarter.

Irish low-cost airline Ryanair Holdings lost 2.3%. The carrier is set to delist its shares from the London Stock Exchange on 20 December. Ryanair noted that the company's stock trading volume on the LSE does not justify the cost of maintaining the listing.

The banking sector lost the most at the end of trading: shares of Raiffeisen Bank International AG fell by almost 7%, Deutsche Bank AG - by 5%, Erste Group Bank AG - by 5.2%, UniCredit S.p.A. - by 4.5%.

The shares of the IT company Amadeus IT Group S.A. were also in the red. (-4.8%) and Wizz Air Holdings PLC (-4.6%).

The growth leaders in the Stoxx 600 were shares of the British online grocery chain Ocado Group (+ 6.8%), the Polish manufacturer of electronic check-in terminals InPost (+ 7.4%), the French luxury goods manufacturer Hermes International (+ 5.2% ), delivery service operators Just Eat Takeaway.com NV (+ 6.3%) and Deliveroo PLC (+ 4.4%).