Yesterday was incredibly eventful despite the complete absence of any macroeconomic data. Although not the entire day but the end of the US session. The market was stable and calm throughout the day. In general, as expected. But suddenly everything changed during the late afternoon in the United States and the panic started again in the market towards the end of the trading day. It all started with the oil market. Suddenly, North American oil prices began to plummet. At some point, they became negative. But the decline continued. It should be noted right away that this applies only to WTI, while the Brent brand, although it has declined in value, still has a much less significant reduction. Moreover, we are talking about futures contracts with delivery in May. The fact is that yesterday was the last day of trading these contracts, and their holders must commit themselves not only to buy, but also to take the agreed amount of oil from storage. So, there are no free oil storage facilities in the United States. In other words, contract holders have nowhere to go for the day. As a result, they began to sell the contracts in panic. And it came to the point that they began to pay extra, if only not to assume the obligation to ship oil. It should be noted that no more than 10,000 contracts passed at negative prices. Each contract is 1,000 barrels of oil. So the total volume is not so great. The price of WTI is still positive. However, the price of oil has never been negative, and although it is only about the May contracts, and especially on the domestic American market, this is a signal that production volumes need to be reduced much more than the oil exporting countries recently agreed. At the same time, the market observed a classic inverse relationship between oil prices and the value of the dollar. Quite regularly, if oil becomes cheaper, then the dollar rises in price. And vice versa. So, the dollar strengthened its position while oil prices fell. Including in relation to the pound. Another thing is that everything developed much more calmly in the foreign exchange market. The decline was not so massive.

Although the pound fell due to quite indirect reasons, and, in theory, it would be worth waiting for its recovery today especially since contracts, the value of which turned out to be negative, are no longer traded since the trading session ended yesterday, the pound is unlikely to succeed. The fact is that data on the UK labor market will be published today and nearly all of the data are for February, which are now of little interest to anyone, but there is one interesting indicator. We are talking about the change in the number of applications for unemployment benefits, which is for March. So, the number of applications for unemployment benefits should grow by 272,000. This is about twice as much as the previous record set in 2009. In other words, we will get the first serious confirmation that the catastrophe over the labor market does not only concern the United States. The same thing could be happening in other countries as well.

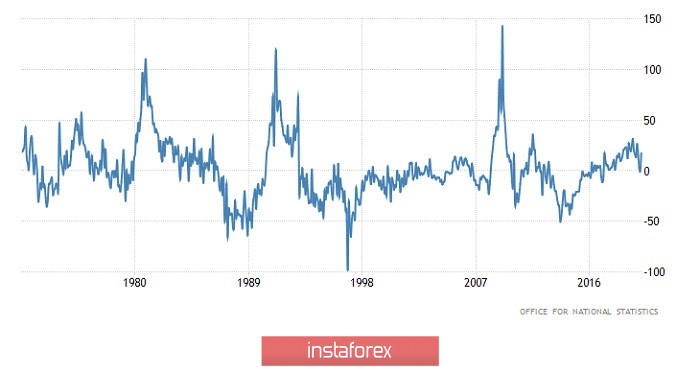

Change in the number of applications for unemployment benefits (UK):

Less important data will be released in the United States. Secondary housing sales in March could fall by 9.7%. However, this will not surprise anyone. Following the collapse of the labor market, investors are only interested in how big unemployment is outside the United States. So home sales will only slightly affect the market, and its impact is only limited to restraining the pound from falling at the end of the trading day.

Secondary Home Sales (United States):

In terms of technical analysis, we see the weakening pound sterling, during which the quote managed to break through the variable support point of 1.2405, which has held us back since April 16. It is worth noting that the quote stood in the side channel for more than 50 hours, where subsequent inertia is considered completely normal.

Considering the trading chart in general terms, the daily period, an attempt is made to resume the downward movement, but the quote is still at the peak of an earlier inertial movement.

It can be assumed that with the current development, the quote is directed towards the 1.2350 level, this is the first predicted point. After that, it is necessary to analyze the consolidation points below the 1.2350 level, since the given inertial stroke could be enough to break the control point and further descend to the area of 1.2270/1.2300.

An alternative scenario will be considered in the event of a price slowdown within the 1.2350 level.

From the point of view of a comprehensive indicator analysis, we see an almost unanimous sell signal due to a massive downward movement.