Hello, dear traders!

Following the results of yesterday's trading, the US dollar strengthened against the euro. The US currency was supported by the growth in the yield of US government bonds, as well as the strengthening of the dollar index. Do not forget that in the context of the COVID-19 epidemic, the US dollar often acquires the status of a protective asset.

If you look at the economic calendar, today at 09:00 (London time), the publication of the index of business activity in the manufacturing sector and the services sector of the Eurozone is expected. From the United States, similar reports will be published at 14:45 (London time), and before that, data on initial applications for unemployment benefits will be released at 13:30. Today's US statistics will end with the release of new home sales at 15:00 (London time).

In the current conditions, it is difficult to assume whether market participants will pay attention to macroeconomic indicators or not. As previously expected, the main focus of investors is on measures taken by national governments to counteract the negative impact of COVID-19.

In the meantime, experts' forecasts regarding the prospects of the European economy are disappointing. Many experts believe that the Eurozone economy has already entered a recession, which may become the largest. It is all the fault of quarantine measures and restrictions associated with rampant coronavirus in European countries. It is predicted that in the first quarter of this year, the Eurozone economy is expected to decline around 3%, and in the current quarter, the economy of the currency bloc will miss no less than 9.5%. Truly shocking figures!

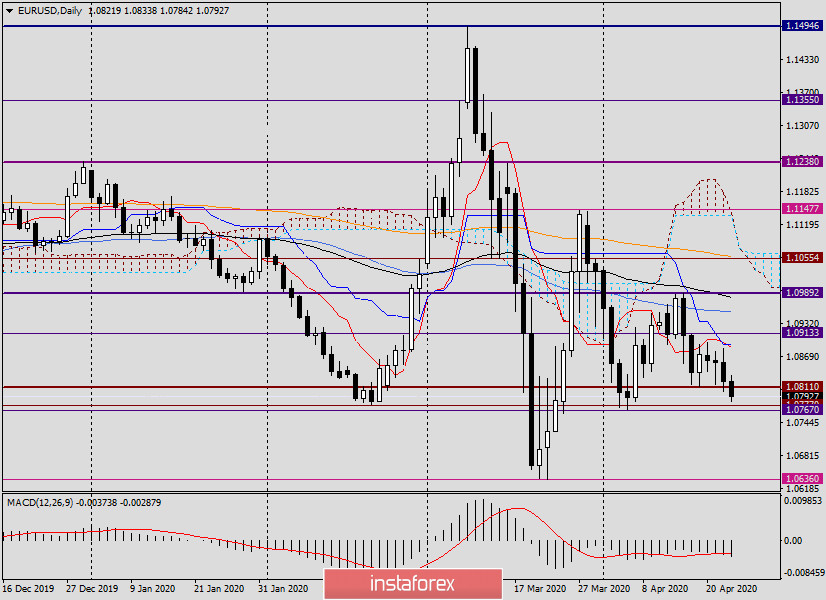

Daily

If we go to the technical picture of the main currency pair of the Forex market, yesterday's recommendations to sell the euro/dollar pair after short-term rises to 1.0874, 1.10892, 1.0903, and 1.0917 were generally correct.

At the trading on April 22, the quote rose to 1.0884, then fell, and the session ended at 1.0822. Yesterday's attempts by bears to push through the landmark level of 1.0800 did not bring the desired result. But today, at the moment of writing this article, this important level is breaking through and trading is conducted near 1.0792.

As can be clearly seen on the chart, the important support zone of 1.0777-1.0767 passes a little lower, so it is quite risky to sell on the approach to these prices. Let's look at the situation that develops in smaller time intervals, where I will immediately try to indicate trading recommendations for EUR/USD.

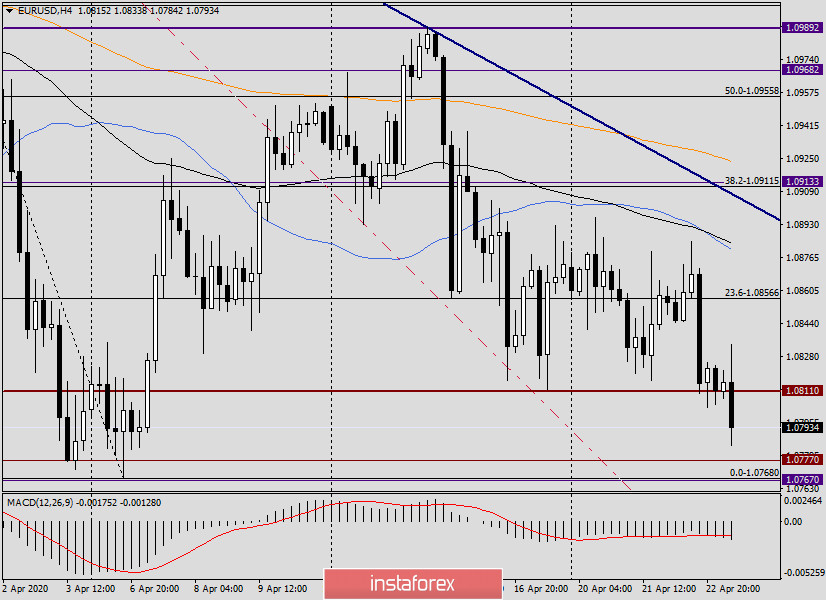

H4

Looking at this timeframe, we see increased pressure on the single currency. Naturally, in such a situation, you really want to open short positions on the euro/dollar pair. However, I would like to emphasize again that the pair is heading to a strong support zone of 1.0777-1.0767, from which a rebound up, or even a reversal of the course, may occur. If the current candle is formed with a full bearish body, without a long lower shadow, we wait for a pullback to approximately its middle, then try to sell. Judging by the 4-hour chart, this will be the price zone of 1.0802-1.0811.

H1

On the hourly chart, the pair is trading below the used moving averages (50 MA, 89 EMA, and 200 EMA), which are late in their decline after the price, and this is the main disadvantage of these indicators. However, we must admit that the current decline is quite sharp, so the lag of movements is not surprising.

I built a descending channel specifically for this timeframe. At the end of the review, the middle (dotted) line of this channel breaks through. If three hourly candles close under it in a row, they will return higher on attempts, we sell from the middle line with a stop above today's highs of 1.0834. The same strategy is proposed for the price zone of 1.0802-1.0811. After closing three consecutive candles below 1.0800, on the pullback to the designated zone, we try to open deals for sale.

And the last option will be to use a breakout strategy, which involves selling on the breakout of the support zone of 1.0777-1.0767. The idea is risky, here you need to carefully monitor the situation and monitor the intensity of the downward dynamics of EUR/USD.

Good luck!