To open long positions on EUR USD you need:

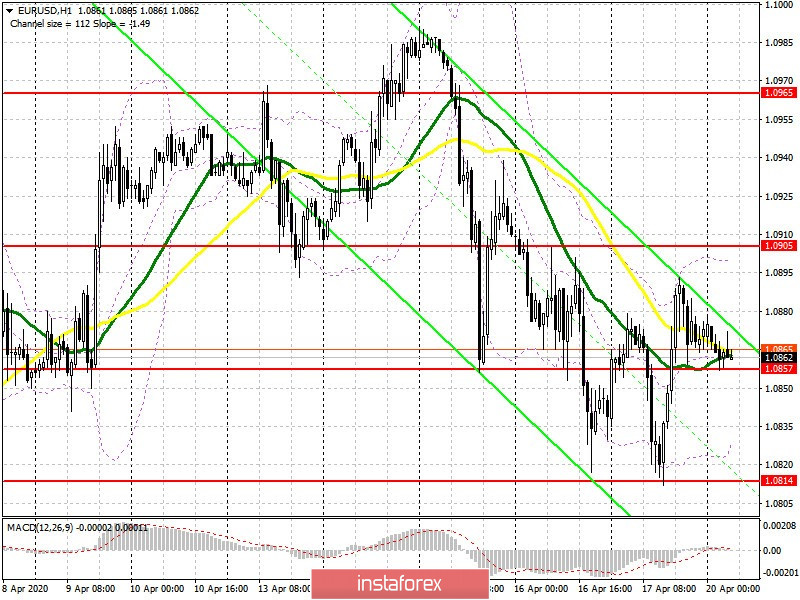

Friday's news that the US successfully passed coronavirus vaccine trials had a positive effect on buyers of the European currency. Euro sellers again achieved a test of a low of 1.0814, where I advised opening long positions, and also returned the resistance of 1.0857 to their control. Trading is currently conducted in the area of this range, and forming a false breakout there will be a signal to open long positions in the expectation of continuing the growth of EUR/USD to the resistance area of 1.0905, where I recommend taking profits today. We can expect a breakout of 1.0905 only when there is good data on the fight against coronavirus and macroeconomic statistics of Germany and the eurozone, which will lead the pair to a high of 1.0965. If the pressure on the euro returns in the first half of the day, it is best to consider new long positions again when testing last week's low of 1.0814, or buy EUR/USD immediately on the rebound from the April low of 1.0770.

To open short positions on EUR USD you need:

Sellers of the euro again achieved a test low of 1.0814 last Friday, which is clearly visible on the 5-minute chart, and then they retreated from the market. Now the entire focus is shifted to the 1.0857 area, and the primary task of the bears is to return EUR/USD to this range. This option will raise the pressure on the pair and lead to a repeated test of the low of 1.0814, which will preserve the chance of updating the larger support of 1.0770, where I advised taking profits. In case of an upward correction, I recommend returning to long positions only when a false breakout forms in the resistance area of 1.0905, which may occur after the release of weak data on the balance of foreign trade in the eurozone. If you grow above the 1.0905 level, it is best to open short positions immediately for a rebound only after testing the high of 1.0965.

Signals of indicators:

Moving averages

Trading is in the range of 30 and 50 moving averages, which indicates market uncertainty after Friday's volatility.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

Growth may be limited by the upper level of the indicator at 1.0890. The pair will be supported by the lower border at 1.0835.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20