What kind of stability can we talk about now?

Hello, traders!

At the end of trading on April 20-24, the US dollar was in demand among investors and strengthened against all major competitors, with the exception of the Australian dollar and the Japanese yen. The main currency pair of the Forex market EUR/USD showed a decline, losing 0.58%.

In the past week's trading, market participants continued to ignore macroeconomic statistics, and the price direction of the euro/dollar was determined mainly by technical factors, as well as the development of the situation with the spread of COVID-19 and measures to counter the pandemic.

Nevertheless, this week will be very full of important events, including the most significant ones. On Wednesday, at 19:00 (London time), the US Federal Reserve (FRS) decision on rates will be announced, and at 19:30 (London time), Fed Chairman Jerome Powell will hold a press conference. Before that, at 13:3 0(London time), the United States will publish preliminary data on changes in GDP for the first quarter.

The next day, the European Central Bank (ECB) will take up the baton, which will publish its verdict on the main interest rates at 12:45 (London time), and at 13:30 (London time), the traditional press conference of ECB President Christine Lagarde will take place. On the same day at 10:00 (London time), preliminary data on GDP for the first quarter, and a report on unemployment in the currency bloc will be released.

It will be very interesting to see how market participants will react to these important events this time. It is clear that in the context of the ongoing COVID-19 epidemic, there will be nothing to be happy about. Data on GDP in the US and the Eurozone are expected to be quite negative, and hawkish rhetoric from the heads of the world's two leading central banks can not be expected. I believe that all investors' attention will be focused on measures to counteract the coronavirus in order to maintain economic stability. Although what stability can we talk about now? This is more a question of saving the economy.

If we return to the topic of COVID-19, a new outbreak has broken out in the Chinese metropolis of Harbin, so we would like to consider that all the worst is over, but, apparently, the final of this terrible tragedy is not yet close. And while the search for a vaccine against a new type of coronavirus continues around the world, the US President said that disinfectants destroy the virus within a minute, and he would be interested to see how it will work by injection. After a wave of criticism that descended on Trump after his irresponsible reasoning about the way to defeat the coronavirus using disinfectants, the American leader called his remarks a joke. Quite a stupid and even cynical joke turned out, especially since the spread of COVID-19 in the United States continues to step ahead of the entire planet.

Well, it's time to consider the charts for the main currency pair, and let's analyze first the results of the week that ended.

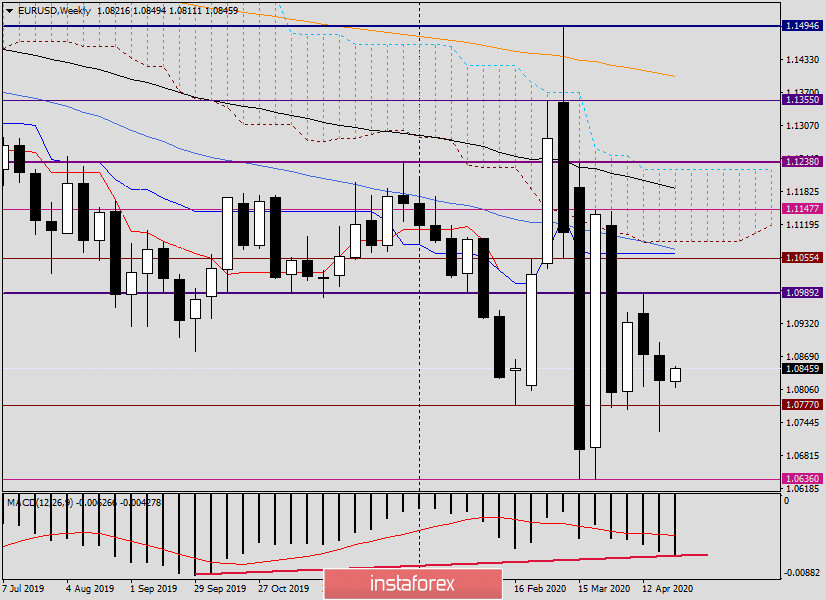

Weekly

Following the results of the last five-day trading, a bearish candle was formed with a fairly long lower shadow and the closing price at 1.0823. At the same time, the minimum values of the last week's session were shown at 1.0727, but the euro bulls managed to raise the quote above one of the key levels of 1.0800 and finish trading above this mark.

