The whole trading day was quiet and calm yesterday which is not surprising, since almost no macroeconomic data was published. Those that were published were more of a reference character and could not affect the market in any way rather, they could make some adjustments to some expectations and force major players to carefully review their long-term plans. That is, there was no need to wait for an instant market reaction. But a panic occurred before the US session began which demonstrated the inverse relationship between the price of oil and the dollar once again. Quite suddenly, the price of North American oil futures eagerly rushed down and one might wonder why trading was not stopped. As a result, the price of oil became negative, but continued to decline and everything was accompanied by a rise in the dollar. However, not so impressive, but still. And the fact is that it was really worth paying attention to the fact that, despite the huge drop in prices, despite all the technical regulations, the trading was not stopped. It is also noteworthy that the fall related only futures contracts with delivery in May. And yesterday was the last trading day on these contracts. And it turned out that the holders of these contracts got rid of them in a panic to avoid oil supplies. After all, they must take it to themselves. Here, we come to the most interesting moment. It turns out that they have nowhere to store it and nowhere to put it. So they are ready to sell it even with a surcharge. At the same time, the WTI exchange price is still positive, although it has dropped to almost $ 20 per barrel. That is, this is a local problem. Although, of course, it is impossible to deny the existence of problems in the global plan, but still not to the extent that the cost of oil around the world was negative. This situation became possible only because of an oversupply of oil in the domestic American market. And the export capacity of the United States is extremely limited due to technical limitations. Their ports are designed to unload oil from tankers, not load it into them. In other words, what we saw yesterday is an internal problem of the Americans themselves, rather saying that it is the United States that should reduce production, and not force everyone else to do it.more likely saying that it is the United States that should reduce production, and not force everyone else to do so.

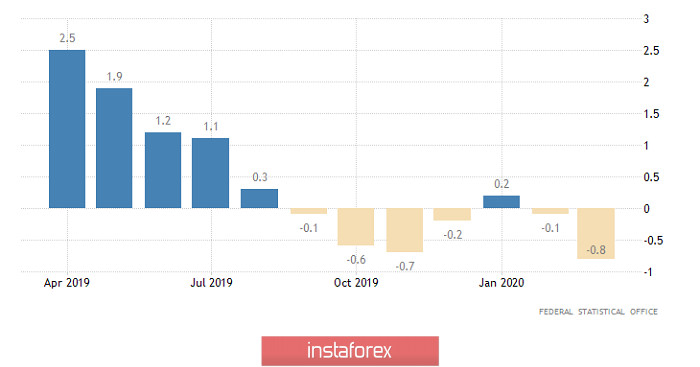

It is also worth saying a few words about yesterday's macroeconomic statistics. The trade surplus of the euro area in February amounted to 23.0 billion euros, while it was expected to amount to 17.5 billion euros. Everything seems to be fine. However, this data has never attracted much interest from investors, especially since the data for February, when many countries reduced imports from China, fearing the spread of the coronavirus epidemic, which was then raging in the middle Kingdom. Nevertheless, the rate of decline in producer prices in Germany accelerated from -0.1% to -0.8% for March. So the threat of deflation continues to grow in Europe, which means that the European Central Bank has more and more reasons to think about the possibility of reducing the refinancing rate to negative values.

Producer Price Index (Germany):

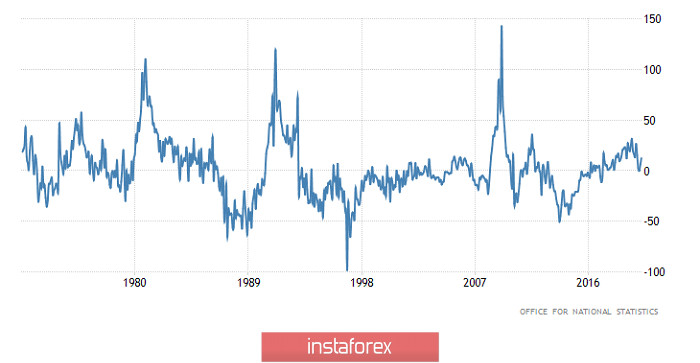

Now, we need to move on to the statistics that the UK showed in the morning. Here, UK data on the labor market was published, which are probably the most significant at the moment. As expected, the unemployment rate rose from 3.9% to 4.0%. The growth rate of the average wage slowed down from 3.1% to 2.9%, which also coincided with forecasts. But the growth rate of the average wage, but considering bonuses and overtime, especially overtime, slowed down from 3.1% to 2.8%, which turned out to be slightly worse than the forecasts, which indicated a slowdown to 3.0%. However, do not be surprised at such remarkable indicators, since these are data for February, and not March. For the previous month, only a change in the number of applications for unemployment benefits was published. It is these data that caused the greatest interest, since amid what is happening in the United States, everyone was well aware that other countries are beginning to form disaster in the labor market. Almost no one doubted that the February 2009 record would be broken, when the number of applications increased by 142.8 thousand. This, by the way, is a historical maximum. At least since 1970. But, to everyone's surprise, the number of applications increased by 12.2 thousand. Moreover, the previous value was revised for the better, from 17.3 thousand to 5.9 thousand. We expected that the number of applications would increase by 272 thousand. However, it turns out that their number does not deviate significantly from the normal value. And frankly, these data are confusing since they contradict logic. The only thing that can be explained is that employment centers, which accept such applications, simply do not work, due to strict restrictive measures to curb the spread of the coronavirus epidemic. That is, people had nowhere to turn in order to apply for benefits. Well, the fact that the data raises doubts and distrust is clearly seen in the pound, which fell into place. Although, amid the US statistics, this data looks good and should have helped strengthen the pound. Thus, we can rejoice that investors are back to their common sense.

