Despite a large reduction in the indicator of the German business environment in April this year, the euro managed to partially recover its position against the US dollar after the morning fall, which continued after yesterday's results of the EU summit. Let me remind you that the results of the meeting of EU leaders again failed to reach a common agreement on the need to create national bonds, which will help to attract more significant amounts necessary to save European countries from the crisis associated with the spread of coronavirus.

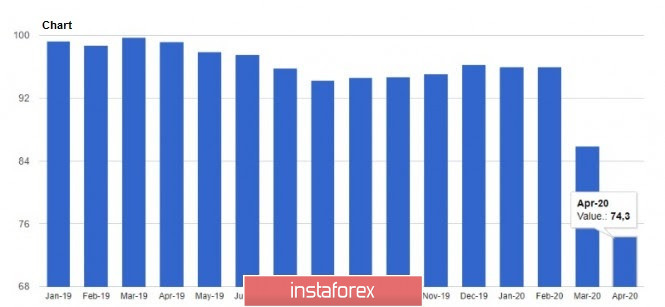

Today's data on the Ifo index was another proof of the sad state of the German economy, which is gradually sliding down. The leading indicator of business sentiment in the Ifo in April fell much more strongly than economists had predicted, amounting to 74.3 points, which is a historical low. Economists have already calculated that such a sharp drop in the index indicates the probability of a 5% drop in German GDP in the 2nd quarter of this year. Another problem is the fact that no one can give at least a general forecast for the recovery of the index since the European economy remains paralyzed due to the quarantine, the weakening of which is not yet expected. Earlier removal of quarantine measures to revive the economy is fraught with a new outbreak of the pandemic, which may lead to the collapse of the entire financial system.

Economists had expected the index to fall only to 80 points from 85.9 points in March this year. The index suffered the most because of a record fall in the current conditions indicator, which collapsed in April to 79.5 points from 92.9 points in March, while economists expected the indicator to be at 80.8 points. The expectations index fell to 69.4 points from 79.5 points in March. It is worth noting that the indicator is calculated based on a survey of more than 9,000 German companies that are involved in the manufacturing sector, services, trade, and construction.

Against this background, the measures taken by the European Commission, as well as the launch of a long-term stabilization aid fund, do not look so premature as, in fact, the release of coronabond funds, which will help finance economies that are on the verge of a crisis due to the spread of falls.

Hence the increase in interest rates on government bonds of Italy, Spain, and other countries, as investors require a higher risk premium. The current yield on 10-year Italian government bonds is 2.076%, while the yield on German securities remains negative at -0.465%. Economists' forecasts for the growth rate of the Italian economy further push major players away from the debt market. For example, Citi expects that in 2020, the Italian economy will fall by more than 10.4%, and measures related to curbing the spread of the coronavirus will remain longer than expected. The measures taken by the authorities may inflate the Italian budget deficit to 8% of GDP, and the debt-to-GDP ratio will approach 160% from the current level of 135%.

Against this background, the reaction of traders to the sale of the European currency is quite understandable, but the sharp intraday market reversal after the Ifo reports is rather associated with a speculative moment and is unlikely to be of serious significance in the medium term.

GBPUSD

The British pound, meanwhile, continues to remain under pressure in pair with the US dollar, but today's report on the collapse of retail sales was ignored by the market, as well as yesterday's indicators on activity in the service sector. This indicates that investors are ready for such data, and the further direction of the market will depend more on the monetary and fiscal policy of the government. Any help will have a positive impact on the British pound in the medium term, as it will help create earlier conditions for getting out of the crisis peak. The main thing, in this case, is not to overdo it.

The report indicated that in March compared to February 2020, retail sales in the UK fell immediately by 5.1%, but economists had expected a worse scenario and a decline of more than 6.0%. However, given the quarantine measures and the economic freeze, this drop is only the tip of the iceberg. Based on expectations, retail sales will decrease by 20-30% in April. It is worth noting that the drop was recorded in all categories at once, except for food products.

Based on these indicators, it is likely that in the 2nd quarter the economy may decline by 25% at once, in general, it is expected to decline by 9.3% over the year. However, much will depend on how long the regime of isolation and social distance continues.

From a technical point of view, nothing has changed in the short term for the GBPUSD pair. Traders continue to trade the level of 1.2340, which will be the main push. And most likely, the downward movement will continue, since nothing good can be expected from macroeconomic statistics, and the end of the coronavirus epidemic is not yet expected. The nearest support levels are seen around 1.2250 and 1.2170. Growth will be limited by the large resistance of 1.2415, where the bears showed themselves in all their glory yesterday. However, even rise above this range will only allow the bulls to reach a maximum of 1.2480.