You can't help but think that the Europeans pay more attention to macroeconomics, and the Americans have become hereditary epidemiologists. And no matter how ridiculous it may sound, the way events unfolded on Friday clearly speaks of completely different priorities for market participants on opposite sides of the Atlantic. During the European session, the market behaved strictly in accordance with short macroeconomic data. The beginning of the American session clearly demonstrated that, unlike Europeans, American market participants are much more concerned about the situation around the coronavirus epidemic. And frankly, there is a certain logic to this. Of course, you can say as much as you like that there is a decrease in the number of new cases of coronavirus infection both in Europe and in the United States. But if in Europe, we are talking about passing the peak, then with regard to the United States, epidemiologists do not yet venture to say the same. Moreover, despite the extension of the restricted quarantine regime in a number of European countries, the restrictive measures are still beginning to gradually soften. But in the United States, it doesn't go beyond talking and wishing. In fact, the longer the economy does not function, the deeper the recession and longer recovery. And it feels like the United States is losing this race.

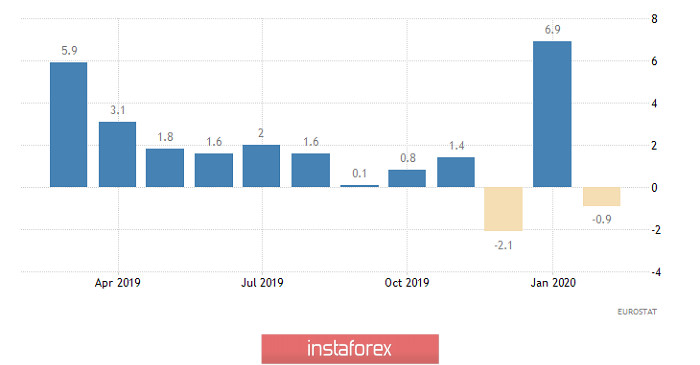

A quite significant slowdown in inflation in Europe negatively affected the single European currency. The final inflation data confirmed a preliminary estimate, which showed a decline in inflation from 1.2% to 0.7%. The most important thing here is not the fact of inflation slowdown, but its pace. Moreover, the risks of deflation have risen again in a number of European countries. Therefore, a similar situation may well provoke the European Central Bank to think about the possibility of lowering the refinancing rate, which is clearly up to negative values. But not only this can be considered a negative factor for the single European currency. The fact is that construction data for February showed a decrease in construction volumes by 0.9%. And this is not for March, but for February. Consequently, the recession will be very, very strong in March. Moreover, growth was forecasted at 1.1%. The only good news in Italy which can be considered is probably the trade balance, whose surplus amounted to 6.1 billion euros in February. It was predicted that it will be equal to 2.9 billion euros. But frankly, the data on the trade balance of Italy are not so important, amid pan-European data especially since this is the data for February.

Scope of construction (Europe):

We have very unfortunate data today in terms of macroeconomic statistics than Friday. Although it did not bring any positive news again about the European economy. In particular, the rate of decline in producer prices in Germany accelerated from -0.1% to -0.8%. We were waiting for the acceleration to -0.7%. So deflationary pressure is only increasing. And what is much more interesting is that it is data for March. The trade balance of the euro area will also be published, with a surplus of 17.5 billion euros. It looks impressive against the backdrop of 1.3 billion euros in the previous reporting period. However, this is data for February, not March. Moreover, the increase in the trade surplus is largely due to the restriction of imports from China, which many countries began to do at the end of February, against the background of the peak of the coronavirus pandemic in China. Now, the situation is reversed.

Today, we will most likely see the chatter of the single European currency in the Friday closing area. At the same time, it will demonstrate a clear desire to move towards the level of 1.0900 especially during the American session, as the epidemiological situation in Europe is still better than in the United States. In this regard, American traders are now looking only at this.

The pound will repeat the dynamics of the single European currency due to the complete lack of any macroeconomic data for the UK and the United States. Another thing is that the reference point is the level of 1.2500.