Quotes for the May WTI futures contract collapsed on Monday before expiring today to -37 dollars per barrel, and the growth at the time of writing is from yesterday's close of 103.77% to 1.42 dollars.

In the US, it is believed that the main reasons for this collapse in percentage terms were coronavirus-85% and a dispute between Russia and Saudi Arabia over the volume of crude oil production, aimed at stimulating price growth, the impact of which is measured at 15%. Of course, there is a lot of truth in this, but there is also another big reason that contributed to the collapse of the price of crude oil and the actual destruction of the shale industry in America. This is the high cost of extracting shale oil using hydraulic fracturing technology.

If the traditional methods of oil production in Russia, the Middle East, the North Sea or the United States allow oil companies even at the current price level, and at the time of writing, the June Brent futures contract is trading at $ 25.27 per barrel, and WTI at 21.38 to receive at least some profit, the shale industry can really exist only at prices far above the level of $ 40 per barrel. In fact, this industry was not killed by Russia and Sadovia or the consequences of COVID-19, but by its high cost. The fact that everything is going down became clear already in March, when the Saudis simply brought down the oil market after their inability to reach an agreement with Russians. From that moment on, the already troubled industry began to fail catastrophically. According to data from Baker Hughes, the number of active rigs fell from 683 in mid-March to 438 as of April 17.

Observing all that is happening, we can say that if an active recovery in oil demand does not begin in the next two or three months amid the recovery in economic activity, primarily the United States and Europe, and against this background prices do not rise above the $ 40 per barrel mark, this industry will order to live for a long time.

Now, who will become the main beneficiary of what is happening? We believe that Russia and Saudi Arabia will benefit. After destroying the competitor in the face of the American shale, they will begin to eagerly occupy the vacant niches that the "shale" previously occupied so actively. By the way, such a change in the positions of the main players in the black gold market will also lead to serious political profits for Moscow, which will only strengthen its position in Europe by building Nord Stream-2 with general approval of the European countries, the list of which is headed by Germany.

Let's return to the likely dynamics of oil prices in the near future. We believe that prices will long remain in the range of 20-30 dollars per barrel. Only the revival of economic activity in Europe and North America, the growth in demand for crude oil will push prices up, but most likely, they will still not reach the level of $ 40 by the end of this year, which will finally eliminate the American shale industry from the oil market as a powerful and serious competitor, leaving it somewhere far behind.

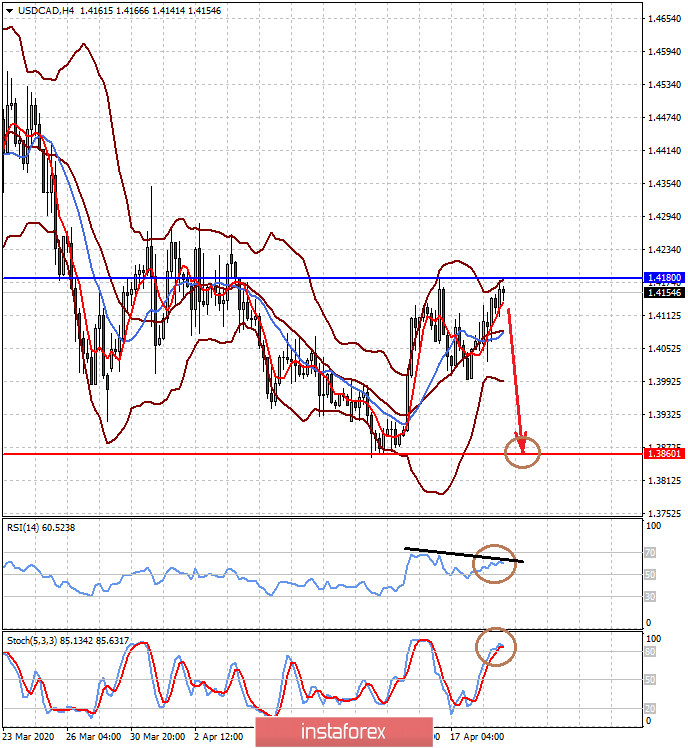

What awaits commodity currencies in this regard? In our opinion, nothing terrible will happen either to the Canadian dollar or to the Norwegian krone. The strength of these currencies is supported by a sustainable commodity industry in Canada, Russia and Norway. It is believed that the potential weakness of the US dollar will only strengthen amid unprecedented incentive measures from the Fed and the US Treasury. The world's exit from the coronavirus captivity will lead to an increase in demand for raw material assets, and the stable financial position of these countries will guarantee the attractiveness of their assets, including national currencies.

Forecast of the day:

The USD/CAD pair is trading below the level of 1.4180. If it does not break through it, we expect the pair to reverse to 1.3860. We believe that this probability persists as long as the pair remains in a short-term downward trend and below the level of 1.4180.

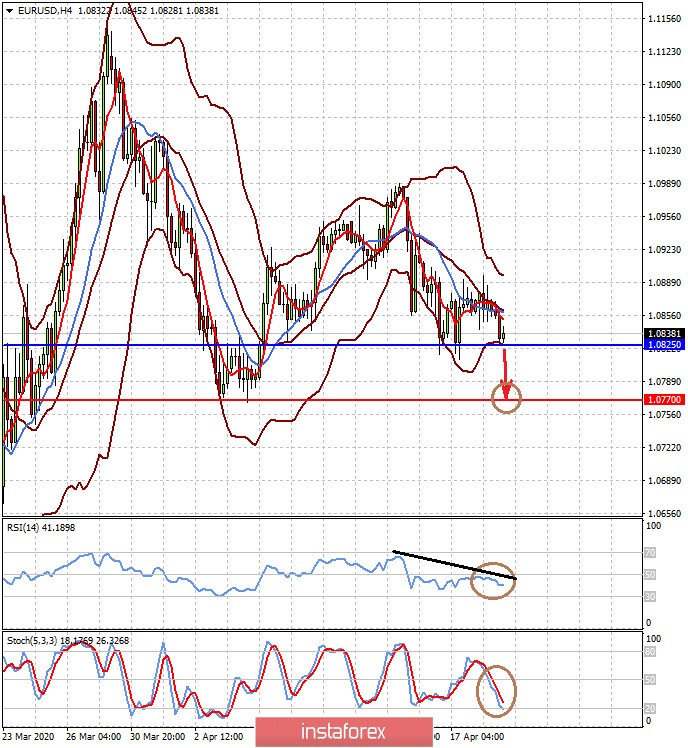

The EUR/USD pair has every chance to fall against the background of the publication of ZEW economic sentiment index data in Germany and the eurozone. Moreover, chaos in the EU still negatively affects it. The officials of this organization are in no way able to develop coordinated countermeasures for COVID-19. We believe that a decline in price below the level of 1.0825 will lead to a decline in the pair to 1.0770.