Although the scale of the pound's fluctuations on Friday was rather symbolic, nevertheless, its movements fit into the logic of published macroeconomic data. This suggests that the market is still trying to return to normal. And one cannot but rejoice.

The pound slightly fell against the backdrop of extremely weak retail sales data since the morning, which showed that, after zero growth in February, they fell by as much as 5.8% in March. And this is in annual terms. At the same time, the data was significantly worse than forecasts of a decline of 4.5%. As you can see, even the forecasts were quite frightening. But in the current circumstances, this is not surprising, since Great Britain began to introduce restrictive measures designed to curb the spread of the coronavirus epidemic back in March. So the decline is due to restrictions that have not been in force for a whole month. Therefore, the April results will be even worse.

Retail Sales (UK):

But the pound began to recover even before the data on orders for durable goods in the United States was published. And not for nothing, since the data turned out to be significantly worse than the forecasts. The volume of orders decreased by 12.0%, and by 14.4%. We should not forget that restrictive measures in the United States began to take effect only in mid-March. And in just half a month, we received a catastrophic decline in orders. So by the end of April, the picture will only get worse.

Durable goods orders (United States):

No macroeconomic releases for today, but the pound has already started to grow since the morning. Unfortunately, if the market tries to portray some semblance of normality in the presence of macroeconomic data, then it does not behave quite adequately in its absence. At the moment, the market is reacting to all sorts of rumors, speculation and rather strange statements by minor officials. The main driving force is rumours that the UK may gradually start lifting the restrictive measures before May 7. At the same time, these rumors are spread even without reference to official sources. This is just speculation. Another factor was the statement of a senior White House adviser. Kevin Hassett suggested that the increase in unemployment in the United States may be the same as during the Great Depression. In a good way, there is nothing new in this, since we are already seeing an unprecedented increase in unemployment in the United States every week. In addition, such a statement is quite strange, since we do not have reliable statistics for the time of the Great Depression, and it is difficult for us to compare. So Hassett's words are more of a metaphor, intended to highlight the dismal state of the American economy. Moreover, investors are much more concerned about how this will affect other countries than the United States itself. But the fact is that this phrase was first uttered by an official. That's what scares you. After all, it turns out that the White House does not expect the economic situation to improve in the near future.

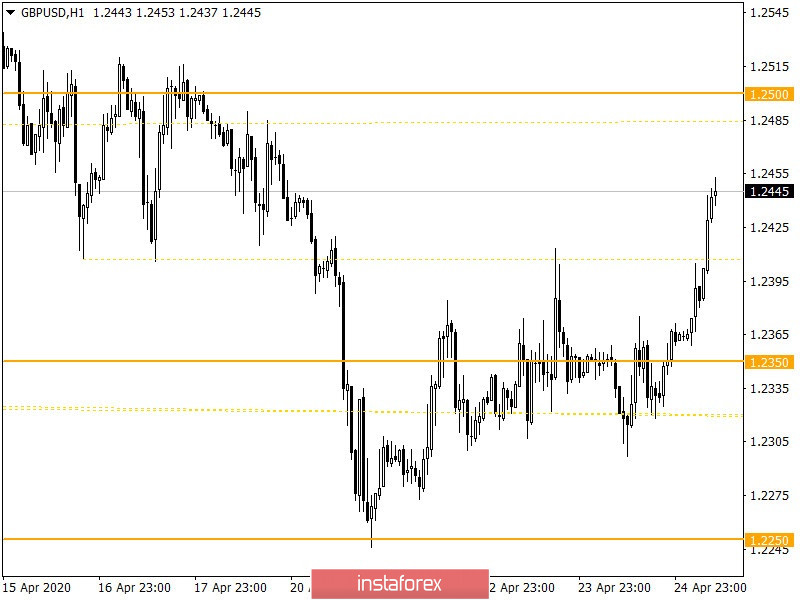

In terms of technical analysis, we see a break in the variable range of 1.2300/1.2385, which restrained the quote for several days. The exit from the flat occurred at the beginning of a new trading week, where the upper limit did not stand, and as a fact - there was an upward momentum.

Considering the trading chart in general terms, the daily period, a correction from the level of 1.2620 is visible, where the existing movement reflects the recovery.

We can assume that the impulsive upward move will feel variable resistance in the area of 1.2450/1.2500, which will play into the hands of sellers who will be able to successfully return to the market on local overbought conditions. In this case, the price will return to the area of 1.2350/1.2400.

From the point of view of complex indicator analysis, we see a buy signal due to a rapid upward move.