Hello!

The results of trading on April 13-17 for the dollar/franc currency pair leave more questions than giving an idea of the further movement of the quote. A little later, we will analyze in detail the technical picture of USD/CHF on several timeframes, but for now, let's briefly talk about the macroeconomic statistics that can affect this trading instrument.

I would like to emphasize that the main influence on the dynamics of this currency pair is provided by data from the United States. However, we do not ignore the fact that today's statistics from Switzerland on the trade balance were significantly better than the previous indicator (3.2 vs. 2.1). No more Swiss macroeconomic reports are expected this week.

But there will be a lot of data coming from the US, including initial applications for unemployment benefits, the index of business activity in the manufacturing sector and the service sector, as well as orders for durable goods.

As has been repeatedly noted, market participants have recently been rather sluggish in their response to macroeconomic statistics, or even completely ignore them. However, when trading a particular instrument, you always need to take into account fundamental factors, because you never know how the market will behave.

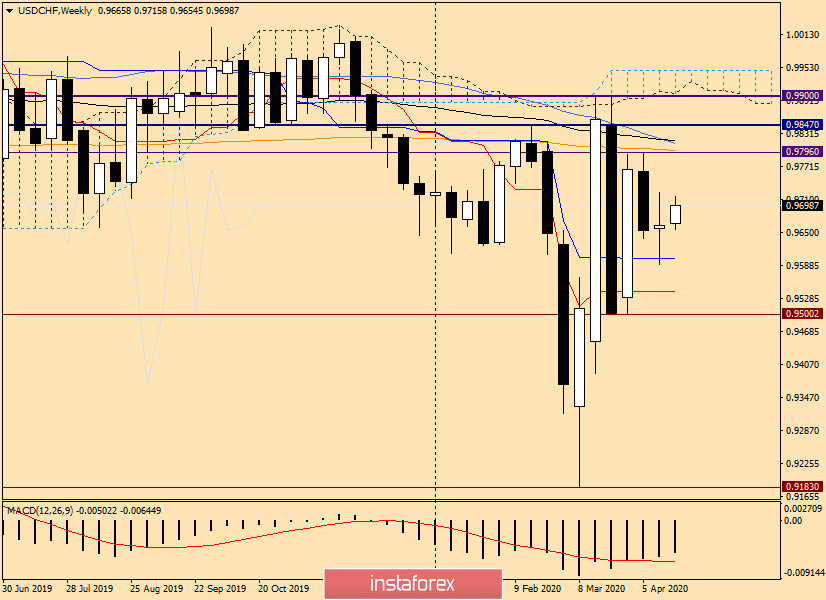

Weekly

The last weekly candle, formed in the form of a "Doji-Rickshaw", does not give a clear idea of the future direction of "Swissie". At the time of writing, USD/CHF is showing strength, but it is still very far from the end of weekly trading, so let's consider both scenarios.

If the growth continues, the pair's bulls may meet very strong resistance in the area of 0.9796-0.9817. As you can see, there is a horizontal resistance level, just above which is the 200 exponential moving average, and a little higher, the 50 MA merged with 89 EMA.

It is quite possible to assume that if the pair grows to these values, there will be a downward bounce and the current weekly candle will have a long upper shadow. If this happens, it will indicate the weakness of the USD/CHF bulls and their inability to continue the growth of the rate. However, this will become clear only after the current weekly trading closes.

If the bulls loosen their grip and lose all the current growth, the pair will break down the Kijun line of the Ichimoku indicator, which runs at a strong technical level of 0.9600. Closing weekly trading below this mark will indicate the next target at 0.9540, where the Tenkan line is located.

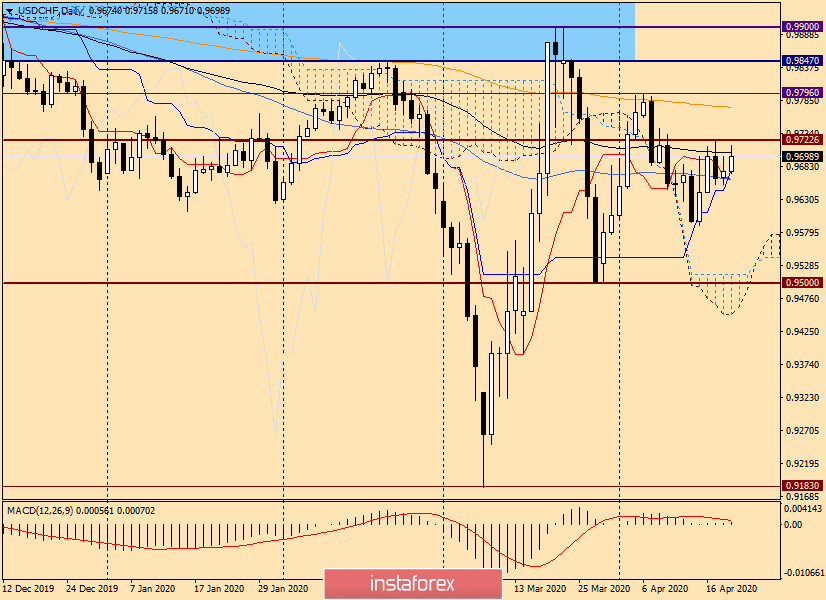

Daily

On the daily chart, the pair cannot yet overcome 89 EMA (black), but even if it passes, it will have to face strong resistance from sellers in the area of 0.9720-0.9740. I have repeatedly noted that the mark of 0.9700 is very strong, and stands alone. The same applies to the level of 0.9900, but it is still very far away, and the path is difficult and thorny.

If today's candle turns out to be a bearish reversal pattern, we sell USD/CHF with a stop loss for the maximum values of today's trading. In the case of a breakout of 89 EMA, the level of 0.9722 and closing the session above, we should expect continued growth to 200 EMA (0.9775), where the pair may again meet strong resistance and change the dynamics to a downward one.

The main trading idea for the USD/CHF pair is sales, the nearest of which is better to plan from the price zone of 0.9700-0.9720. We consider further targets and attractive prices for opening short positions after the pair rises to the area of 0.9795-0.9815.

However, there are options for purchases. Those who wish can try to open long positions after lowering to the price zone of 0.9675-0.9665, but before that it is better to see confirmation signals of Japanese candles.

Good luck with trading!