Change in the number of applications for unemployment benefits (UK):

Basically, nothing interesting is published until tonight. The data on home sales in the secondary market, which should show a decrease of 9.7% will only be released by the end of the trading day in the United States. There is nothing surprising in this result, given everything that happens with the epidemic of coronavirus. And the data themselves have never really had a serious impact on the market. However, a slow stabilization in the oil market, which is inevitable, may contribute to a slight weakening of the dollar. Nonetheless, it is unlikely to be even stronger than yesterday's strengthening.

Secondary Home Sales (United States):

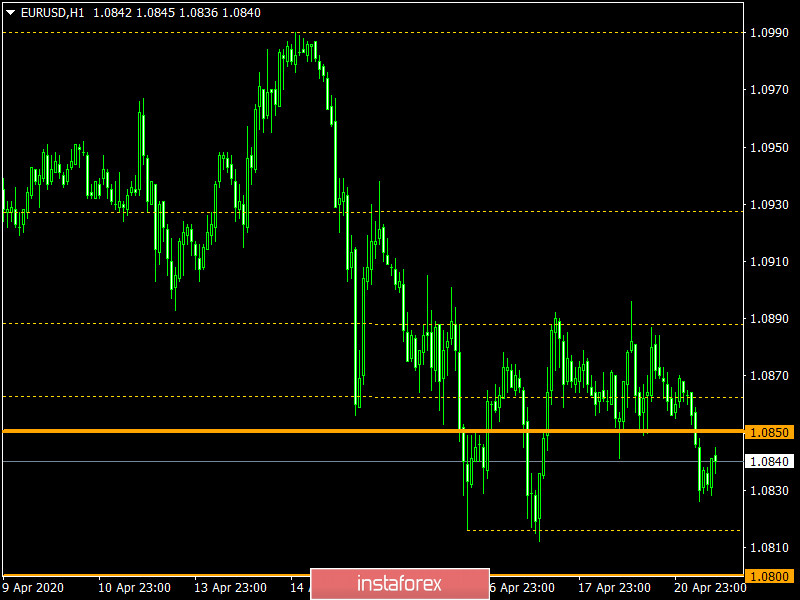

During the night surge in activity, the euro/dollar pair successfully declined to the area of 1.0825, where it slowed down and formed a slight rebound. It can be assumed that the downward infusion will still remain in the market, where the nearest variable pivot point is at the minimum of 1.0812 on April 17. The most significant support level is at 1.0800.

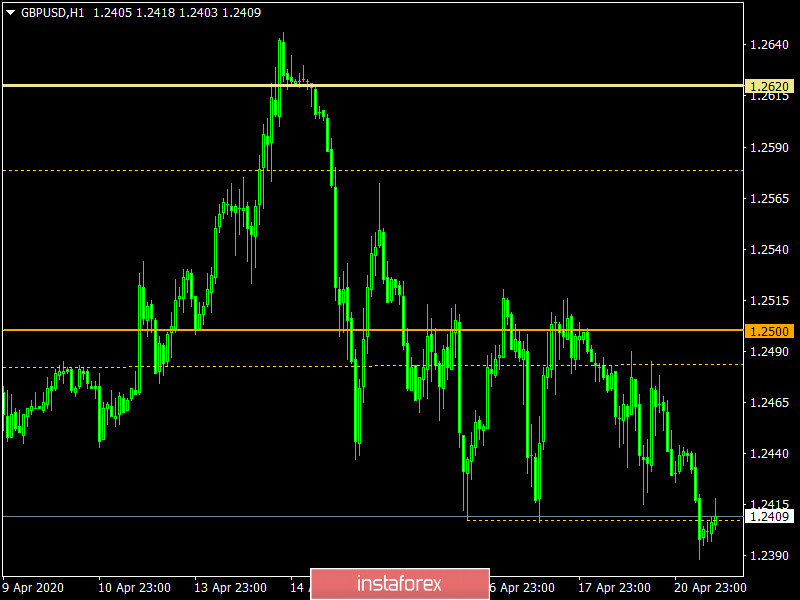

The pound/dollar pair resumed its downward movement, breaking through the variable pivot point of 1.2405 on the way. It can be assumed that if the set mood is maintained, a further decline to the main level of 1.2350 is not excluded.