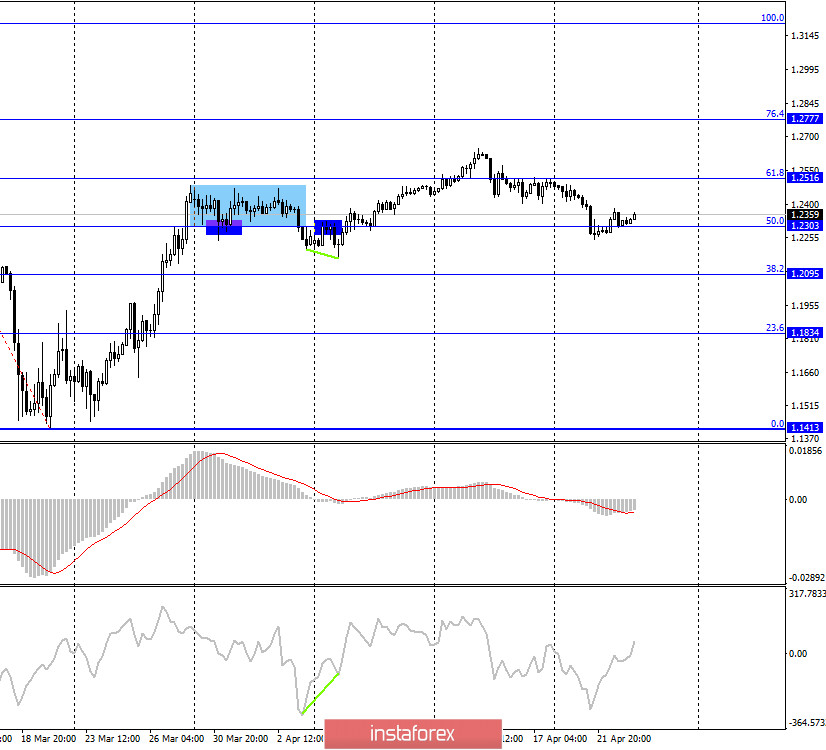

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a new reversal in favor of the British currency and increased to the upper border of the downward trend corridor. Thus, the rebound of the pair's exchange rate on April 23 from this line will work in favor of the US currency and resume falling in the direction of the lower line of the corridor, which potentially gives us a very large move. At the same time, fixing the pair's rate above the descending corridor will allow traders to expect continued growth. There is a small amount of news coming out of the UK right now. Therefore, the information background can be said to be zero. Economic reports do not arouse interest among traders. In general, the country continues to fight the coronavirus epidemic in the same way as the whole world.

GBP/USD – 4H.

As seen on the 4-hour chart, the pound/dollar pair performed a reversal in favor of the British currency and secured above the corrective level of 50.0% (1.2303). Thus, the probability of further growth towards the next corrective level of 61.8% (1.2516) is high. However, on the hourly chart, a rebound from the upper line of the corridor is possible. Thus, we potentially have two opposite signals. If a buy signal is formed on the hourly chart, then everything is fine. Otherwise, on the 4-hour chart, I recommend waiting for the close under the Fibo level of 50.0%, which will allow traders to expect a reversal in favor of the US currency and a resumption of the fall in the direction of the corrective level of 38.2% (1.2095).

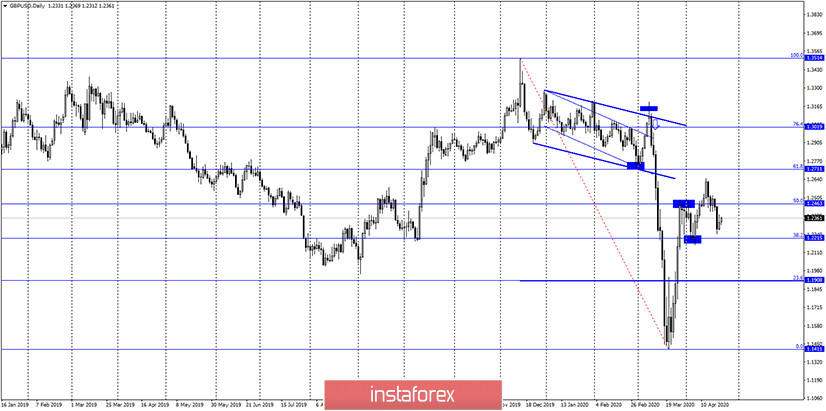

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.2463). Thus, the pair can resume the fall of quotes in the direction of the next corrective level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term.

