Tomorrow's EU summit may end in another failure. Such discussions began to go around the market after EU officials failed to agree on the issue of pan-European bonds and, as well as to European Commission's proposal to increase the EU budget for 2021-2022. Germany, Austria and Sweden wants a clearer time limit regarding the concessional lending fund, as the growth of eurozone's debt could cause a serious political split in the EU.

The European Commission wants to increase the EU budget. According to Thierry Breton, none of the EU countries can cope on their own so the EU may need more than € 1.6 trillion to help the economies. Germany, however, disagrees, claiming that they can manage on their own, and financing at their own expense from weaker countries is not included in their plans. This indicates a possible domestic political split in the EU, which will lead to the collapse of the eurozone's integrity.

EU's first aid program worth € 540 billion euros has already been approved. Operation is expected to begin on June 1. € 100 billion will be used to reduce unemployment by compensating employers so that they do not fire their employees due to the crisis. € 200 billion will be allocated to the European Investment Bank, which will be used for soft loans to small and medium-sized businesses. The remaining € 240 billion will be distributed among states most affected by the pandemic, such as Italy, Spain, etc.

The US Congress approved another package of measures worth almost $ 500 billion. About $ 300 billion will be used to support small businesses in the form of soft loans, $ 60 billion for another aid program, while the remaining 75 and 25 billion will be spent on hospitals and the fight against coronavirus. The House of Representatives is expected to vote on the bill this week.

Yesterday, attention was drawn in the secondary market of US real estate. According to the report of the National Association of Realtors, sales in March fell immediately by 8.5%. The decline was basically caused by the quarantine measures implemented because of the virus.

US retail sales from April 12-18 jumped by 1.3%, according to the report of The Retail Economist and Goldman Sachs. Compared to the same period last year, the index fell by 20.1%. In Redbook's report, a sharp decrease of 10.6% is observed in the first two weeks of April, and about 4.4% compared with the same period last year.

For the technical viewpoint of EUR / USD, the pair remained unchanged compared to past forecasts. Only the break of the support level of 1.0815 will increase pressure on the trading instrument and push it to the lows of 1.0770 and 1.0715. If the bulls manage to regain control of the market, which will happen if EUR / USD trades above 1.0850, then we can expect a larger increase to the highs of 1.0890 and 1.0940.

Oil and CAD

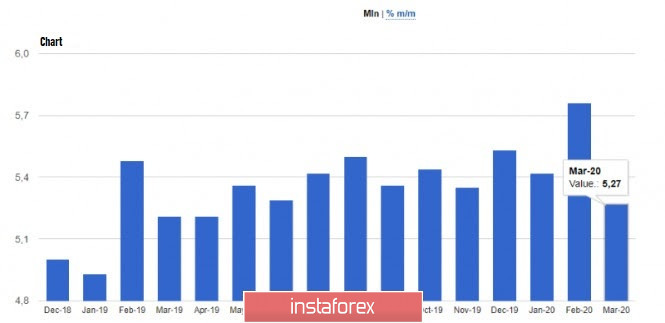

The Canadian dollar remains losing against the US dollar amid the collapse of the oil market. Canada's retail sales report, which indicated an increase of 0.3% in the index for February, did not even contribute to the strength of the pair.

Yesterday, WTI crude oil plummeted to $ 7 per barrel. OPEC countries are considering a larger production cut, but it will not help the market much. US President Donald Trump ordered energy and finance ministers to develop a plan to allocate funds for the oil and gas industry, noting that he would not allow the oil and gas industry to collapse. Trump also said that he is considering all options for supporting the US oil and gas sector, including banning oil imports from Saudi Arabia.

WTI is currently rallying in the region of $ 10-11 per barrel. Judging by the schedule, increase is not expected in the near future. Any statements made by Russia or Saudi Arabia on this subject can be a catalyst of oil's movement to either side.

The storage space for extracted oil in the US may end in May this year, which will lead to a larger sale of June futures, as was the case with May oil, which collapsed to a historic $ -40 per barrel.