Hello, dear traders!

Recently, the New Zealand dollar has somehow fallen out of sight. Assuming that many traders are interested in the NZD/USD currency pair, I decided to fill this gap

Since no macroeconomic statistics from New Zealand are expected until the end of this week, the fundamental factor for this currency pair will be the reports from the US. Let me remind you that today at 13:30 (London time), data on initial applications for unemployment benefits will be released, and later, at 14:45 (London time), indices on business activity in the manufacturing sector and the service sector will be published.

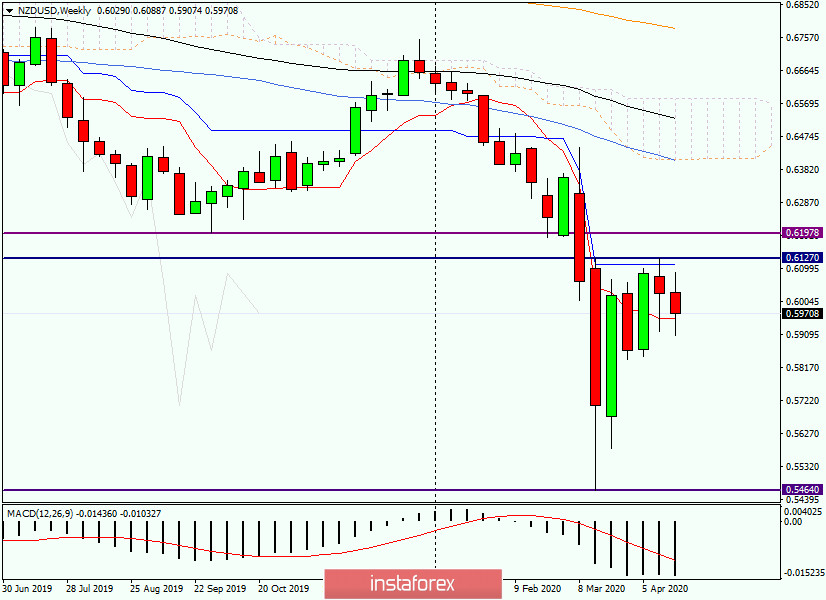

Let's move on to the NZD/USD charts and, since this currency pair is not often considered, let's start with the weekly timeframe.

Weekly

As you can see, after the fall to 0.5464, the exchange rate of the New Zealand currency began to adjust. The breakdown of the Tenkan line of the Ichimoku indicator did not find its confirmation, and the quote returned higher. Moreover, at the auction of the last five days, attempts were made to pass up a strong Kijun line. However, they were not successful, and the pair remained between the two lines.

At this week's trading, bears on the "kiwi" are again trying to lower the price under the Tenkan, but at the time of writing, this line provides quite good support and does not let the price lower. If the players on the downside still manage to push the Tenkan and close the week under this line, the further downward scenario will have a good chance of implementation. A Doji candle with approximately equidistant shadows and the closing price between Tenkan and Kijun will postpone the question of the further direction of the quote until better times.

If there is an upward reversal from the current values and the weekly session ends above Kijun and the resistance level of 0.6127, there will be prospects for further growth, the nearest goal of which will be a strong technical level of 0.6200.

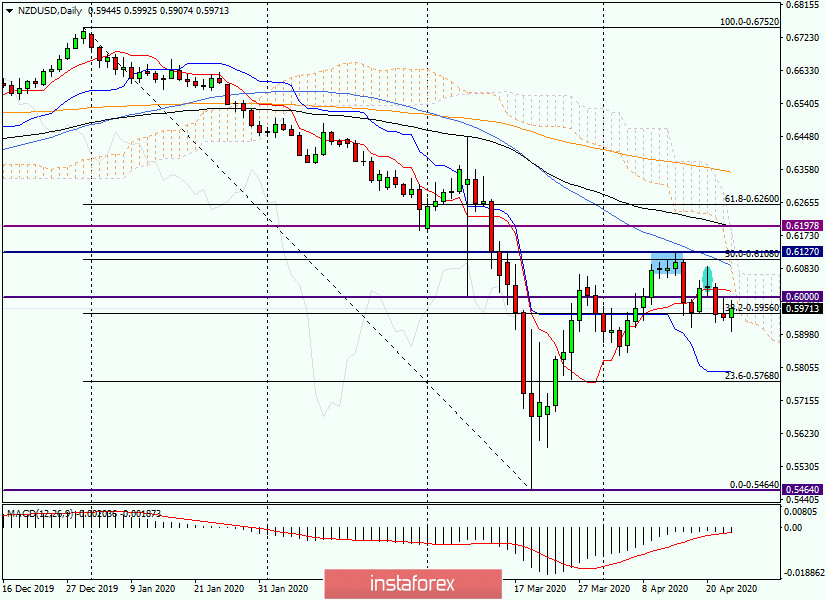

Daily

On the daily chart, the situation can also not be considered certain, and it is not so easy to identify the further direction of the pair at the moment. Naturally, the pair is in a downward trend and made a classic correction to the middle of the fall of 0.6752-0.5464.

I selected a combination of Japanese candles under the resistance of 0.6127 and the Doji candle for April 20. Both models are reversals and signal the end of the corrective rise of the "New Zealander". It is characteristic that today's strengthening of the "kiwi" is largely due to the growth of oil prices, which led to a weakening of pressure on commodity currencies. How long this will last is unknown. I dare say not for long. If so, then you should look for selling points on the pair's growth attempts. Judging by the daily chart, the rise to the Tenkan line (0.6017) can be a good guide for opening short positions on the New Zealand dollar. Do not forget that an important and significant psychological level of 0.6000 passes a little lower, which will also prevent the continuation or resumption of corrective growth.

If you define trading recommendations for NZD/USD, then this is trend positioning, which means sales. I suggest considering opening short positions after rising to the levels of 0.5978, 0.5990, 0.6000, and 0.6017.

Good luck!