Overview of fundamentals:

There were no economic reports in America on Wednesday. In the UK, the March inflation report was released, which was successfully overlooked by traders. The information background is generally not too strong, but traders continue to ignore most of it.

The economic calendar for the US and the UK:

UK - index of business activity in the manufacturing sector (10:30 GMT).

UK - index of business activity in the service sector (10;30 GMT).

US - number of initial applications for unemployment benefits (14:30 GMT).

US - index of business activity in the manufacturing sector (15:45 GMT).

US - PMI for the services sector (15:45 GMT).

Today, April 23, the news will be in both Britain and the US. I believe that the report on initial applications for unemployment benefits will be the most important today. If there is no reaction from traders to it, then the rest of the reports will be even more so.

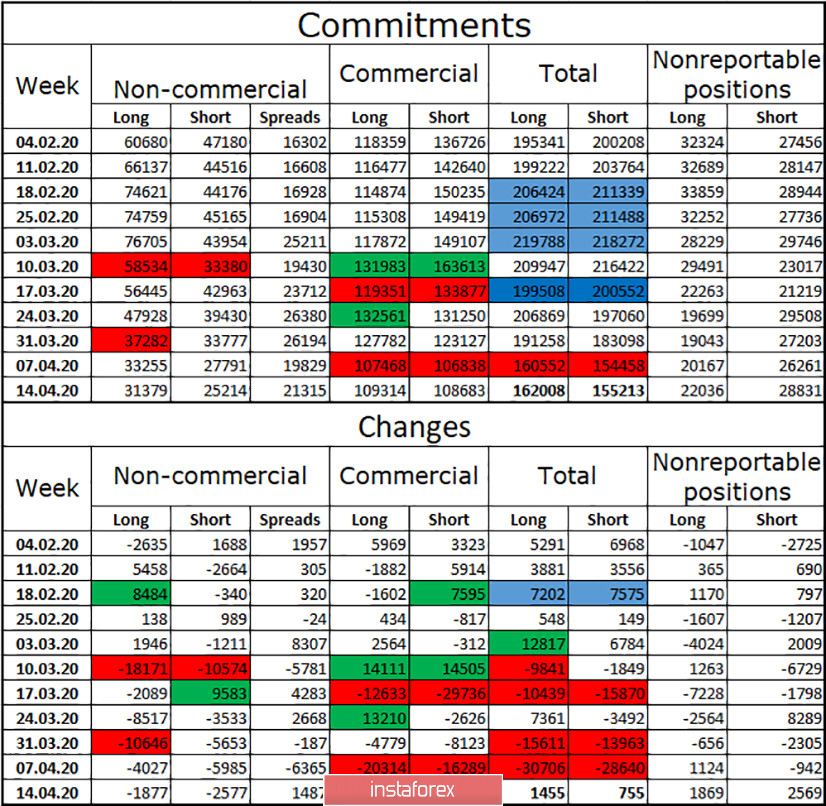

COT (Commitments of Traders) report:

The latest COT report was released on Friday and showed a minimal increase in interest among major market players in the British currency. However, this growth is so minimal that it is impossible to conclude the growth of interest in general. The total increase was only about 3,000 contracts for both groups - short and long. Thus, I believe that the pound remains an extremely unattractive currency for major market players. For example, speculators have now concentrated in their hands the minimum number of contracts for a long time - only about 80,000. And the total number of contracts is now about 320,000. For comparison, the total number of euro contracts is more than a million. There were no major changes during the reporting week. For all categories of traders, changes are minimal - plus or minus 2-3,000. The minimum advantage remains on the side of the bulls, as the total number of long contracts exceeds short by 7,000.

Forecast for GBP/USD and recommendations to traders:

I believe that today we should sell the pound with the goal of 1.2095 if we close under the corrective level of 61.8% on the 4-hour chart or rebound from the upper line of the descending corridor on the hourly chart. I recommend buying the pound with the goal of 1.2516 if the pair closes above the descending corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.