Monday's historic fall of oil quotes disappointed OPEC countries, pushing them to re-examine the agreement to find other options on slowing down this downturn.Monday's historic fall of oil quotes disappointed OPEC countries, pushing them to re-examine the agreement to find other options on slowing down this downturn.

According to Helima Croft of RBC Capital Markets, OPEC + leaders are currently in serious negotiations to resolve the crisis. Unfortunately, declining demand still persists.

Algeria proposed immediate reduction, much earlier than the original schedule of May 1. However, other OPEC members seem unsupportive of the idea. Moreover, it doesn't even seem to be of great importance at this stage.

OPEC + promised huge production cuts of about 10 million barrels per day - about 10% of global supply. But it is still not enough to compromise with the falling demand. According to the International Energy Agency, April consumption will drop by about 29 million barrels per day - still greater than the supply produced by all OPEC members.

"It was too late and too small - very small," said Paolo Scaroni, former CEO of Eni SpA, pertaining to the OPEC + agreement.

Saudi Arabia and Russia claimed that they are ready to take additional measures if necessary but it is unclear whether they really have the desire or ability to reduce production right now.

Trump, on the other hand, is working on a plan to save jobs in the US.

"We will never fail the great American oil and gas industry," Trump said on his Twitter account on Tuesday. "I have instructed the Minister of Energy and the Minister of Finance to develop a plan that will provide funds to ensure that these very important companies and jobs are secured in the future!"

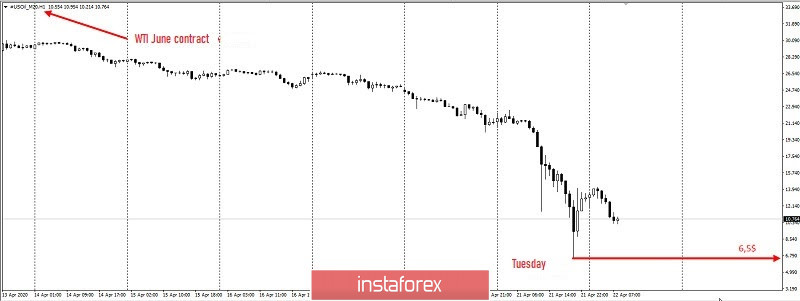

On Monday, WTI oil fell below zero for the first time in history, just as the May contract is expiring. On Tuesday, the loss spread to the following month, causing a rout, making some brokers suspend oil trading.

The Trump administration spent weeks looking for ways to help independent oil companies hit by the price smash.

The plan is for the US Department of Energy to purchase unused crude oil reserves and include them to US 'emergency stocks. The department is allowed to allocate up to 1 billion barrels of oil for emergencies, but the agency has used only about two-thirds of this volume.

The decline of May and June contracts highlight the severity of the current oil crisis.