Yesterday's summit failed to make traders purchase risky assets, despite the attractive prices. The euro's decline is expected to continue.

EU summit results.

Leaders of the 27 EU countries approved an emergency economic assistance program worth € 540 billion, which will start on June 1, and primarily support business and the public. Most of the funds will go to the economies of countries that need more help, such as Italy, Spain and so on.

According to Charles Michel, head of the European Council, the European Commission is tasked to develop a new plan for the European Economic Recovery Fund, which will provide support to EU countries affected by the coronavirus. However, neither the approximate fund volume, nor options for raising funds for it were discussed, so risky assets declined more against the US dollar. Traders were very much counting on the specifics. Discussions on the corona bond were also anticipated in the summit, but it did not happen. In a statement, Italian Prime Minister Giuseppe Conte said that the decision to create the fund was unanimous, so the European Commission must analyze the needs and come up with relevant proposals by May 6.

Germany, the Netherlands and other EU countries oppose the issue of pan-European bonds. According to Germany, such decision will raise money under the general guarantee obligations of all EU countries, but funds will be sent only to countries most affected by the coronavirus, to which large economies do not belong. Germany and a number of other countries will not take part on the debt burden of Italy, Spain and others who are in need of help.

Reports on the increase of contributions to the community budget flamed euro's drop. According to the European Commission Head Ursula von der Leyen, EU member states must increase contributions to the community budget from 1.2% to 2% of GDP. Such measures will be effective for at least two years. The decision was made in order to increase funds for economic recovery.

Meanwhile, France approved a bill on changes to the country budget. The new bill is designed to allocate € 110 billion to support the French economy and citizens' health. € 24 billion will go to unemployment benefits, while another € 20 billion will go to business.

The United States also adopted a new aid package worth almost $ 500 billion. $ 320 billion will go to the program supporting small business, € 75 billion for hospitals and the health system, and about $ 25 billion will be spent on the development and testing of coronavirus vaccine.

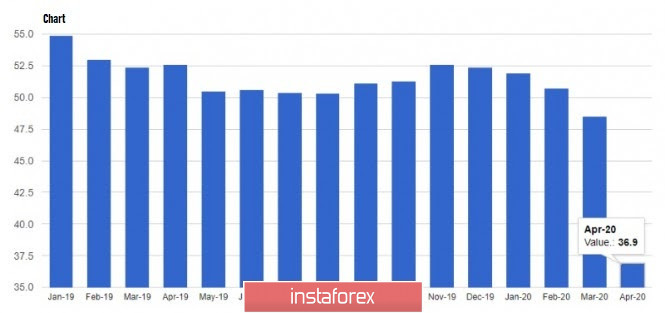

The condition of the US manufacturing sector is slightly better than economists' prediction. According to the IHS Markit, the preliminary PMI of procurement managers for the US service sector fell to 27.0 points in April, while the preliminary PMI of procurement managers for the manufacturing sector fell to 36.9 points. Economists expected a drop to 35 points.

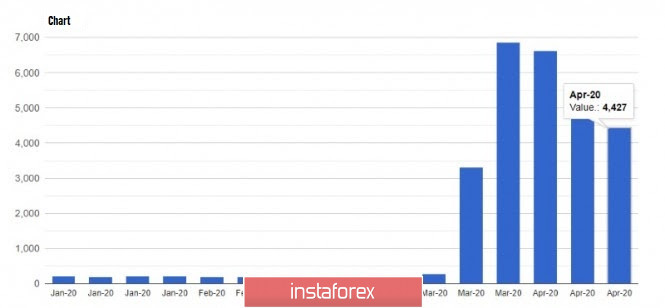

Although there's a slowdown, recession in the US labor market continues. Applications for unemployment benefits from April 12 to 18 totaled to about 4.4 million, better than the previous week's 5 million.

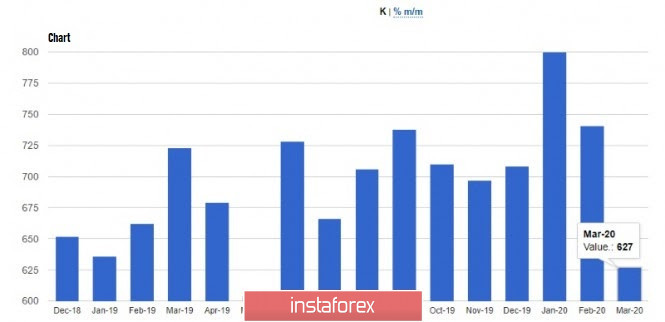

Housing sales continue to drop because of the quarantine measures imposed by the US authorities. According to the US Department of Commerce, sales in the primary housing market fell by 15.4% in March and determined to 627,000. The average price of new houses in March was 321,400.

Manufacturing activity in the area of the Kansas City Fed declined, although a slight improvement can be distinguished. According to the data, the composite index fell to -30 points in April.

As for the technical picture of the EUR / USD pair, the break of the 1.0760 support, which market participants have already tested many times, will lead to a larger sell-off of risky assets with a minimum of 1.0710 and 1.0640. If the bulls manage to keep the pair from breaking the level, an upward correction to the resistance area of 1.0800 and 1.0850 can be expected. However, judging by the current situation, pressure on risky assets will continue in the medium term.