EUR/USD – 1H.

Hello, traders! On April 20, the euro/dollar pair performed a certain fall to the lower border of the side corridor that I built after closing the pair's quotes above the previous downward trend line. After this closing occurred, the pair's quotes performed a reversal in favor of the US dollar and resumed falling. Thus, the signal to buy was false. It was this moment that gave me the idea that there is no trend now. And if so, then it means that there is a sideways movement. At the moment, the euro/dollar pair has fallen to the lower border of the side corridor. Thus, the rebound from this line will work in favor of the EU currency and the beginning of the growth of quotes in the direction of the upper line of the corridor. Only fixing the pair's exchange rate under the side corridor will allow traders to count on a further drop in quotes, and the mood of traders will again be characterized as "bearish". Yesterday was marked by an event that happens once in a lifetime. Oil futures prices fell to $ 0. This is, of course, a paradox, but the fact remains. It should be noted that today oil prices have already returned to their usual values of about 21 dollars per barrel.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes returned to the Fibo level of 23.6% (1.0840). I have built a new downward trend line on this chart that defines the mood of traders in the long term as "bearish". At the same time, the pair's quotes should be fixed below the corrective level of 1.0840 in order to expect a further fall in the direction of the next corrective level of 0.0% (1.0638). Today, the divergence is not observed in any indicator. Closing the pair's exchange rate above the trend line will work in favor of the European currency and the beginning of growth in the direction of the corrective level of 50.0% (1.1065).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a fall to the Fibo level of 23.6% (1.0840). The Fibo level grids on the 4-hour and daily charts remain identical. The only thing is that the daily chart shows more clearly reversals and rebounds from important correction levels. I also built a new "triangle" that perfectly displays the decline in trader's activity in recent weeks.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 20, there was not a single important report or news in the European Union or in America. Thus, weak movements of the euro/dollar pair and the absence of a trend correspond to the information background

News calendar for the United States and the European Union:

On April 21, the calendars of economic events in the European Union and the United States are empty again. Traders today will again have nothing to pay attention to.

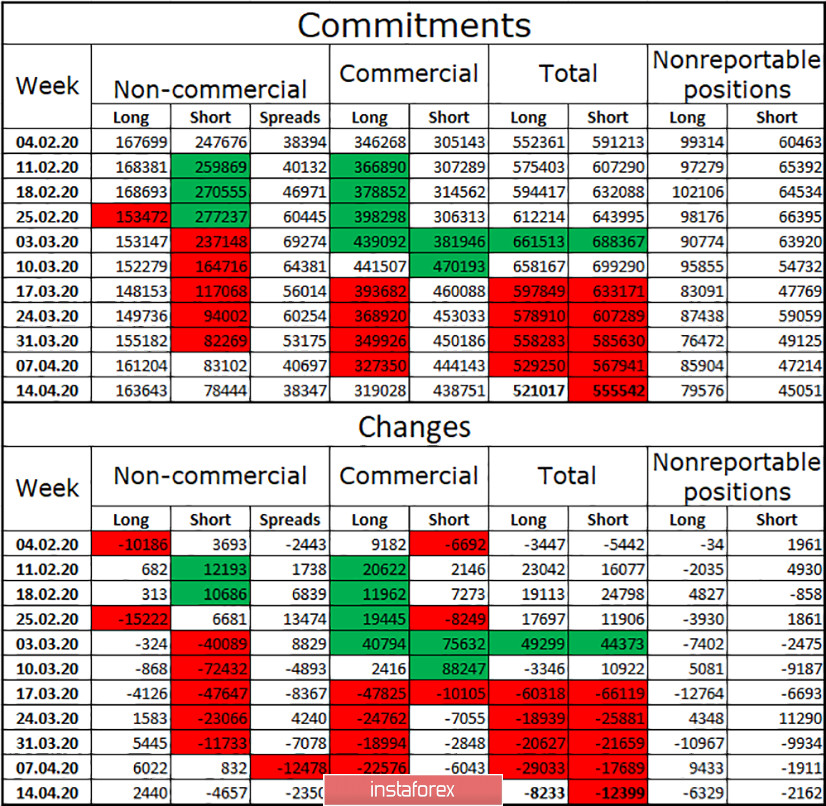

COT (Commitments of Traders) report:

A new COT report was released on Friday. As I expected, it showed no major changes. Major market players were again engaged in getting rid of long and short contracts. The first category lost 12,399 contracts during the week, while the second category lost 8,233. The increase was recorded only for long-term contracts of the "Non-commercial" group, i.e. speculators. However, these same speculators have been actively getting rid of short contracts in recent months, not believing that the dollar will become more expensive again. Thus, the overall advantage among large players remains on the side of short positions, but mainly due to hedgers. It is in the hands of hedgers that the largest number of open transactions is concentrated. Over the past week, the number of short-term contracts has decreased in absolute terms, so the probability of a fall in the euro currency is reduced.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend waiting for consolidation under the level of 23.6% (1.0840) on the 4-hour chart, as well as under the side corridor on the hourly, and then sell the euro with the goal of 1.0638. I recommend buying euros if the lower line of the side corridor (1.0827) is rebounded with the goal of the upper line of the corridor (1.0893).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.