Economic calendar (Universal time)

We can note data on basic orders for durable goods in the USA (12:30) among the expected indicators in the afternoon.

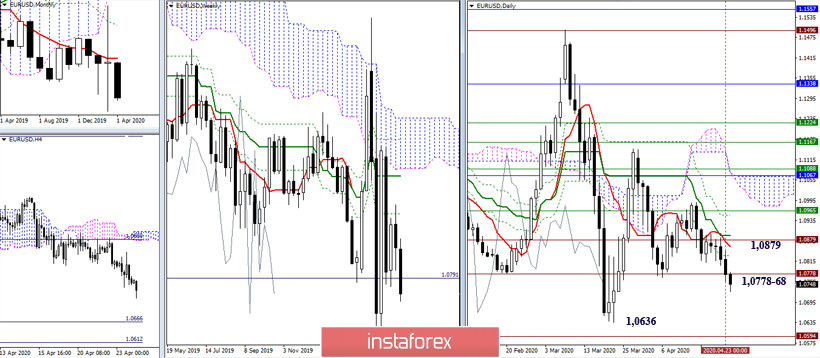

EUR / USD

As expected, the pair continued to decline after updating the low of last week. As a result, yesterday's day was closed in the support area of 1.0778-68 (historical level + minimum extremum). Today, the issue of the breakdown of the level is being resolved. The breakdown and closing of the week below the supported supports will give it to the next landmarks - the minimum March extreme (1.0636) and the target for the breakdown of the Ichimoku cloud on H4 (1.0666-12). The closure of the current week above the found support may serve as the basis for the formation of rebound.

Over the previous day, the pair managed a lot - to define a new low and test the key resistance for strength. Today, on H1, players to decline continue the downward trend. Now, there is a slowdown in the first support of the classic Pivot levels (1.0739), further reference points are S2 (1.0702) and S3 (1.0648). In the case of the development of an upward correction among the resistances, 1.0793 (central Pivot level) and 1.0836 (weekly long-term trend) will be of primary importance today. Consolidating above these resistances will change the current balance of power in the lower halves and create conditions for possible changes in the higher halves.

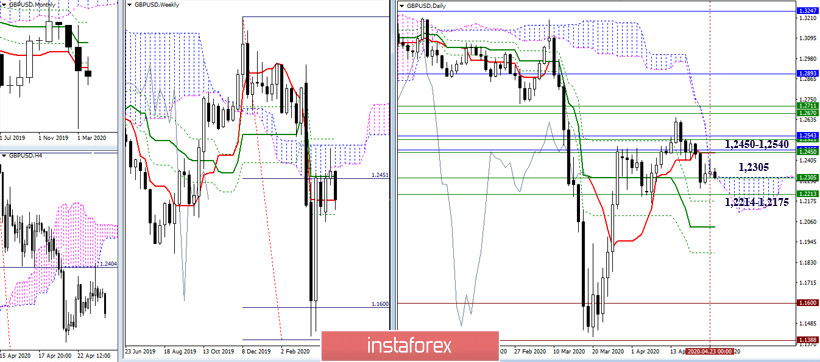

GBP / USD

The slowdown continues. A daily cloud was added to the efforts of the weekly short-term trend (1.2305). As a result, the current slowdown may be delayed, and the closing of the week above the weekly short-term, in the bullish zone relative to the daily cloud, may serve to further restore bullish positions. The breakdown of the support met by 1.2305 and the subsequent 1.2214-1.2175, as well as the closing of the week below these levels will be an increase in bearish sentiment, which will most likely lead to a continued decline.

Yesterday, the resistance to the weekly long-term trend, tested for strength, coped with the task and defended the interests of players on the downside. At the moment, the pair is working under the key resistance of the lower halves again, which hold the defense today at 1.2354-78 (central Pivot level + weekly long-term trend), while the bears retain support for most of the analyzed technical indicators. Moreover, updating the low (1.2246) will restore the downward trend. It should be noted that the support for the classic Pivot levels today is located at 1.2294 (S1) - 1.2247 (S2) - 1.2187 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)