As a result, we see a situation in which the market does not want to decline, but also cannot grow. Given the nuances of candle analysis, after such candles, the rate often rises. If this assumption turns out to be correct, the euro/dollar has every chance to grow to 1.0950 and 1.0990. At the same time, the breakdown of the last mark will open the way to the area of 1.1065-1.1087, where the Kijun line of the Ichimoku indicator, 50 simple moving average and the lower border of the weekly cloud pass. Naturally, it will not happen today.

A bearish scenario will be indicated by the update of the last lows at 1.0727, after which euro/dollar may re-test the support at 1.0636 for a breakout. Taking into account the upcoming important events outlined above, it is quite difficult to assume the market behavior and price direction, but according to the technical picture on the weekly timeframe, there are good reasons for strengthening the exchange rate.

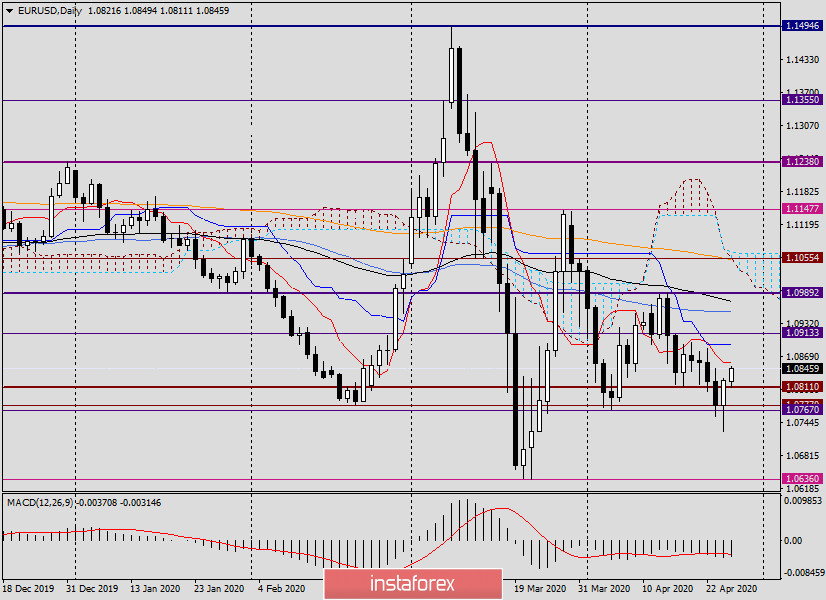

Daily

At this time interval, the candle for April 24 confirms the probability of a possible subsequent strengthening. This is indicated by the factor of changing market sentiment after the pair fell to 1.0727 and the formation of a bullish candle with a long lower shadow.

If the rise continues, the nearest resistance may occur in the area of 1.0858-1.0892. As you can see, here are the Tenkan and Kijun lines, and only fixing above the latter will indicate the ability of the euro bulls to further raise the rate. With this situation developing, the next targets are 50 MA (1.0954) and 89 EMA, which passes at 1.0977.

For downside players, the main task is a true breakdown of the support of 1.0727. In this case, the upward scenario will be untenable, and the pair will most likely once again test the strength of the support level of 1.0636.

Conclusion and trading recommendations for EUR/USD:

We must admit that the situation is quite complex and far from clear. However, given the recent candles on the weekly and daily charts, I would venture to assume that the EUR/USD pair has a better chance of moving north. For those who agree with this assumption, I recommend considering purchases after a short-term decline in the area of 1.0805-1.0780.

Taking into account that there are many strong resistances at the top, we can not exclude options for sales, which are better to plan after the appearance of bearish candle patterns near the levels of 1.0845, 1.0865 and 1.0900.

In conclusion, I would like to remind you once again that given the important events that were outlined in this review, any surprises and multidirectional price movements are possible. Based on this assumption, I do not recommend setting large goals. We will discuss positioning in more detail in future reviews of the main currency pair.

Good luck!