Discussions related to the upcoming EU summit continue to put pressure on the European currency. The collapse of oil quotes, particularly the May contracts, worries the market.

Today, US President Donald Trump announced his plans to sign an executive order temporarily banning immigration. He said that this decision is influenced by the current coronavirus situation, as well as the need to protect jobs. Trump is an open supporter of the restriction of immigration to the United States. After his victory in the US elections, he immediately began implementing the ideas of his election campaign, one of which was the construction of a wall on the border with Mexico. Moreover, in relation to terrorism threats, Trump restricted entry for citizens and refugees from a number of Muslim countries.

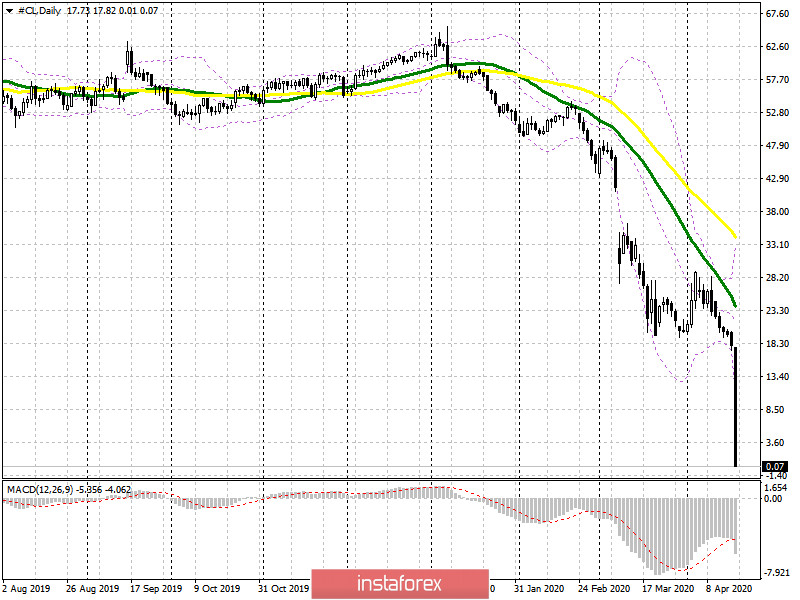

Oil

WTI oil is trading around $ 22 per barrel. The sharp drop in May contracts surprised the world.

May futures fell to negative levels, closing at minus $ 40.32 per barrel. This suggests that producers will have to pay extra for buyers to take their oil from them. Such situation is influenced by the fears formed by the overabundance of oil in storage. Producers in the US were hit hardest by this sharp drop in prices, so authorities will begin new verbal interventions. One example is the recent statement of Donald Trump about the need to reduce production, after which oil quotes jumped by more than $ 10. Unfortunately, the effect was only temporary.

Some experts suggest that the oil industry is coming to an end. However, as long as there are no serious alternative sources of cheap energy, everything will be fine with extraction, production and processing. Prices will remain extremely low for 1-1.5 months, but the gradual exit of the coronavirus pandemic will favor the industry. Demand and consumption will resume, which will strengthen oil quotes for summer contracts.

EUR/USD

The macroeconomic data from the US did not affect the EUR/USD pair, which continues to be under pressure before the EU summit, at which several important decisions will be made.

According to the Chicago Fed, economic activity in March this year declined amid the spread of the virus. The index came out with -4.19 points against 0.06 points in February. Values below -0.35 indicate a decline in economic activity.

The decision to issue "pan-European" bonds, which have been talked about so much lately, is likely to be made at the upcoming EU summit. However, there is a serious risk that Germany, which does not want to take part in the debt burden of the eurozone, will nevertheless oppose it, which will create additional pressure on the euro, as it will aggravate internal political conflict. Traders will have to assess the market's reaction to the expected result. If pressure on the euro continues, then the summit will most likely be a failure. If the bears fail to push the pair below April's lows, it is quite possible that insiders will seize the moment and begin to buy risky assets even before the outcome of the summit, which in its essence will no longer have any significance to the market. The break of the support level at 1.0815 will increase pressure on the pair, which will push it to the lows at 1.0770 and 1.0715. On the other hand, if the pair trades above 1.0850, then we can expect an increase to the highs at 1.0890 and 1.0940.

AUD

Today's report on the labor market did not affect the Australian dollar. Despite its failure, the AUD/USD pair remained trading in the area of April's highs.

According to the Australian Bureau of Statistics, the number of jobs in Australia from March to April this year fell by 6.0%, while wages declined by 6.7%. The Reserve Bank of Australia said that the fiscal and monetary policies will mitigate the expected decline in GDP. Australia's financial system remains resilient amid current shocks.