The single European currency is under pressure due to the inability of the EU authorities to agree among themselves on the amount of financial assistance to the region against the backdrop of the coronavirus pandemic.

On Wednesday, the EU summit managed to agree on the amount of financial assistance, which amounted to 1 trillion dollars against the expected two. In addition, participants did not provide details of how it will be provided and on what terms. This uncertainty became the reason for quite volatile trading on Thursday for the main currency pair euro/dollar, and then its fall to the local minimum of April 6 this year.

The main obstacle to reaching a consensus that was satisfactory on all sides was the divergence of views of the so-called "northern" countries led by Germany, which so far do not experience such financial problems as the "southern" countries, where the leader is Italy, which experienced a severe shock from pandemic COVID-19. As we mentioned earlier, these contradictions are an important destabilizing factor for the existence of the EU and the eurozone. Italy, Greece, Spain, and a number of other "southern" countries are offended by the lack of desire and inability of the EU bureaucracy to help them during the most difficult period of the pandemic. On the contrary, there were extremely unpleasant facts of plundering, for example, Italy by Poland, when cargo with protective equipment from China passed through its territory. This left a heavy residue that would be difficult to remove in the future.

Therefore, observing everything that happens, we believe that the strengthening of centrifugal forces against the backdrop of a split between the "north" and "south" of Europe will negatively affect the exchange rate of the single currency in the near future. If the EU authorities do not present a clear "road map" for the region's recovery from the crisis, and will be limited to half measures, then we should expect continued decline in the single currency against the US dollar in the near future even despite the obvious weakness of the latter. We consider it possible to resume sales of the euro on its local upward rebounds.

Forecast of the day:

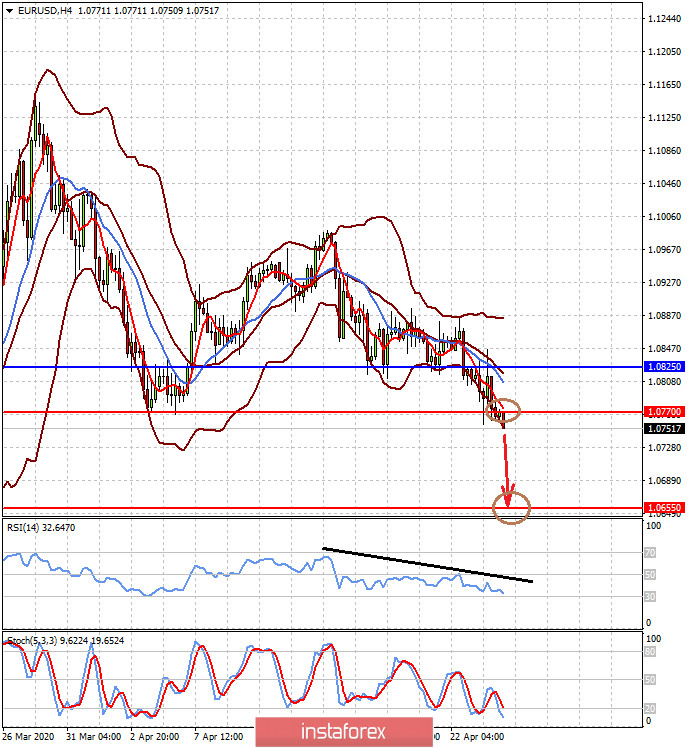

EUR/USD remains under pressure at the end of the EU summit. The price has already declined to our yesterday's goal of 1.0770 and even broke through it. Thus, we expect it to continue to decline to the second goal of 1.0655.

AUD/USD is trading above the level of 0.6350. We believe that in the wake of the improvement in the situation on the commodity market, the pair will continue to rise and realize the figure of the continuation of the "downward flag" trend with its growth to the level of 0.6445.